Want to know how your Amazon Vendor Negotiations compare to those of other brands? You’re in the right place!

Trade negotiations can feel daunting. They define the commercial performance of your Amazon business for years to come. With U.S. tariffs and rising economic uncertainty, the stakes are even higher.

At the same time, Vendor Managers continue to push hard on Net PPM targets, cost support, and operational improvements. But how aligned are these asks across categories?

Together with market research firm Stratably, I wanted to understand the latest AVN trends in 2026. We looked at Amazon’s priorities, expectations and evolving negotiation strategies.

Today, we’re sharing all our insights with you.

Summary of Key Findings

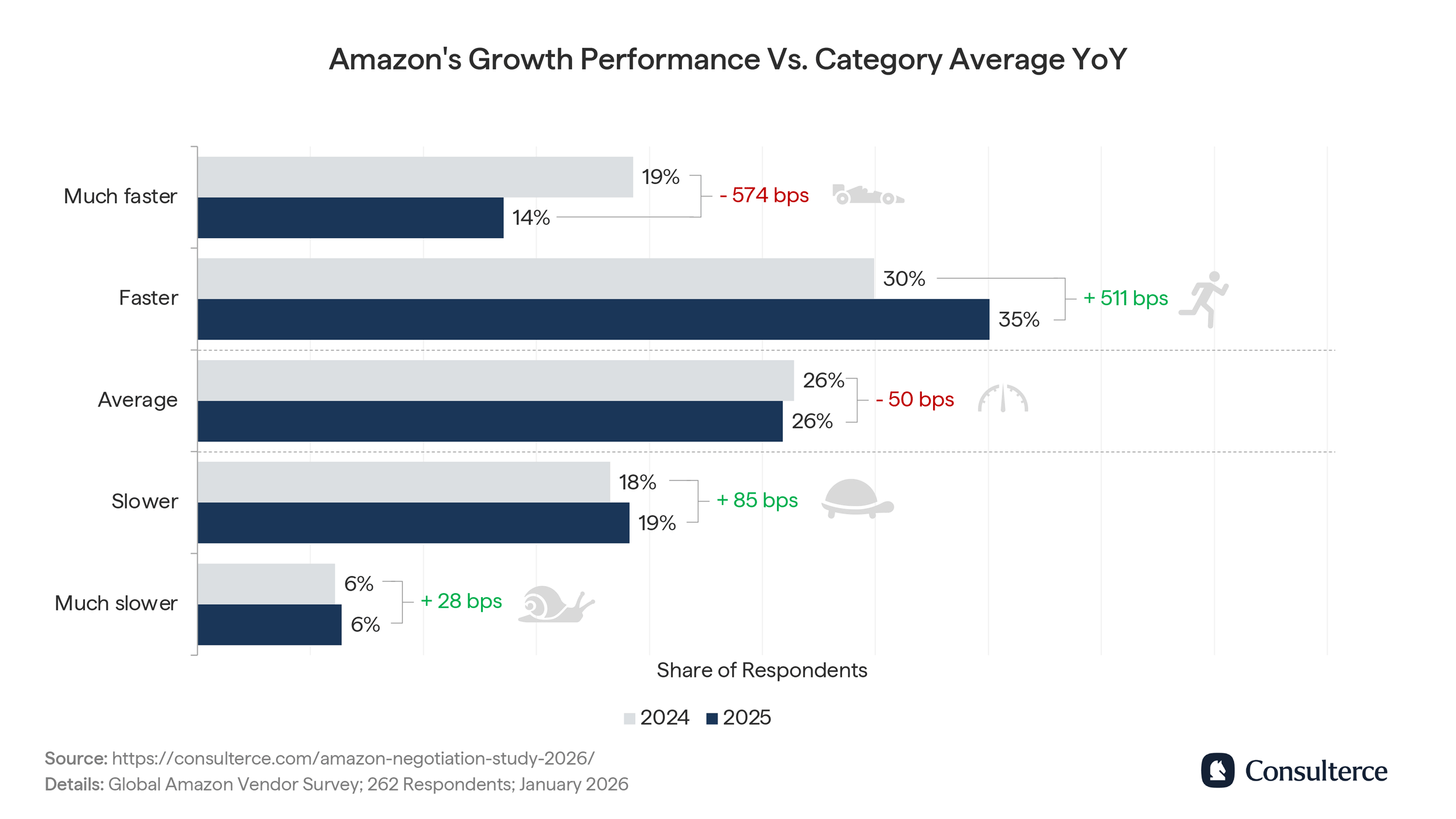

- Amazon’s margin focus is weighing on growth, with fewer vendors reporting category-outperforming sales in 2025 (-570 bps YoY).

