Vendor negotiations with Amazon can feel overwhelming and complex to manage. But don’t worry! In this guide, you’ll gain clarity about what to expect and how to prepare and negotiate your trade terms with the online retailer.

If you sell through Vendor Central on Amazon, you know the call: Every year, the online retailer invites its suppliers to participate in annual trade negotiations, also known as Joint Business Plans (JBP) or Annual Vendor Negotiations (AVN).

While most retailers view these conversations as a way to build and maintain relationships with suppliers, Amazon focuses mainly on operational and commercial improvements.

That’s why brands need to handle AVNs with Amazon differently than with their other retail partners.

In this guide, you will learn exactly how to successfully prepare and negotiate trade terms with your Vendor Manager.

This article will cover:

- What is an Amazon Vendor Negotiation?

- Overview of trade terms

- Phase1: Plan and prepare

- Phase 2: The kick-off meeting

- Phase 3: Negotiate with Amazon

- Phase 4: Control and measure

- Bonus: FAQ

In a hurry? Get this article as a PDF instead!

By subscribing, you acknowledge to have read & agreed to my Privacy Policy.

What is an Amazon Vendor Negotiation?

The Amazon Vendor Negotiation (AVN) is what most brands will know as a Joint Business Plan (JBP) or trade negotiation from other retailers.

It’s an annual process where Amazon meets with its largest vendors, shares an assessment of their past year’s performance and proposes the investment structure of any trade terms for the next twelve months.

AVNs with Amazon differ from those of other retailers in that Vendor Managers approach negotiations from a purely transactional angle.

You are likely to negotiate with a different Amazon buyer each year, making it difficult to build a strategic relationship as you do with your other retail customers.

The annual negotiation process typically begins with a kick-off meeting, followed by a series of negotiations on the commercial terms of the deal.

The online retailer is known for putting a hefty price tag on a projected growth scenario, often without a clear plan on how to achieve it.

And that’s when the negotiation begins.

Process overview

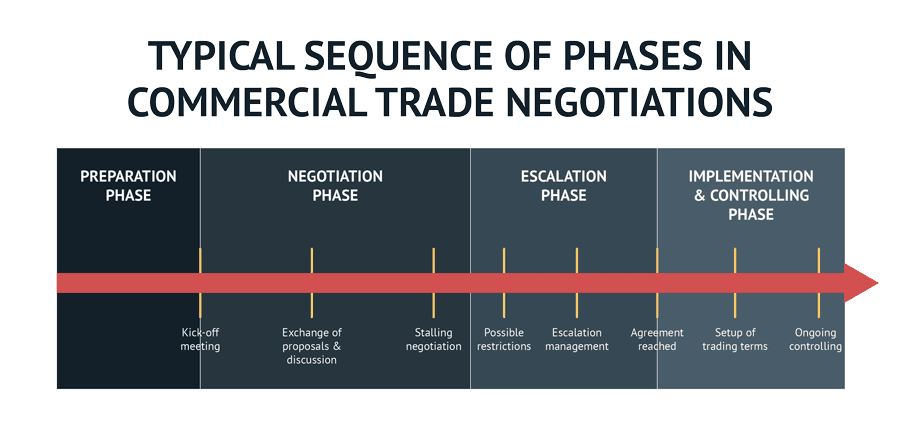

Negotiations on trade terms follow a typical sequence of phases.

They start with a preparation phase in which both the vendor and retailer review the account’s performance and prepare their negotiation strategy.

The following negotiation phase is then marked by an exchange of several commercial proposals and counter-proposals.

If both parties cannot reach an agreement, they may move to an escalation phase. In this phase, meetings may be held with senior stakeholders, and both parties may introduce measures to underline their position.

Once an agreement is reached, the negotiation concludes with the implementation and controlling phase.

