Profit margins are one of the most important metrics to keep track of when selling products online. Today, we’re taking a closer look at their definition, formulas and concrete examples.

If you want to understand your business’s profitability, you will quickly come across the term profit margin. It expresses how much your company earns as profit from each sale.

If you’ve ever wanted to learn all there is to know about margins, you’ve come to the right place.

This article will cover:

- What is the profit margin?

- Types of profit margins

- What is a good profit margin?

- How to improve your profit margins

- BONUS: Gross profit margin calculator

Let’s dive right in.

Definition: What is the profit margin?

The profit margin is a key metric for businesses to measure how much they gain from each product sale.

A profit margin outlines how many cents profit a merchant generates from each dollar of sale.

As such, the profit margin is a profitability ratio that sets the realised profit ($) in relation to the generated revenue ($). The result is a margin figure, which is expressed in percentage form (%).

Example: A margin of 27% describes a profit of $0.27 for every $1 earned.

Profit margins play a substantial role in corporate finance. They help sellers understand the bottom-line performance of their product portfolio and whether they break-even.

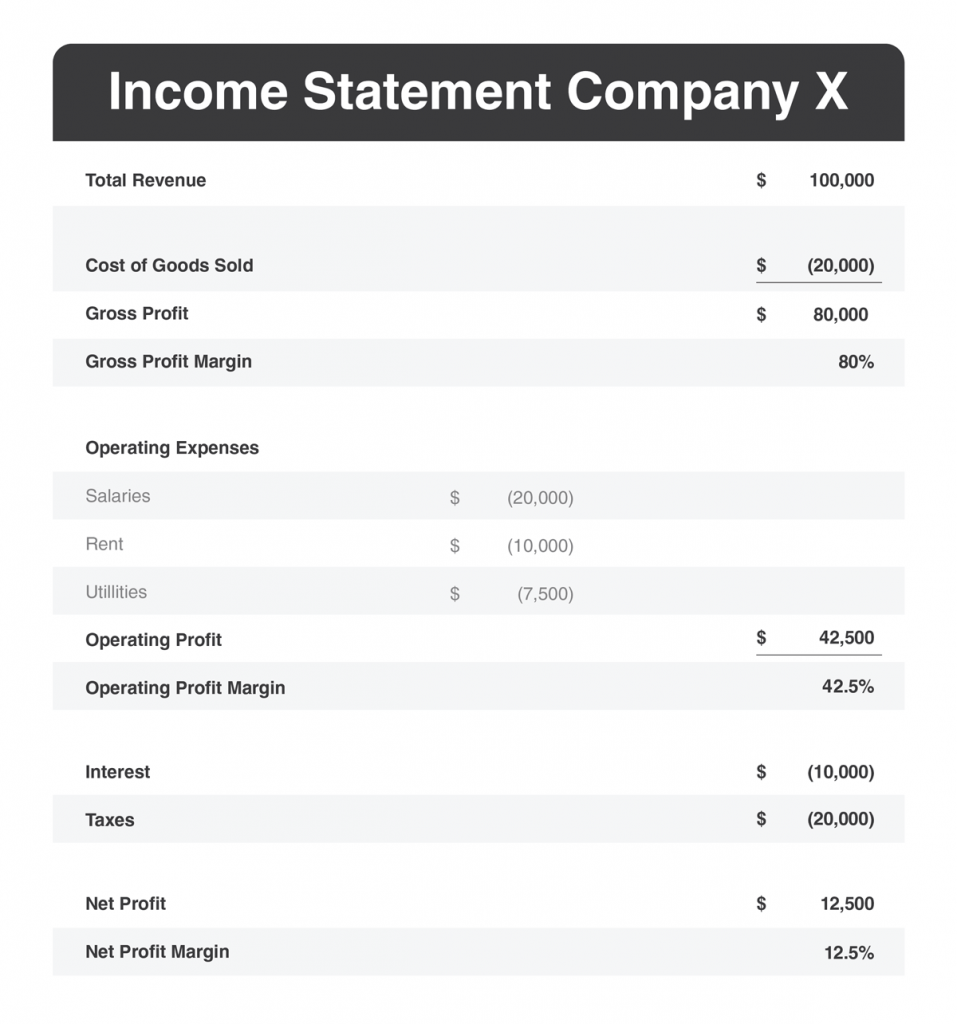

On an aggregated level, they describe the financial health of a business. This is why a company’s income statement always includes a gross, operating and net profit margin figure.

Let’s take a closer look at the nuances between these margin types.

![]() Heads Up

Heads Up

The following paragraphs talk about net sales. This term is interchangeably used with revenue or selling price of a product.

Types of profit margins

There are three types of profit margins:

Their breakdown is as follows:

First, the company takes its net sales revenue and deducts the cost of goods sold (COGS) from it. COGS are costs directly associated with the production of a product, e.g., for raw materials or labour to assemble the product. This leaves the gross profit.

In a second step, the indirect operating expenses (e.g., rent, utilities, advertising, labour, R&D) are being subtracted from the gross profit figure. This results in the operating profit.

Lastly, the company deducts any other expenses (e.g., debt payments), interest and taxes from the operating profit. The resulting figure is the net profit.

All three margin types are part of a company’s income statement:

With the breakdown of retail profits out of the way, let’s take a closer look at each margin type.