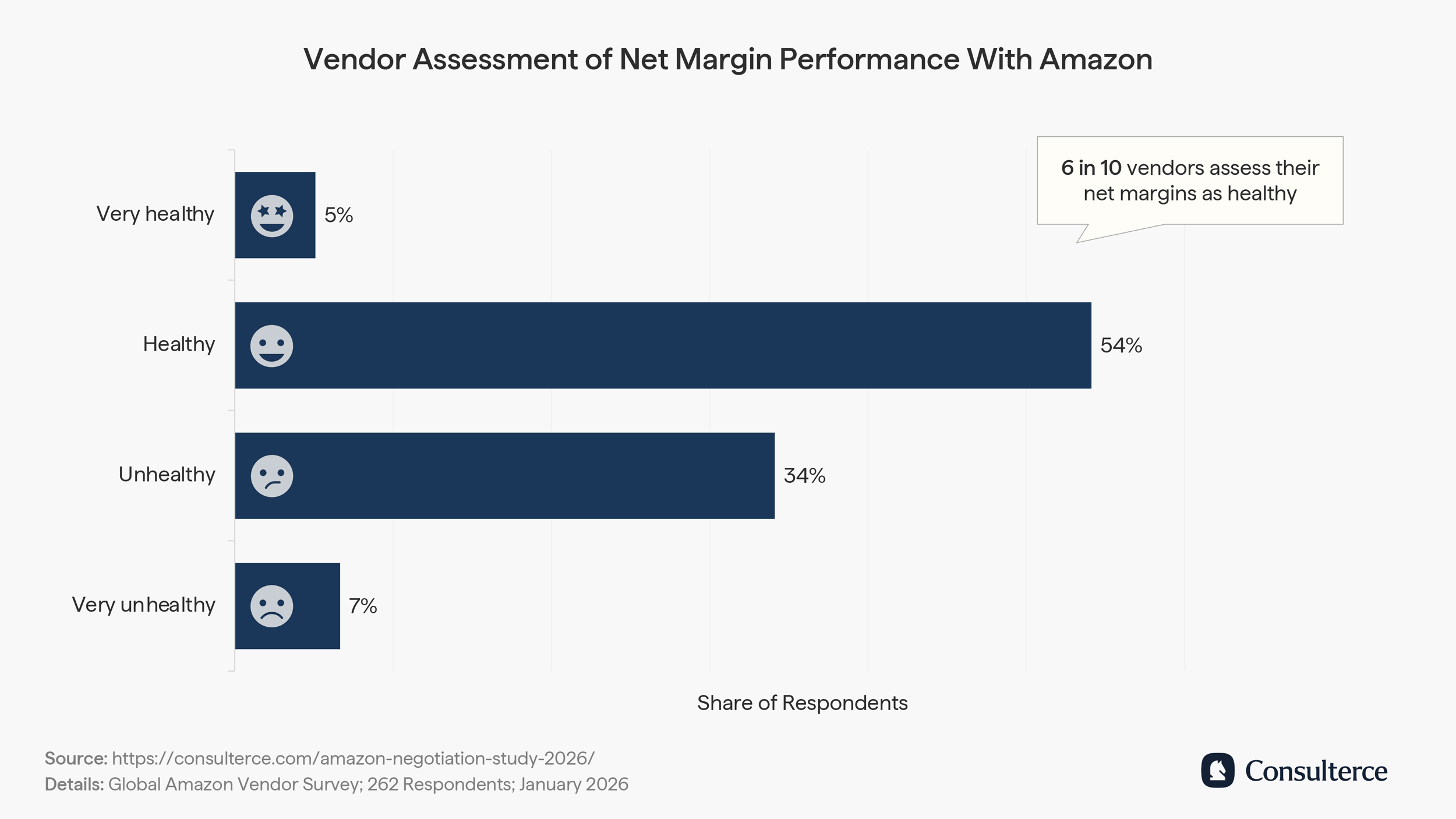

- Customer profitability is on the decline, with 40% (+1,400 bps YoY) of vendors reporting that their net margins fall short of internal profit targets.

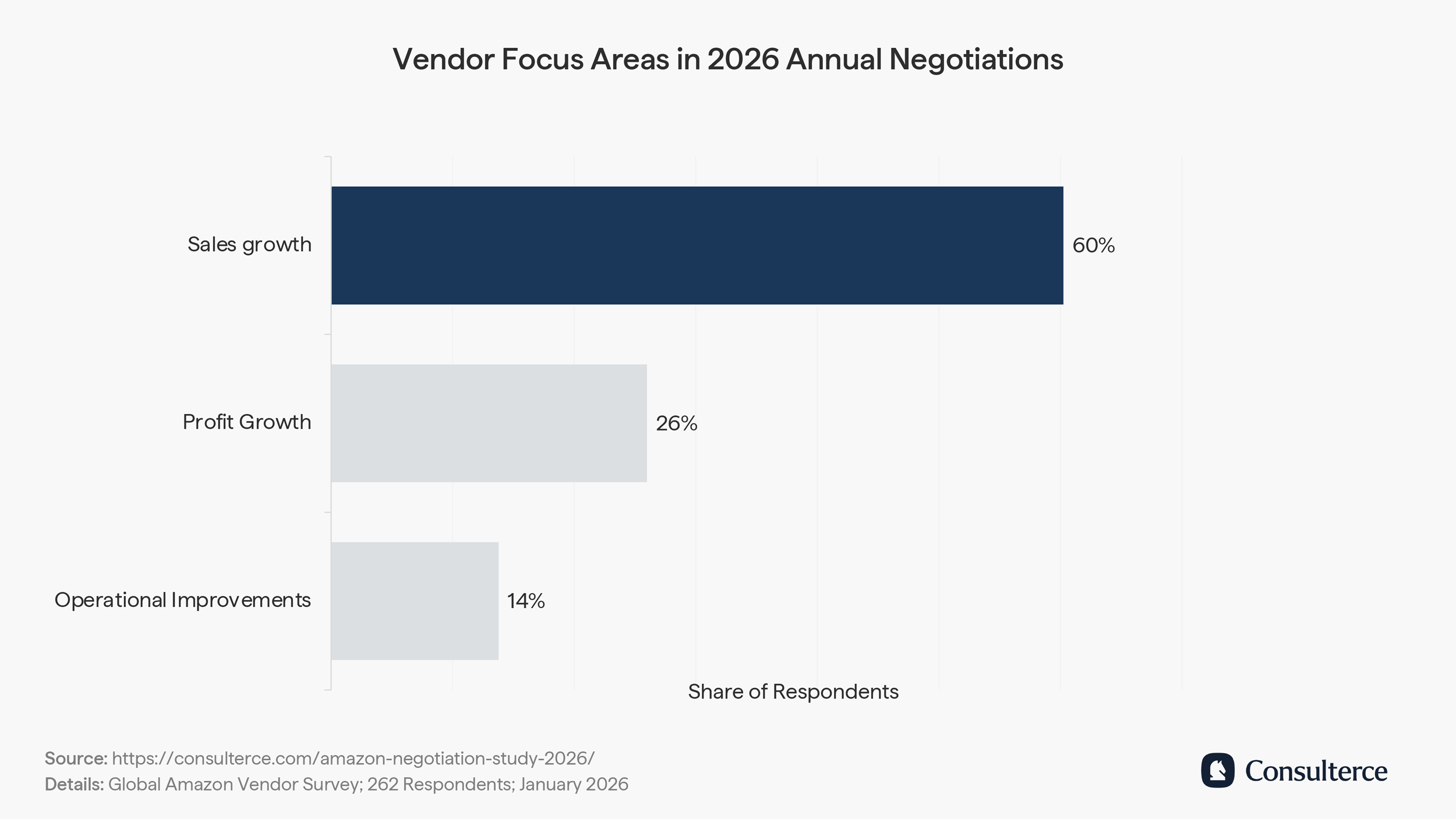

- Yet, only 26% of vendors prioritise profit optimisation as the primary goal in 2026 AVNs.