Types of European Vendor Negotiations

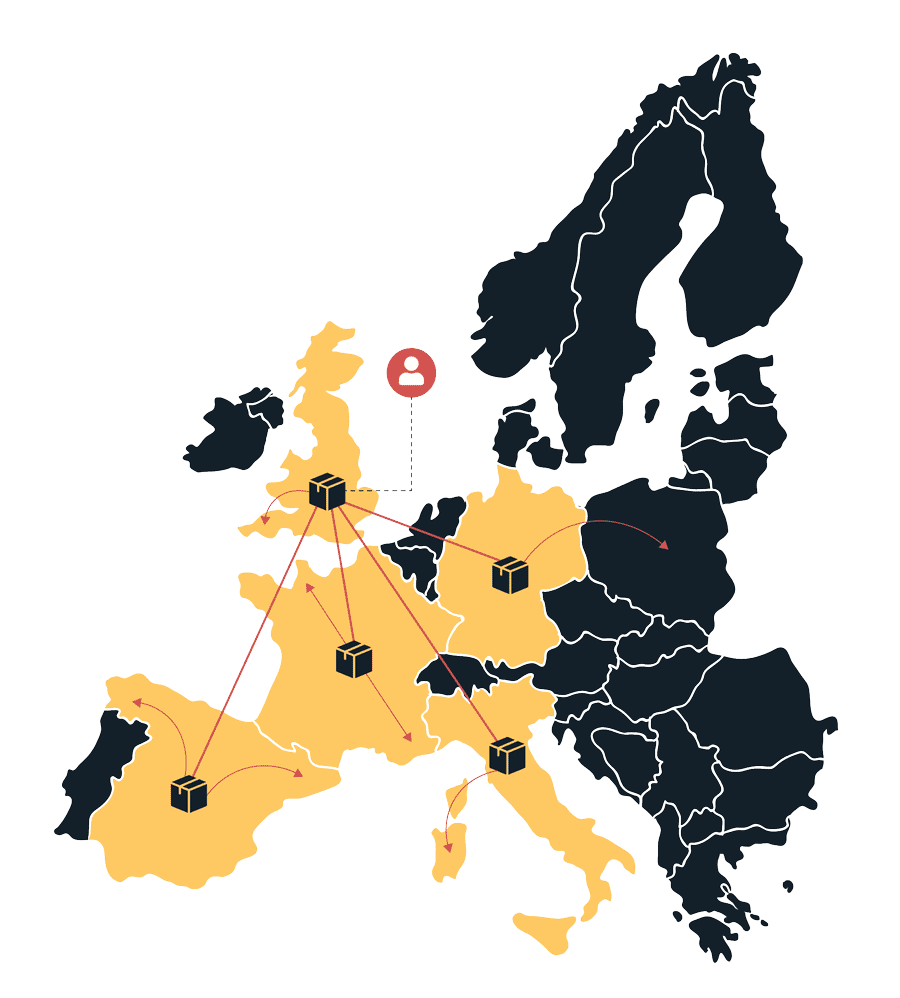

In recent years, Amazon has increasingly focused its ambitions on aligning trading terms on a pan-European basis. This allows the online retailer to pool its resources and compare terms across marketplaces.

If you are an Amazon vendor selling in Europe, you will likely be subject to one of the following three types of negotiations:

- Local,

- Pan-European Coordinated or

- Pan-European Managed Negotiations.

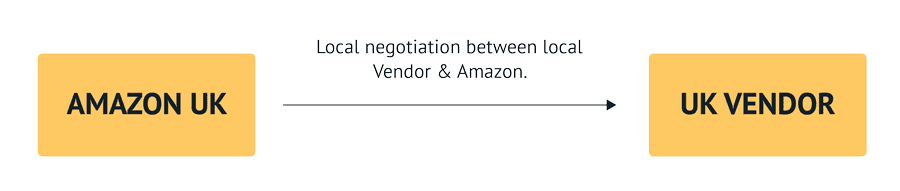

Local negotiations

Local negotiations are the simplest form of AVNs. Your local Vendor Manager will negotiate trade terms for only their market.

For example, if you’re selling products exclusively on Amazon.co.uk, you will likely enter trade negotiations with a local UK Vendor Manager.

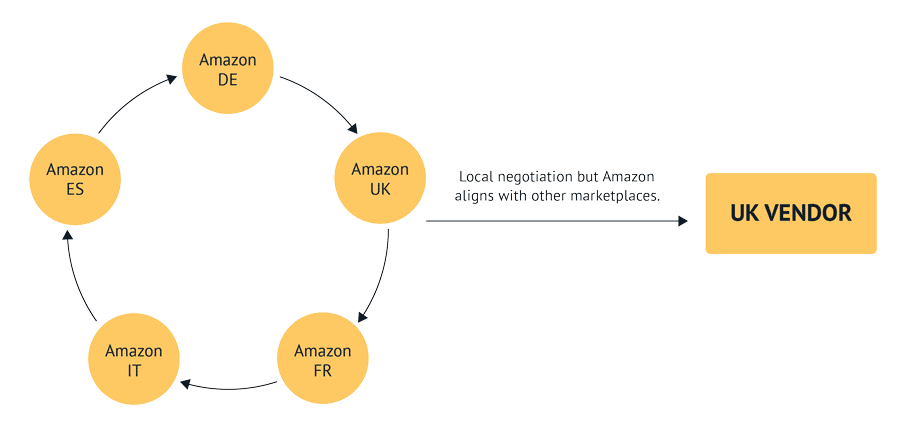

Coordinated Pan-European negotiations

Coordinated pan-EU negotiations are similar to local negotiations with Amazon. The only difference is that Amazon recognizes that you’re selling in different marketplace locations (e.g. in EU5 or EU9).

Local Vendor Managers will regularly coordinate with their European counterparts responsible for your brand. This allows them to understand and compare the terms with your business across marketplaces.

However, note that Amazon will likely phase out this form of negotiation over the coming years. That’s because it recently changed its organisational structure, focusing now on managed pan-EU negotiations.