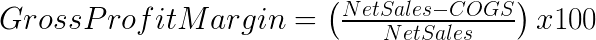

Gross profit margin

The gross profit margin is also often described as “retail margin”. It is the difference between the retail price and the costs of goods sold (COGS). COGS describe all costs directly associated with the production of a product. This includes direct raw material and labour costs. It excludes any marketing or operating expenses.

To achieve strong gross margins, merchants need to either increase their selling prices or minimise production and acquisition costs. In ecommerce, pricing often constitutes a dynamic margin component, while COGS remain relatively steady over time. By tracking the gross profit of a product, sellers can become aware of unprofitable pricing and sourcing strategies.

Here’s the gross margin formula:

Gross Profit Margin Example:

Net Sales: $10

COGS: $5

Gross Profit % = (($10 – $5) ÷ $10 ) x 100 = 50%

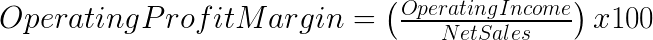

Operating profit margin

The operating profit margin is also known as Earnings Before Interest and Tax (EBIT). It is the profit a company makes from its operations. Before deducting interest and taxes.

The operating profit is calculated by subtracting all operating expenses from the gross profit. Operating expenses are costs that are needed to run the business. Examples of operating expenses are marketing, rent, salary and overhead costs.

The operating profit is the income available to a company to pay its debt, interest and taxes. Banks and investors use the operating margin to gauge the financial health of a company. It also serves as a benchmark to compare companies in the same industry with each other.

Here’s the operating margin formula:

Operating Profit Margin Example:

Net Sales: $10

COGS: $5

Operating Expenses: $2

Gross Profit % = (($10 – $5 – $2) ÷ $10 ) x 100 = 30%

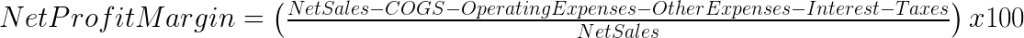

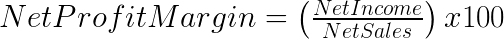

Net profit margin

The net profit margin reflects the net income of a business: The total amount of revenue left after all direct and indirect associated expenses are accounted for. This includes COGS and operating costs, but also other expenses from a company’s investments. Minus interest and tax payments.

Here’s the net margin formula:

Net Profit Margin Example:

Net Sales: $10

COGS: $5

Operating Expenses: $2

Interest: $0.5

Taxes: $1.5

Gross Profit % = (($10 – $5 – $2 -$0.5 – $1.5) ÷ $10 ) x 100 = 10%

What is a good profit margin?

The short answer: It depends.

The benchmark of a good margin varies from industry to industry. A tax accountant is likely to achieve high-profit margins. In contrast, a manufacturer that also has to consider raw material acquisition costs will struggle to achieve similar margin levels.

As a general rule of thumb, a net profit margin of 10% is considered average across industries.

Examples of high-profit industries are luxury and high-end goods. This includes luxury watch manufacturers or premium apparel companies. Examples of low-profit industries are businesses with high operating expenses. This includes supermarkets and restaurants.

Knowing the average profit margin of your industry is key to inform your pricing strategy. It indicates how much markup you can apply to the cost of goods to achieve an average margin position.

💡Bonus Tip

You can calculate your product price based on a margin or markup target. Access my easy-to-use retail margin calculator to do just that.

How to improve your profit margins

With the definition of profitability metrics out of the way, let’s answer the question: How can you improve your profit margins?

Looking at the retail margin formula, it consists of expenses (COGS) and revenue (net sales). These two components can generally be influenced by businesses. This means that there are two options to improve profit margins:

- By reducing costs, or

- by increasing sales and maintaining cost levels.

Method 1: Reducing costs

If you sell an item for $10 and are able to reduce the cost of goods from $5 to $4, your gross margin increases by 10%.

That’s why reducing cost structures by leveraging economies of scale is important when growing your sales. Every dollar saved accelerates the bottom-line performance of your business.

Method 2: Increasing sales at fixed costs

Another way to improve your profit margins is to increase your sales by maintaining the same expense levels. Simply put, you sell more at a fixed cost rate.

For example, generating net sales of $10,000 with $5,000 in cost of goods sold results in a gross margin of 50%.

But if net sales can be increased to $12,000 with the same absolute COGS, the gross margin increases to 58.3%.

BONUS: Gross profit margin calculator

As an ecommerce merchant, it is crucial to define your pricing strategy. Adding a markup on the cost of a product is the easiest way to define its retail price. And my easy to use margin calculator has you covered.

Simply enter the cost of the item and the desired markup into the fields below. The calculator will automatically compute the resulting gross profit and selling price (excluding VAT).

The markup describes the amount by which the cost of a product is increased to arrive at its selling price. Margins refer to the revenue minus cost of goods sold of a product.

Profit Margin Calculator Results

Your sale price

$0.00

Your profit

$0.00

Gross margin

0.00%

Conclusion

So there you have it. The types, formulas and examples of profit margins explained. I hope this article has brought you lots of value.

Got questions or comments? Ping me on Twitter.

—

Enjoyed this article? Here are more things you might like:

Value-Based Pricing – The definite guide to one of the most popular pricing strategies in retail.

The Complete Guide to Break-Even – Learn how to calculate the point of break-even of your business.

7 Ecommerce Metrics to Measure From Today – Learn everything you need to know about metrics, KPIs and how to measure them effectively.