- Hybrid structures fall short of margin expectations, with only 15% of vendors prioritising a switch from Vendor to Seller Central in 2026.

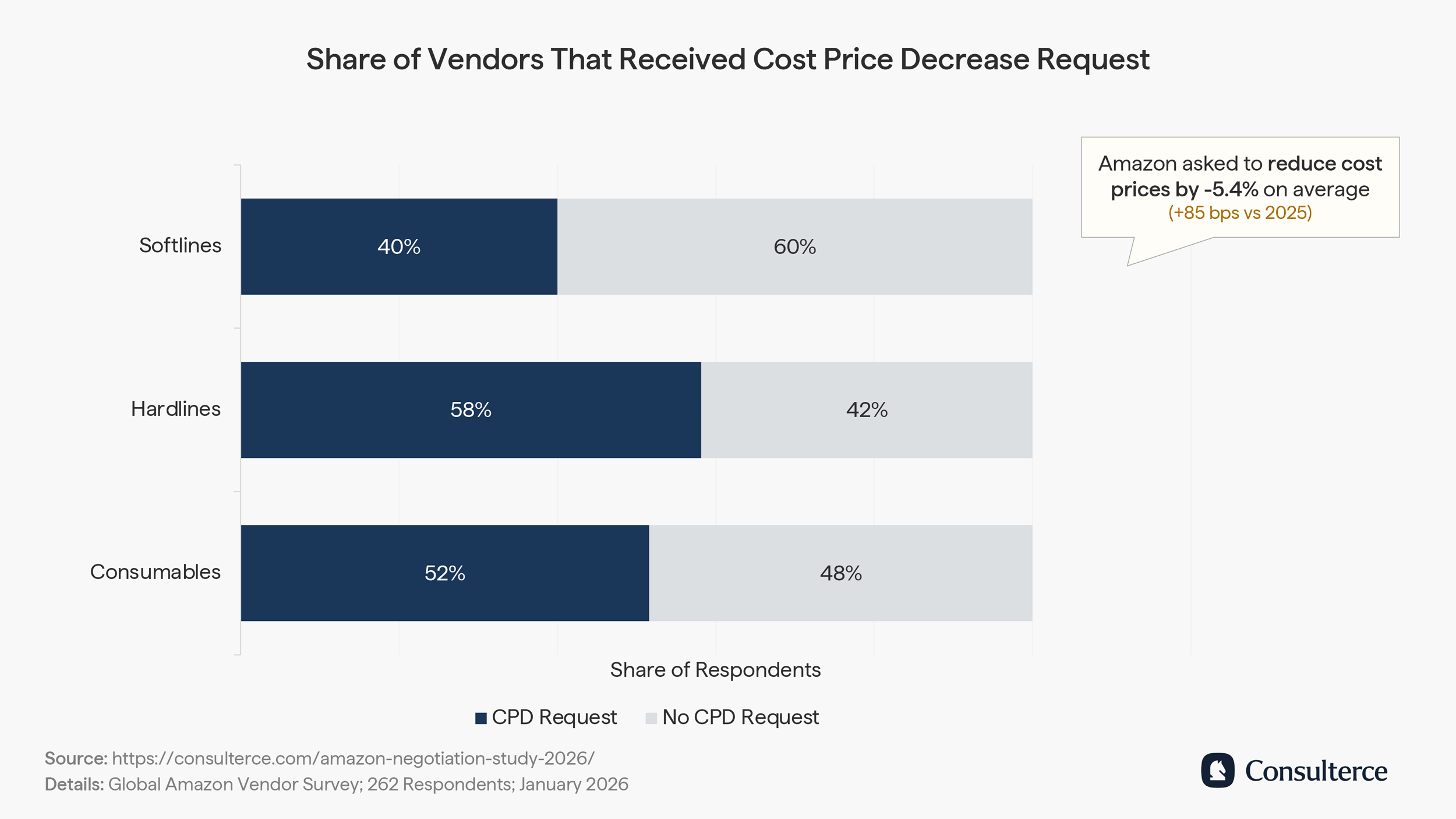

- Fewer vendors (54% / -1,000 bps YoY) have received cost price decrease requests from Amazon.

- Where requested, Amazon is pushing for lighter cost price reductions, averaging -5.4% (+85 bps YoY).

- Conversely, 41% of vendors plan to increase their cost prices with Amazon, while 44% intend to keep cost prices flat in 2026.