Managed Pan-European negotiations

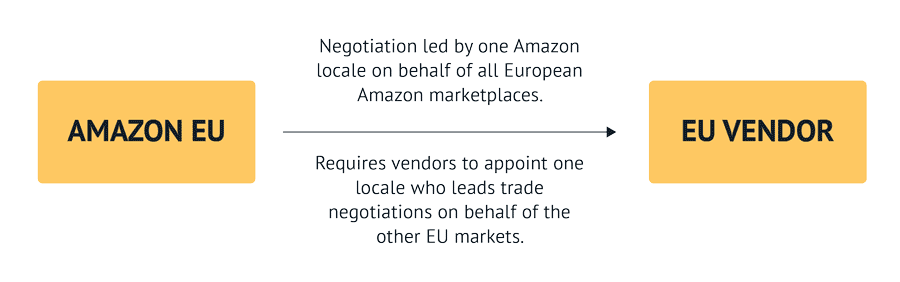

The managed Pan EU setup tries to simplify the trade terms negotiation between Amazon and your brand. Instead of having multiple teams talk to multiple local Vendor Managers all across Europe, you’ll only speak to one Amazon buyer on behalf of all markets.

Overview of Amazon terms

Now that you know about the different types of EU negotiations, let’s understand the trade terms you’re likely to come across in your Amazon AVN.

Vendor Managers will often refer to them as base terms. These generally fall into one of three main categories:

- Marketing Allowances,

- Service Programme Fees, and

- Operational Investments.

Note that investments in Amazon Advertising are not part of the annual term negotiations with Amazon Retail. However, investments into deals and promotions may be subject to your retail negotiation.

Vendor Managers will focus on the base terms of your account, as these investments directly impact Amazon’s Net PPM.

So let’s take a closer look at each of them.

Marketing Allowance

Amazon offers two types of marketing allowances: Automated Marketing and Retail Marketing.

Automated Marketing (or: Co-op) is often referred to as a listing fee that gives vendors access to the Amazon marketplace. They use the funds for on- and off-site product placements and to re-target customers, e.g., on social media, search engines like Google, etc.

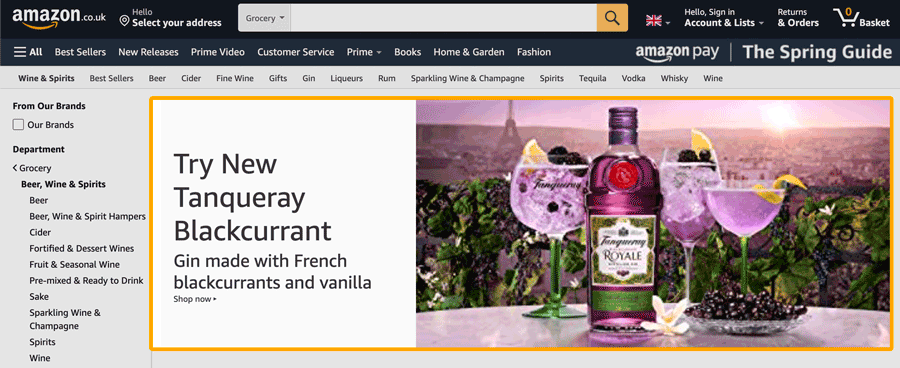

Retail Marketing, also called Amazon Balance, is an investment that gives vendors access to scheduled on-site banner placements on a category page. The campaign slots can be booked via Vendor Central.

Subscribe and Save

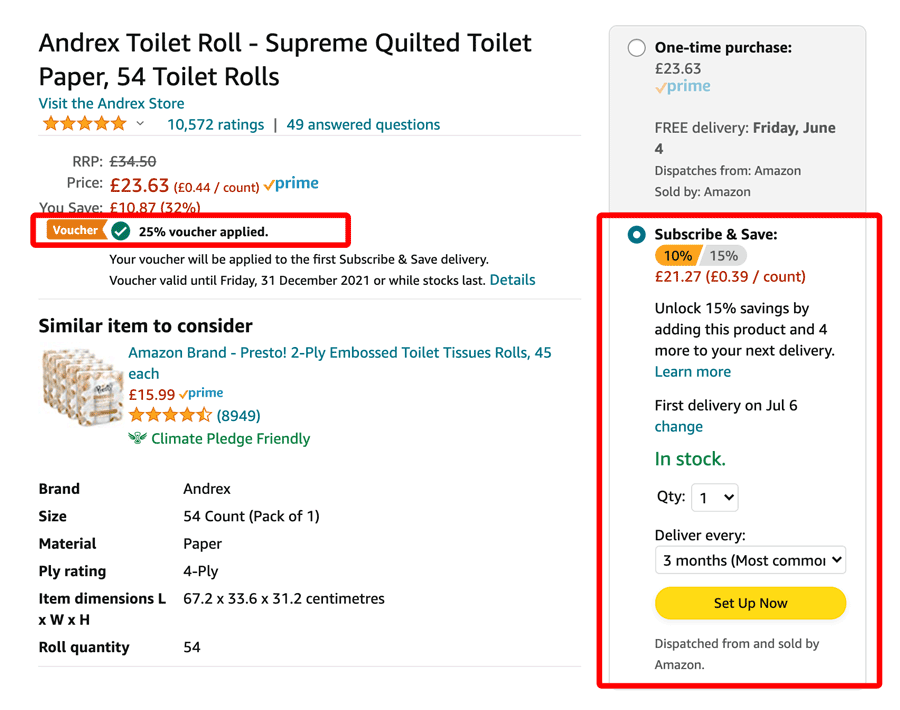

Subscribe and Save (SnS) is Amazon’s loyalty programme to ensure that customers make repeat purchases of replenishable products on its marketplace.

