Today, you’re going to learn everything you need to know about profitable online sales.

In fact, I will show you exactly how to calculate the break-even point, the moment at which your business starts to turn a profit.

So if you want to fully understand the break-even formula, you’ll get a ton of value from today’s guide.

Let’s dive right in.

In a hurry? Skip to the break-even formula right away by clicking this link.

Table of Contents

- The Definition of the Break-Even Point

- Why you Should Perform a Break-Even Analysis

- The Break-Even Formula

- Conclusion

Definition: What is the Break-Even Point?

First, let’s define what the break-even point is.

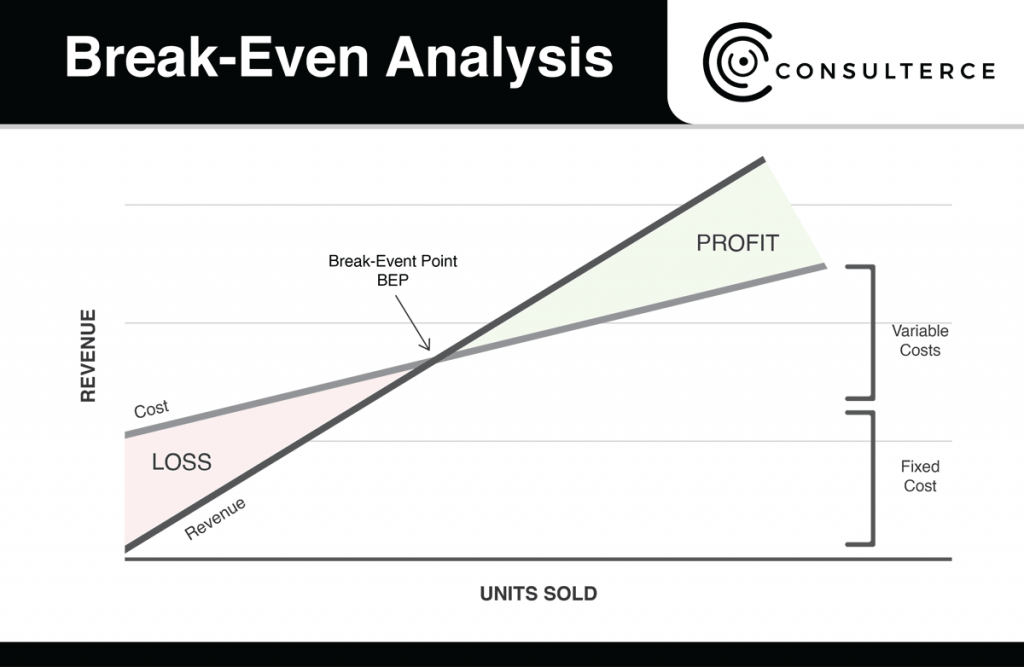

Simply put, the break-even point (BEP) describes the moment from which the incoming revenue of your company equals its costs.

At this point, your business generates neither a loss nor a profit.

In other words, the costs “break-even” with the sales of a product.

To identify the BEP of your business, you need to perform a break-even analysis.

You can do this in two ways:

- on company level, i.e., defining the point of break-even for your overall business, or

- on product level, i.e., the point from which a single product turns profitable.

Which level you use really depends on whether you just want to understand the profitability of a single product or your entire business.

Why Should You Perform a Break-Even Analysis?

There are many benefits to knowing the point of break-even.

First, it tells you exactly how many times you need to sell a product to offset the running costs of your business.

(Rent, salaries, …)

But what’s even more important:

The break-even analysis helps you to understand the financial health of your business.

And as a result, you can take control of the elements that hinder you to break-even and also find ways to increase your profit margins.

The three main benefits of calculating the break-even point are:

- It uncovers hidden or overlooked cost components along your value chain;

- It allows you to identify the right pricing strategy for your products;

- It’s a reliable method to determine your profitability levels.

Let’s take a closer look at each of them:

1. It Allows You to Uncover Hidden Costs

The break-even analysis is a core part of any business plan. It gives investors insight into when a company is expected to offset its costs for the first time.

Running this analysis will force you to consider all the cost components that exist when selling products online.

Even the ones you might not think about right away, e.g., costs of customer returns, variable shipping costs, etc.

2. It Helps you to Identify the Right Pricing Strategy for Your Business

Now that you know your obvious and not so obvious occurring costs, the price of your products is another factor that determines your profitability.