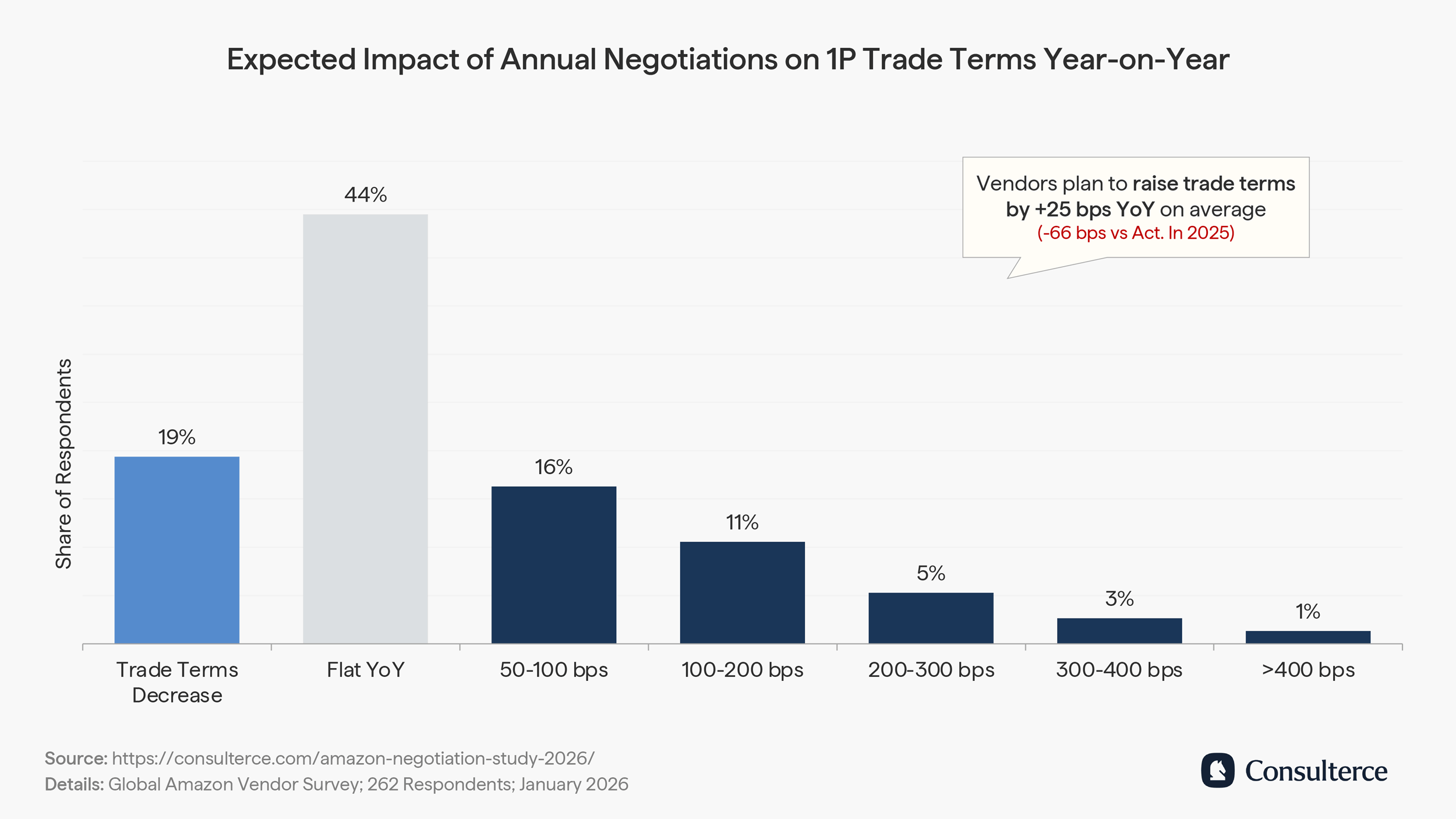

- Only 19% of vendors expect their trade terms to decrease in 2026. 45% expect flat terms YoY. 36% of 1P brands plan to increase trade investments.

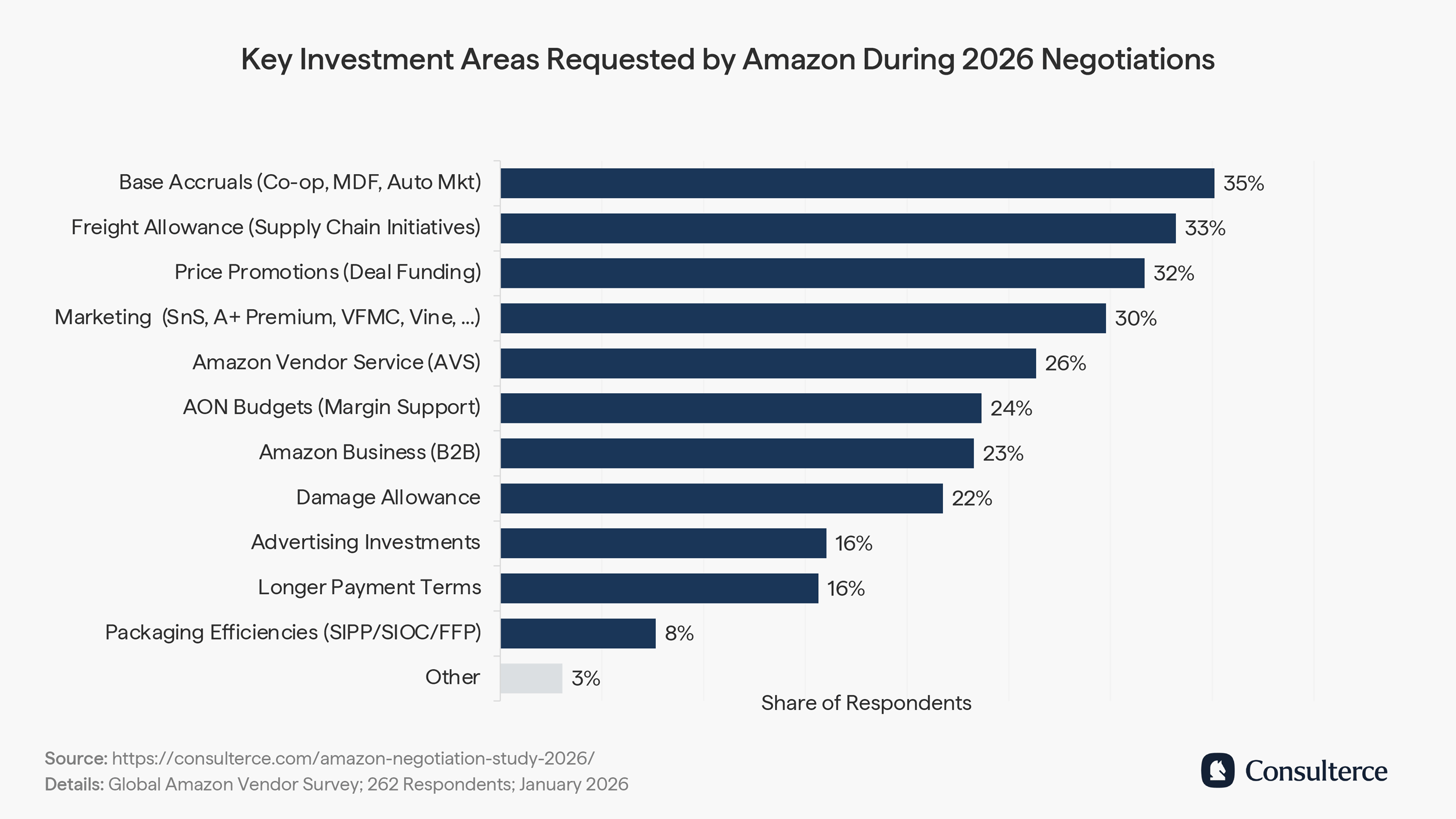

- Amazon focuses negotiation asks on: higher base accruals (35%), supply chain initiatives (33%), more deal funding (30%), Amazon Vendor Service (26%), AON margin support (24%), and Amazon Business (23%).