Typical examples of eligible products are dishwasher tabs, hand soap, or toothbrushes.

Customers typically receive a 10% to 15% discount for the first purchase and an increased discount of 15% to 20% for any order thereafter.

Vendors can either pay a flat percentage for participating in the programme or opt for pay-as-you-go financing, i.e., they receive an invoice for the actual subscription costs of their portfolio.

In recent years, Amazon has made it a requirement for brands selling consumer goods to opt into the SnS programme.

However, brand owners need to be careful when setting up their promotional strategy, as the SnS discount also applies when a product is on deal.

Amazon Vine Programme

Vendors can purchase credits for Amazon’s Vine programme, which lets them send product samples to selected Amazon customers.

In exchange for receiving the item free of charge, these customers commit to publishing a review on the Product Detail Page, helping brands to build trust with other customers.

Amazon Vendor Service (AVS)

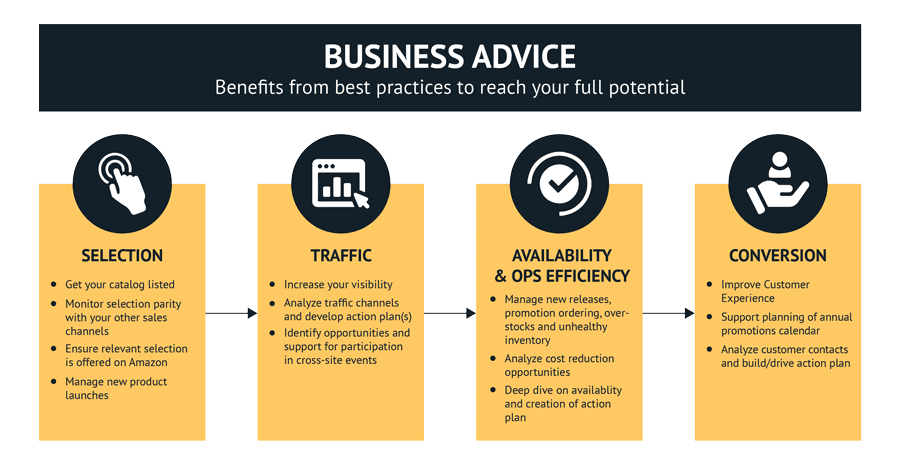

The Amazon Vendor Service (AVS), formerly known as Strategic Account Service (SAS), is a paid programme that gives suppliers access to a dedicated contact to assist with operational matters such as ordering or the catalogue.

Although the AVS is often sold as a strategic programme, it is more of a day-to-day contact for brands to answer their questions and coordinate product launches and promotions.

Vendors that choose not to invest in AVS risk being moved into Amazon’s mass vendor management (Vendor Success Programme) and losing access to a dedicated Vendor Manager contact.

Volume Incentives

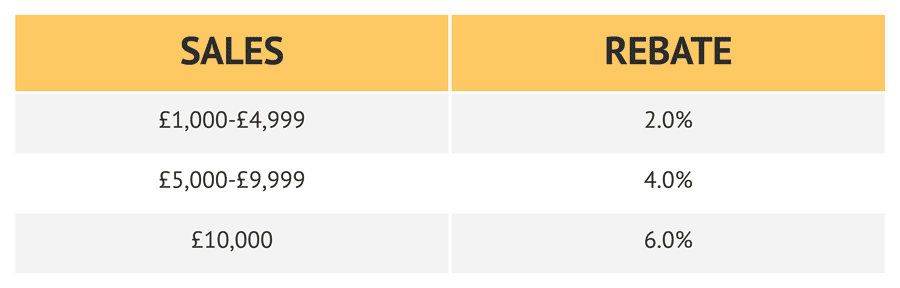

Volume Incentives (or: Volume Incentive Rebates, VIR) are granted either as a fixed or tiered percentage. They incentivise Amazon to buy additional volume from a brand.

Amazon often optimises its free cash flow by setting a high sales target that suppliers pay for throughout the year. If this target is not reached by the end of the cycle, the accrued investment is refunded.

Damage Allowance

The Damage Allowance, also known as liquidation fee, is a commercial trade agreement to compensate Amazon for damaged goods received from customers within the warranty period.

It is one of the more controversial terms of trade that Amazon charges, as the data behind them is rarely shared, and brands have no way of judging the legitimacy of the fee.

Vendors of electronic items may also be asked to opt into Amazon’s Warranty Repair Programme. It allows customers to get repairs from a certified service centre without having to contact the manufacturer.

Freight Allowance

Next to commercial allowances, Amazon also offers many logistical solutions to enable its vendors to distribute goods more effectively.