There are many types of pricing strategies sellers can choose from. And knowing the BEP will help you to decide which one will best support your profit targets.

For example, if you sell products with high-cost components, a premium pricing strategy might be the one to go with.

On the other hand, if you’re selling goods with low production costs and want to increase the number of sales, value pricing might be the strategy to go with.

3. It Determines Your Profitability

Before we finally turn our eyes on the break-even formula, you should remember one thing:

The key advantage of calculating the break-even point is that it enables you to determine the profitability of your business.

With this knowledge, you can either try to decrease the costs along your supply chain or change the average price you sell your products for. Both have a positive effect on your profit margins.

The Break-Even Formula

The basic break-even formula is defined as follows:

Break-Even Point = Fixed Costs ÷ (Average Price – Variable Costs)

More specifically, there are two ways to calculate the break-even point:

The first is based on the number of units you need to sell to cover all your costs. The second is based on how much revenue you need to generate in order to break-even.

Method 1 – Calculating the Break-Even Point Based on Units (Volume)

Divide the fixed costs by the revenue per unit minus the variable costs per unit.

Fixed costs do not change, no matter how many units you sell of a certain product. Variable costs vary depending on the number of sales you generate.

Break-Even Point (Units) = Fixed Costs ÷ (Revenue Per Unit – Variable Costs Per Unit)

Example: Let’s say the average selling price of your top-selling product is $100. The monthly fixed costs amount to $1,000 and the variable costs are $50 per unit.

Leveraging the above formula, you need to sell 20 units per month to break-even:

$1,000 ÷ ($100 – $50) = 20 units

Method 2 – Calculating the Break-Even Point Based on Sales ($)

Divide your fixed costs by your contribution margin.

The contribution margin is calculated by subtracting the variable costs from your average selling price.

Break-Even Point (Sales in $) = Fixed Costs ÷ (Average Price – Variable Costs)

Example: Your company faces $150,000 in fixed costs each month. The contribution margin is 15%.

Therefore, your business reaches its break-even sales level at a sales threshold of $1,000,000 per month.

$150,000 ÷ 15% = $1,000,000

HEADS UP

Before you jump right into calculating the BEP of your products you should be aware that your contribution margin might change over time. That’s because it takes into account your variable costs. In other words, your contribution margin might vary from month to month, especially when you’re selling multiple products at the same time. So be sure to update and monitor it regularly.

Now that you know when to use which break-even formula, let’s take a closer look at its single components.

This will help us to identify opportunities to increase the overall profitability of your products.

Fixed Costs

Fixed costs are costs that do not increase or decrease, regardless of how many items are sold. In other words, a company needs to pay for these costs, even if it does not sell a single product.

Examples of fixed costs are:

- Rent

- Warehouse/storage charges

- Property taxes

- Marketing automation

- Insurances

Average Price

The average price describes the price point you are selling your product on average for (pretty easy, right?).

If you sell directly to the end-customer, this is the average selling price (minus taxes) displayed on your shop’s website. If you are selling to middlemen such as wholesalers, this component describes your cost price you are selling your products at.

Variable Costs

Contrary to fixed costs, variable costs change in with the number of products you sell.

Examples of variable costs include:

- Production materials (raw materials)

- Utilities

- Payment processing fees

- Import duty taxes

Variable costs can swing in both directions. While you might expect to face increased costs when producing more items, economies of scale can, in fact, have a positive impact on your variable costs.

💡BONUS TIP

There’s quite a significant relation between the contribution margin and variable costs of your products. As a result of the economies of scale effect, your costs come down, and your margins improve if you increase the sales of your product. That’s why you should always try to negotiate a better price if you buy more raw materials or products from your suppliers, once your sales volume increases.

Conclusion: The Break-Even Analysis Defines the Long-Term Success of Your Ecommerce Business

Running the break-even analysis is not as complicated as it may first seem.

But calculating the BEP it is only the first step of a series of decisions you have to take:

Is the number of units you have to sell to turn into the profit zone realistic? Will price elasticity effects hinder the successful launch of your product? Do you need to cut costs along your supply chain?

If you’re just starting out with your ecommerce business and have to manage a limited financial budget, knowing the BEP is crucial to assess and control your profits.

But also experienced business owners should pay close attention to the power behind the break-even analysis. As simple as it might seem, it can uncover hidden and expensive cost components along the supply and value chain of your business.

Got questions or comments? Ping me on Twitter.