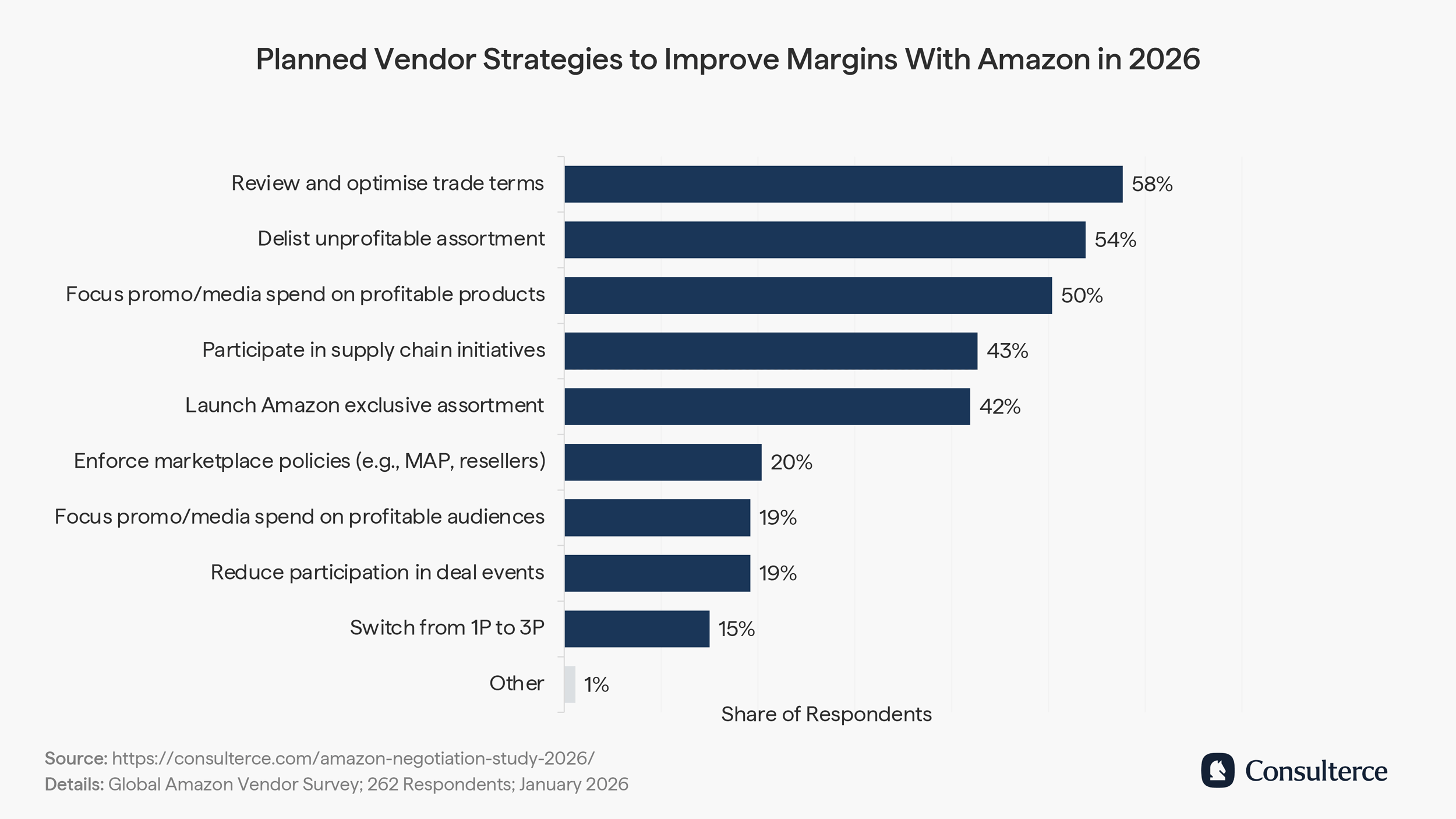

- Key focus areas for vendors are: optimising trade terms (58%), delisting unprofitable assortment (54%), managing profit mix (50%), cutting supply chain costs (43%), and launching Amazon exclusives (42%).