This directly integrates into the flywheel model that Amazon is known for, as reducing distribution costs enables the retail giant to structure its margins more effectively.

To access these supply chain programmes, vendors have to pay a Freight Allowance. Some of these solutions are known as PICS, Direct Import, Direct Fulfillment, Pallet or Full Truck Load Ordering.

Return Rights

Return Rights allow Amazon to send back purchased goods to a supplier. There are various reasons for returning stock, including defective, damaged or overstocked goods.

Vendors can either grant full return rights or define the type of reasons for which they are willing to accept returns from Amazon.

Payment Terms

As with any other retailer, Payment Terms are part of the commercial negotiations with Amazon.

Different payment terms are possible, but most brands will typically have these set around 30 to 60 days EOM.

This means that Amazon receives a 2% discount if it pays the invoice before payment is due at the end of the second month following the month of the invoice.

Phase 1: Preparing your Amazon Vendor Negotiation

Now that you know what terms will likely be part of your Annual Vendor Negotiation, it’s time to roll up your sleeves.

Amazon’s negotiation cycle usually begins in early October, which means you should start your preparations during the slower summer months.

I strongly recommend starting the process no later than mid-August so that your teams have enough time to review and build their business case.

Gather your data

As we discussed earlier, Amazon treats the annual negotiation process very transactionally. So it’s critical that you know your numbers.

Tip: Make sure you know your revenue, margin and operational figures for the last 12 months before entering a discussion around trade terms.

Bonus tip: Register your brand with Amazon Brand Registry. This will give you access to Amazon’s Retail Analytics in Vendor Central, which allows you to see enhanced sales reports.

But don’t just review your past top- and bottom-line performance. Also make sure your teams review the concrete agreements you have made with Amazon in the past.

Has Amazon kept its promises and delivered on the set targets over the last twelve months?

Look at things like:

- Supply chain improvements.

- Promotional partnerships.

- Successful NPD launches.

- Out-of-stock performance.

- Cost savings.

You want to get a crystal-clear picture of whether you have achieved the goals for which Amazon has set the trading conditions over the last twelve months.

This exercise will also give you a better understanding of what your business specifically needs.

For example, if you think that a closer collaboration with Amazon will benefit your teams, you may want to negotiate access to their Amazon Vendor Service.

Plan your budgets

Once you’ve reviewed your Amazon account performance, it’s time to take a look into the future.

Based on your account’s past growth trajectory, you should model your growth forecast for the upcoming year. From there, you can work with your finance teams to build an investment plan.

This is where a lot of smaller vendors get it wrong. They wait until Amazon presents them with an investment plan and then scramble to understand whether the ask is justified.

That’s not a position you want to find yourself in. Instead, take a proactive approach and plan your targets upfront.

Tip: Align with your MD and Commercial Director team to ensure they understand that Amazon is neither a typical retailer nor marketplace. Investments often have to be made upfront to see the desired results, which is different to the rest of your retail partners.

Know your value

By now you should have a pretty good understanding of your past performance with Amazon and a first understanding of your future budgets.

The next step is to identify your brand’s position in the Amazon category. This allows you to better understand your negotiation power.

If you’re one of their top ten brands, you will have more leverage than a vendor that ranks outside the top in any given category.

So where do you find that info?

You’re likely already working with the leading market research company in your industry. It’s crucial that you’re leveraging their reports.

For example, Nielsen offers tailored category landscape reports that will help you understand key category trends and identify which subcategories, manufacturers, brands and items play the biggest role in driving sales.

Tip: The value of your brand goes beyond your category position. You may have gained insights into the importance of your brand from previous strategy conversations with Amazon. Remember that selection not currently offered to Amazon is only one of many levers to play within your annual negotiation.

Understanding your value is a key step in the preparation phase, so do your homework properly. It will largely determine your negotiation strategy and thereby your commercial success with Amazon.

Prepare scenarios

Amazon spends a lot of time preparing and planning the annual vendor negotiation process. So you should too!

Once you’ve gathered your data and know what budgets and value you bring to the table, start preparing different scenarios. You should be clear about how an ideal, realistic, and worst-case scenario would look in your AVN process.

For example, what is your contingency plan if Amazon asks for a 5% increase in trade terms? Or: What if Amazon stops selling your products due to low profitability?

Scenarios like the above may sound unrealistic at first but believe me when I say that they happen all the time.

So you and your teams need to plan ahead. You should know whom you have to inform in your logistics, finance and sales department if things fall out of place.

Start drafting your scenarios by keeping the following points in mind:

- Your Amazon negotiation strategy

- Timelines of the negotiation

- Escalation stakeholders

- Escalation roadmap

- Contingency budgets

- Red lines of your negotiation

Have an exit strategy

Once you have prepared your negotiation scenarios, you will naturally come across the following question:

What if you can’t reach an agreement with Amazon?

The answer depends a lot on the importance of Amazon to your business. If they only account for a small proportion of your total sales, you may be able to shift your focus to other retailers instead.