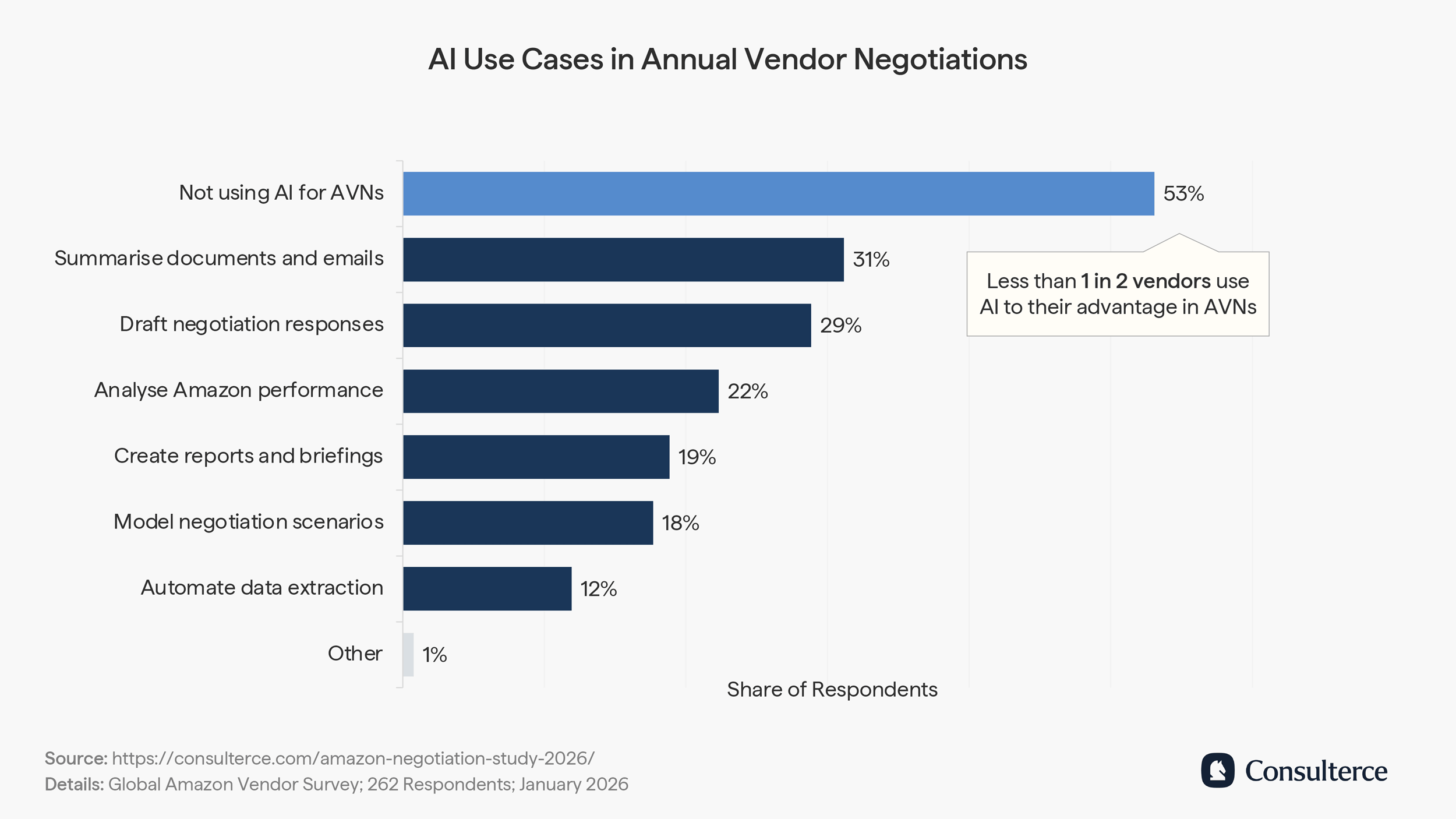

- 53% of surveyed vendors do not use AI to support their AVN preparation or execution with Amazon.

Amazon’s growth advantage is eroding

Amazon’s growth in 2025 was increasingly constrained by a stronger internal focus on profitability and operational efficiencies rather than demand alone, raising the bar for vendors to unlock outsized growth.

Against this backdrop, it’s unsurprising that volume growth for manufacturer brands on Amazon has softened. A meaningful share of brands that reported ‘much faster’ growth in 2024 now see a deceleration in 2025 (-574 bps YoY).

While 49% of respondents still report Amazon growing faster or much faster than other retailers, 1 in 2 vendors now view Amazon’s growth as merely in line with or slower than the category average, underlining the erosion of Amazon’s historical growth advantage.