But if the online marketplace is a major gatekeeper for your online growth, you need to consider other options.

Instead of shutting down your Amazon business, switching from a 1P to a 3P or hybrid relationship can help manage your profitability.

Whatever your situation, an exit strategy will help you assess how flexible you can or cannot be if negotiations stall.

Having clarity about possible scenarios before the actual negotiation begins ensures that you don’t make the wrong decisions later on due to time or commercial pressure.

Phase 2: Kick-off meeting

After finishing your preparations, it’s time to get serious. Around the fourth quarter of each year, you will likely receive an email from your Vendor Manager asking for a meeting to discuss the joint business.

Some Amazon buyers will call it a “Joint Business Plan”, while others will not give it a name altogether. Whatever the wording – this meeting marks the start of your annual trade negotiations.

So let’s take a look at what you can expect from it.

Meeting structure

Your Vendor Manager will either invite you to their office or hold the kick-off meeting virtually. These meetings can last between two and up to six hours. Either way, expect Amazon to lead the meeting.

The typical meeting agenda of an AVN kick-off looks like this:

- Overview of Amazon initiatives and category trends

- Review of the joint account performance

- Priorities for the next 12 months

- Growth target incl. a proposal for future trading terms

Although you may be used to presenting your product innovations to your other retailers in such meetings, don’t expect your Amazon buyer to reserve any time for that.

Amazon negotiates very transactionally and typically shows little interest in your product roadmap. It’s frustrating, but that’s the way it is.

Required attendees

Before you accept the meeting invite, it’s always a good idea to ask for a list of Amazon meeting attendees. This will help you mirror Amazon’s stakeholders at a similar seniority level from your side.

For example, if a Senior Vendor Manager is leading the meeting, you should mirror them with a Senior Account Manager from your side, and so on.

| Amazon Stakeholder | Equiv. Vendor Stakeholder |

|---|---|

| Vendor Manager | Account Manager |

| Senior Vendor Manager | Senior Account Manager |

| Category Leader | Head of Sales / Ecommerce |

| Director | Sales Director Ecommerce |

Tip: Limit your team’s attendance to as few participants as possible. That way, you can bring in more senior leaders if negotiations stall later on.

Amazon’s Key Performance Indicators

During the kick-off meeting, your Vendor Manager will use a handful of KPIs to make their business case. So let’s take a look at the metrics you should know about:

PCOGS or Shipped COGS

Short for Product Costs of Goods Sold. It is a revenue figure that takes your cost price to Amazon and multiplies it by the volume sold to their customers.

Vendor Cost Price * Volume Shipped to Amazon Customers

Net Receipts

Similar to PCOGs, but this metric multiplies your cost prices with the volume that you as a vendor have shipped to Amazon warehouses.

Vendor Cost Price * Volume Shipped to Amazon Warehouses

Net Pure Profit Margin (Net PPM, or: Procurement Margin)

The main profitability metric that Amazon refers to when talking about a vendor’s bottom-line performance. It takes the average selling price, deducts the cost price and adds your back-end terms.

Revenue – PCOGs + Terms

Note that back-end terms exclude investments into Amazon Advertising and any chargebacks. You can also find a detailed Net PPM definition here.

Lost Buy Box (LBB)

Lost Buy Box measures the number of times Amazon could not win the Buy Box because other marketplace sellers could beat its price.

The lower the percentage, the better your direct reach to Amazon’s customers.

Number of lost buy boxes / Total number of detail page impressions

Procurable Out of Stock (ROOS)

ProcOOS measures the availability rates of Amazon. It’s an output metric that indicates the operational performance between vendors and Amazon.

Having your ProcOOS value below 10% is great. If it is below 5%, it is considered best in class.

Number of times Amazon was out of stock / Total number of detail page impressions

How to deal with the first Amazon ask

After reviewing your brand’s performance and future priorities, your Vendor Manager will close the meeting by presenting you with an initial growth forecast.

This forecast is typically derived from your previous growth trajectory but is unlikely to consider your actual growth potential through, e.g., new product launches or product mix changes.

Still, Amazon is likely to put a price tag on that growth. Investment asks of four to eight per cent are common. The approach is to anchor high so that there is enough room to negotiate over the following weeks.

At this point, the number one rule is to stay calm and not get emotional. Once you see the figures, follow a pragmatic approach. Ask how and why the proposal was structured the way it was presented and make note of the answer.

Tip: Disagree early on if statements made are not correct. Make your Amazon buyer aware of any missed targets from previous negotiations. Raising these issues early will help you position yourself.

Again, I would not recommend agreeing or disagreeing with the terms presented during the session.

The kick-off meeting is mostly about Amazon launching the negotiation process. Your Vendor Manager is likely to have a few of these meetings in the same week they meet you.

So after Amazon has explained its proposed terms to you, end the meeting and agree on the next steps and expected timelines. That’s all there is to it!

Phase 3: Negotiating with Amazon

Now it’s finally time to negotiate. After your Vendor Manager has sent over their investment proposal, review it in detail.