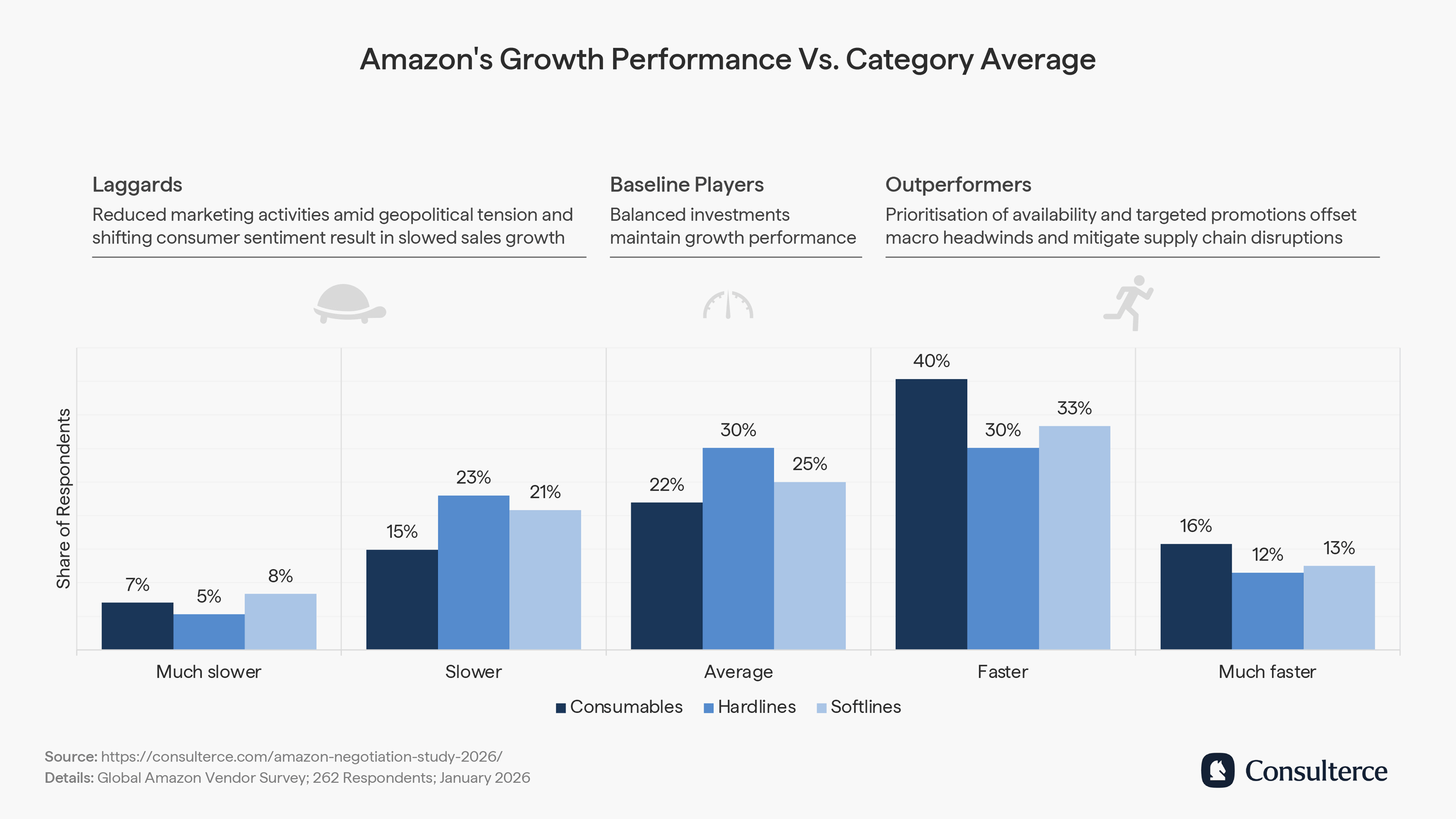

Vendors in the Consumables segment reported mostly steady to strong growth, with 78% stating their performance is either ‘average’ (22%), ‘faster’ (40%), or ‘much faster’ (16%) than the category average. Only 15% reported slower-than-average growth, and 7% of CPG brands indicated that their growth was significantly below expectations – a signal of relative stability in essentials-driven categories. Yet the figures indicate increasing reliance on Amazon for growth, underlining the need to diversify beyond the platform.

In contrast, performance in Softlines has been notably more polarised: 46% of vendors reported faster-than-average growth, while 25% reported performance in line with category benchmarks, and 29% reported underperformance. This suggests that a smaller subset of fashion and apparel brands continue to significantly outperform their category, while many others are falling behind, indicating an uneven demand distribution and tighter consumer discretionary spending.

Hardlines vendors were the most evenly distributed: 28% grew more slowly, 30% reported average growth, and 42% grew faster than the category average, indicating a more fragmented competitive category environment.

Profitability pressure is mounting for 1P vendors

Since the beginning of our AVN survey, Amazon has achieved significant improvements in trade investments with 1P vendors. After terms rose by 69 bps YoY in the 2024 AVN cycle, 2025 negotiations led to a further 91 bps increase.

This is starting to show in the results of our early 2026 AVN study. Only 59% of vendors rated their net margin performance with Amazon as ‘healthy’ or ‘very healthy’, down 1,400 bps from the same period last year.

Sales growth remains the #1 priority for manufacturer brands

Yet, the weaker customer margin performance doesn’t appear to be affecting vendor negotiations just yet. In fact, 60% of surveyed brands said sales growth remains their top priority, compared to 59% a year ago.

Only 26% of brands plan to prioritise profit growth in 2026 negotiations, while a further 14% say improving operational processes and supply chain efficiency will be their main focus.

Cost prices are emerging as the central negotiation focus in 2026

Interestingly, cost prices seem to form the main battleground in 2026 AVNs. While fewer vendors (54% / -1,000 bps YoY) have received cost price decrease requests from Amazon, CPD asks averaged -5.4% (+85 bps YoY).

This can be partially explained by the fact that US tariffs and geopolitical uncertainty have had a far lesser impact on selling prices than anticipated. But also shows that Vendor Managers use this newly won certainty to reverse previously accepted cost price increases.

Across product families, Hardlines brands are most affected, with 58% receiving cost price decrease requests, followed by Consumables (52%) and Softlines (40%).