Here’s where the quality of your preparation comes into play. If you’ve done your homework, you will be able to easily assess whether the proposed investment areas align with your growth ambitions.

If they do, then great! Your job is now to ensure you’re paying a lower than the proposed price for the added benefits.

But if the proposed investment structure does not reflect your strategic ambitions (or worse, isn’t commercially feasible), you need to prepare for a much tougher round of negotiations.

Tip: Amazon does not expect you to accept their first proposal as is, but they expect you to provide feedback promptly. So make sure you respond to their first email within five to ten days.

Negotiation mechanics

For many, negotiating feels like a very complicated process. There are many pitfalls, and the outcome often seems unpredictable.

Experienced negotiators know that this is not the case. However, the secret to a successful commercial alignment is to know the underlying mechanics.

The ZOPA framework

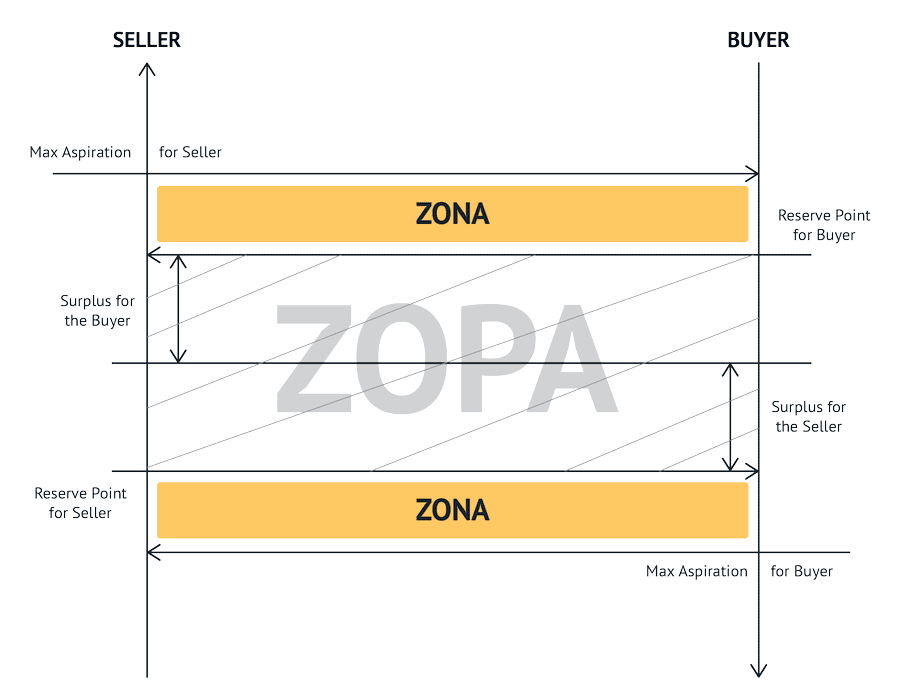

When two parties come together to negotiate, they will typically present each other with a so-called anchor.

Each anchor represents the best-case scenario for that party to which the other is unlikely to agree with. Therefore, it sits in the Zone Of No Agreement (ZONA).

It’s a bit like a Turkish bazaar: The seller anchors with their highest selling price (e.g. $20), while the experienced buyer asks for a much lower one (e.g. $10).

If neither party moves from their original offer, it is unlikely that the negotiation will conclude successfully. Therefore, a negotiation typically involves several iterations in which both parties approach the Zone Of Possible Agreement (ZOPA).

The Zone Of Possible Agreement is the area where both negotiating parties can find common ground. In other words, they will compromise and reach an agreement in this area.

In our bazaar example, both parties may agree on a final price of $15, as it still returns a profit for the seller and provides enough value to the buyer.

So how does this translate to your annual negotiations with Amazon?

When Amazon presents their first ask (i.e. anchor), it is unlikely that you as a vendor will simply agree to it. This is because their first ask likely sits in your Zone Of No Agreement (ZONA).

Conversely, Amazon is unlikely to agree to the first proposal you present because they assume it is your best-case scenario and does not reflect your true willingness to invest.

As a result, you should always anchor your counter offer at a much lower base than where you want to close the negotiation.

Negotiating commercial terms

You’ll remember me saying that negotiating with Amazon can feel a little different than with your other retail customers.

But what does that actually mean?

Put simply, there will be a lot of emails going back and forth between you and your Vendor Manager. They don’t have much time to spare, so don’t expect to have a lot of phone calls or face-to-face meetings with them.

That’s why your response to Amazon’s first proposal must clearly position your central asks.

These could be cost price increases, a reduction or a restructuring of existing trading terms.

In any case, you should outline where your business has invested in the joint partnership over the past twelve months:

- Have your costs to serve Amazon gone up?

- Have you delayed a mid-year cost price increase?

- Etc.

Try to quantify this impact on an annual basis and express it as a percentage of your Amazon sales. Highlighting these investments will help you build your case and positioning in your negotiation.

Want a tried-and-tested tool to track and quantify your AVN results? Check out my Excel-based negotiation calculator. NEW

You should always insist on getting an overview of the margin development of your account by month for the past year.