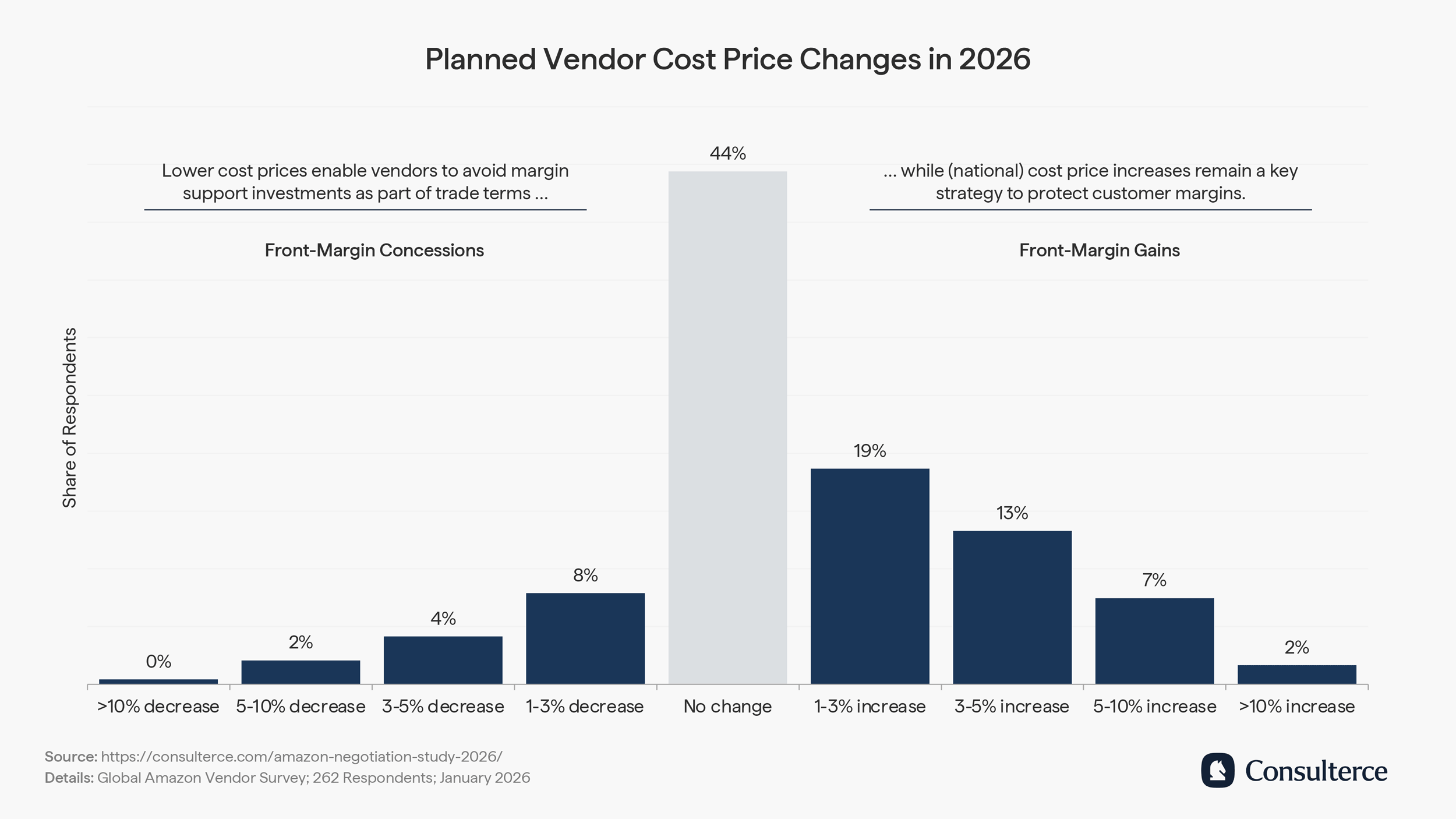

Conversely, vendor cost price strategies are becoming more defensive going into 2026. While Amazon continues to push selectively for cost price reductions, only 14% of surveyed brands plan to concede on front margins.

On the other hand, 44% of vendors intend to keep cost prices unchanged, signalling a clear preference for stability over front-margin concessions.

More notably, 41% of vendors plan to increase cost prices rather than reduce them, using selective CPIs as a mechanism to protect customer margins and offset ongoing trade and operational pressures.

This indicates a growing divergence between Amazon’s cost price ambitions and vendor margin protection strategies, making cost prices a central negotiation focus in 2026 AVNs.

Despite slowing growth, vendors plan for largely stable trade terms in 2026

Expectations around trade terms remain relatively resilient going into the 2026 AVN cycle. Despite softer growth dynamics and rising profitability pressure, most vendors don’t anticipate a material deterioration in their trade terms with Amazon.

Instead, sentiment suggests a preference for stability. 44% of surveyed vendors expect trade terms to remain flat year-on-year, while 36% even plan to increase trade investments to secure growth, visibility, or strategic support from Amazon.

Only 19% plan to tighten their trade terms with the online retailer, highlighting a continued willingness to invest in the Amazon relationship, even as margin pressure starts to unfold in the customer P&L.

Amazon prioritises base accruals and supply chain initiatives in 2026 trade negotiations

Looking at Amazon’s negotiation agenda, base accruals remain the primary lever in 2026 AVNs. 35% of surveyed vendors indicated that base accruals were a key investment request from their Vendor Manager. Reflecting Amazon’s ongoing focus on securing predictable, recurring profitability across its vendor base, rather than relying solely on one-off cost or margin support concessions.

At the same time, supply chain initiatives are gaining importance in negotiations (33%). AVN discussions increasingly centre on improving operational efficiency, inbound reliability, and cost-to-serve economics, positioning supply chain performance as a key contributor to Amazon’s margin objectives.

Deal funding (32%) and marketing services (30%) further reinforce Amazon’s preference for securing its Net PPM performance, while transferring the executional burden to 1P vendors.

Vendors focus on cost, assortment, and media efficiency

On the vendor side, priorities are shifting toward internal optimisation. Rather than relying exclusively on negotiation outcomes, many brands are increasingly focusing on levers they can control directly to protect profitability.

Optimising trade terms (58%), delisting unprofitable assortment (54%), and improving profit mix across portfolios (50%) are among the most commonly cited strategies.

In parallel, vendors are placing greater emphasis on media efficiency, redirecting spend toward more profitable products and audiences rather than increasing budgets incrementally.

Artificial intelligence remains an untapped opportunity

Despite the growing complexity of AVNs, artificial intelligence remains underutilised by most 1P vendors. 53% of surveyed brands still don’t use AI to support their negotiation preparation, performance analysis, or scenario modelling with Amazon.

This represents a clear opportunity gap. AI-driven tools can help vendors analyse large data sets more efficiently, model negotiation scenarios, and identify profit risks across cost prices, trade terms, and assortment decisions.

As AVNs become increasingly data-driven, the ability to leverage AI effectively will likely be a key differentiator between reactive and well-prepared vendor organisations.

Conclusion

This wraps up our survey insights from the early 2026 AVN cycle. If you found value in today’s article, please share it with your team on LinkedIn.

And if you participated in the survey, Thank You! Without your support, this study would not have been possible.

I’m going to run another study on the final results of the 2026 AVN cycle. Subscribe to my newsletter and be the first to know when it is published!

Background of survey and profile of survey participants

The survey was conducted in December 2025 and targeted representatives of first-party Amazon suppliers. A total of 262 survey responses were recorded. The survey was conducted anonymously.

Vendor business size with Amazon

41% of survey respondents reported annual Amazon sales between $0 and $10 million. Another 39% of surveyed participants reported annual Amazon sales between $10 and $50 million. 10% of survey respondents reported annual Amazon sales between $50 and $100 million. 10% reported annual Amazon sales of over $100 million.

Vendor categories of survey participants

46% of survey participants sell items in the Hardlines goods product family, 44% are actively selling Consumer Goods (Consumables), and 10% were manufacturers in Soft Lines (Fashion, Luxury, and Accessories).

Geographical distribution of survey participants

The survey participants were located in multiple regions. 60% of respondents were located in Europe, 38% in North America, and 2% in Asia-Pacific markets.

Disclaimer

The survey is not and was not sponsored by, run, or affiliated in any way with Amazon.com, Inc. or any of its subsidiaries.