This information will help you understand whether any commercial support requested is justified. If Amazon does not share this information, you know that it’s probably a bluff.

As you can see, persistence and creativity are key to successfully aligning trade terms with Amazon. But even if you take the most rational approach, you sometimes find yourself confronted with a Vendor Manager who wants to get it their way. They may choose to “escalate”.

How to handle disincentives

Every now and then, Amazon may take measures to speed up the annual negotiation process. This happens mainly when commercial discussions have been ongoing for several weeks without significant progress.

Amazon is known to use various tactics to accelerate negotiations, ranging from suspending the Buy Box to redirecting traffic or even pausing orders entirely.

Regardless of the punitive action, you should know that these are usually short-term measures to escalate unresolved commercial issues between both companies.

Note that there are a couple of red lines that may trigger punitive actions against your account, such as:

- Deliberately delaying negotiations,

- Showing little commitment,

- Asking for a significant reduction in terms,

- Blocking their teams from reaching out to your leadership team,

- Not agreeing to backdate terms.

Amazon wants to conclude negotiations with its vendors as quickly as possible so they can move on to other pressing tasks.

If you find yourself in a situation where Amazon has introduced measures against your brand, be prepared for a short-term sales disruption and work with your Vendor Manager on the sticking points.

Know that Amazon will not typically uphold these measures for a long period of time, as they have an equally negative impact on their CX.

However, it is of utmost importance that you take these measures seriously. Only then will you be able to resolve and conclude your negotiations.

Utilising escalation mechanisms

While you could see an escalation as something you strictly want to avoid, think again.

Earlier in this article, we discussed that Amazon purposefully integrates the escalation phase into its negotiation process. Why?

Because it allows Amazon to access more senior stakeholders on the supplier side.

Let that sink in for a moment.

If you think about it, this is pretty great news for you as well. Because it also gives YOU the chance to access their senior leadership!

Most vendors have no idea who sits above the Category Leader of their Amazon category. This can make it tricky to build a truly strategic relationship.

So depending on your situation, escalations can be an effective way to bring Amazon’s leadership to the table.

… which in turn can help you leave detailed discussions behind that your Vendor Manager would otherwise always come back to.

Phase 4: Measure & Control

The last step in the Amazon negotiation process is to put your new trading terms into action.

Your Vendor Manager will typically send you all agreements for your confirmation via Vendor Central.

But before you start confirming those contracts, there are a couple of things you need to consider.

First, ensure your Vendor Manager sends you a written overview of the agreement structure, including a clear summary of which of the existing contracts are to be amended and which are to be terminated.

Second, make sure that your contract period matches the period of service provision. For example, if you enter into an AVS contract, make sure that the contract start date matches the actual service start date.

Third, don’t sign anything you’re not 100% clear on. I know, it sounds like a no-brainer. But I’ve seen it too often that account managers confirmed agreements without understanding them entirely. Don’t do that!

Once your new arrangements have been set up, ensure that your audit teams have access to them via Vendor Central.

Tip: Let your audit teams review the Amazon account figures on a monthly basis. That way you can be sure that any deviations from the agreed terms will be discovered early on, giving you time to address and rectify these issues during the current contract period.

Conclusion – Take ownership of your Amazon business

Annual trade negotiations can quickly become very complicated. Every negotiation is different, and there is no one-size-fits-all approach.

However, I hope this guide has given you an insight into how to prepare, negotiate and control the outcome of your Annual Vendor Negotiations with Amazon.

If you found value in today’s article, please share it on LinkedIn or any other social platform.

Need help with your Amazon negotiation?

Want a blueprint that shows you how to effectively prepare and conduct your negotiations with Amazon? I can help your team navigate the complex process and achieve the desired results.

Bonus: Frequently Asked Questions

The above outlined process illustrates the typical stages of an Amazon vendor negotiation. However, I also want to share some tactical advice to help your 1P business get ahead.

If you have another question I should answer, ping me on LinkedIn.

A: You can upload your cost price increases (CPI) via Vendor Central, but they are likely to get rejected by Amazon’s systems. So it is better to send your Vendor Manager an advance notice of the cost increase and ask for their written acceptance and confirmation.

If your CPI still gets rejected, you can either pause the delivery of affected products or make the cost increase part of your annual negotiations.

A: Your Amazon buyer will let you know how they intend to set up the negotiation process.

A: If you get an email asking you to adapt trading terms, your account is likely part of the Vendor Success Programme (VSP).

VSP vendors follow a different process without any direct contact with a Vendor Manager. You’ll need to weigh up whether to agree to the updated terms or reject them. In the latter case, Amazon may restrict the sale of unprofitable items.

A: If your account has grown over the last twelve months, your Vendor Manager will expect you to increase your investments accordingly. You will need to justify why this is out of the question, e.g., due to increased costs to serve Amazon, portfolio mix effects, etc.

However, don’t expect this to be an easy discussion. As with all trade negotiations, growth does not come for free, and Amazon will want its fair share of investment.