Difficult vendor negotiations, skyrocketing costs and tough pricing algorithms have many brands questioning the 1P Vendor model. Could the switch to Seller Central (3P) be the solution?

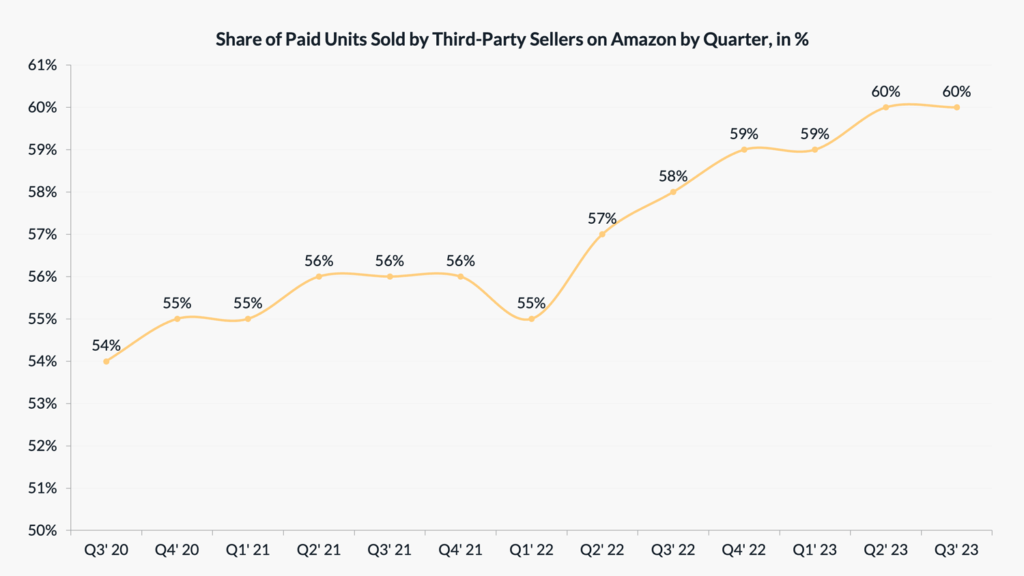

If you are considering the move from Vendor to Seller Central, you are not alone. The share of brands selling via Seller Central has increased dramatically over recent years.

In 2023, 60% of all sold units on Amazon came from third-party sellers.

The number one reason for brands switching to Seller Central?

They are trying to avoid the high costs normally associated with the 1P business model. But they often ignore the hidden cost components that come with running a 3P account.

So if you’re a vendor and wondering if you should switch to Seller Central, this article is for you! We will explore when you should consider moving to Seller Central and what to look out for when pursuing this strategy.

This article will cover:

- Why move from 1P to 3P on Amazon?

- When to move from Vendor to Seller Central

- How to make the switch to Seller Central

- Challenges of switching 1P to 3P

Why move from 1P to 3P on Amazon?

The reasons why vendors think about becoming third-party sellers usually fall into three categories.

They either want to…

- Improve their margins,

- Control their product prices, or

- Take back control over their inventory management.

The frustration many brands have with the 1P Vendor model stems from the fact that it’s become complex and expensive to manage.

Today, Vendor Managers mostly refer vendors to self-service tools or the case system in Vendor Central, leaving brands without much human interaction to manage their Amazon accounts.

At the same time, vendors are subject to annual vendor negotiations, or Joint Business Plans (JBPs). Brands often see these negotiations as lengthy and difficult, adding a bitter taste to the 1P sales model.

This is problematic as Amazon has invested significantly to improve the experience of 3P sellers, giving them access to features like A+ content or Brand Registry that were previously exclusive to vendors.

With more transparent rate card fees for sellers than for vendors, switching from Vendor Central to Seller Central may present a real cost-saving opportunity that brands should consider when selling on Amazon.

| Vendor (1P) | Seller (3P) |

|---|---|

| Brands and manufacturers sell wholesale (1P) to Amazon. | Brands and manufacturers list products and sell directly to consumers. |

| Limited control over product pricing, inventory management and product launches. | More control over product pricing, inventory management and product launches. |

| No direct contact with end customers. | Direct contact with end customers. |

| Highest chance of winning the BuyBox by default. | Has to compete for the BuyBox with lower prices and fast delivery. |

| Yearly negotiation of trading terms. | Fixed fees to sell on the marketplace. |

When to move from Vendor to Seller Central

The motivations for switching to Seller Central differ from the scenarios in which brands should open a 3P/FBA account. Let’s take a closer look at each of them:

Scenario 1: Amazon has given up on you

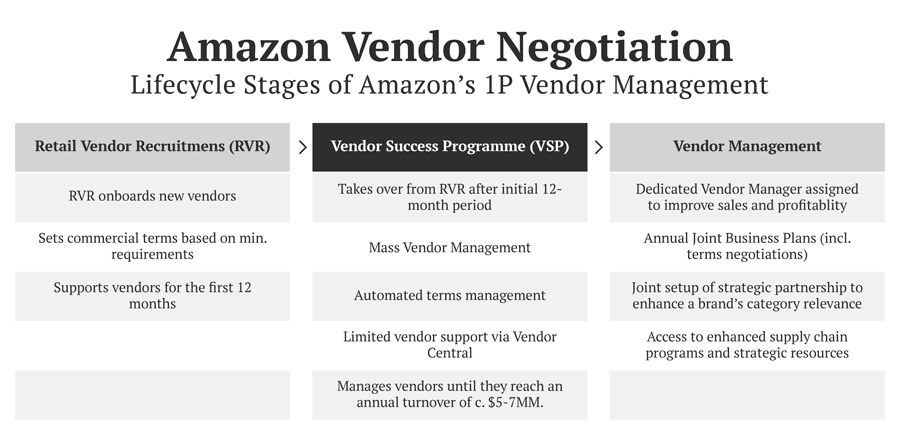

If you’re a brand that doesn’t have access to a dedicated Vendor Manager and relies on the case management in Vendor Central to resolve issues, chances are you’re being managed by Amazon’s Vendor Success Program (VSP).

Their job is to manage brands with low revenue figures at scale, keeping direct contact to a minimum. It is not uncommon for VSP managers to handle several hundred vendor accounts simultaneously.

This makes it difficult for brands to get dedicated support for managing inventory levels, operations or questions about their catalogue.

On the other hand, Amazon invests significantly in the support for its 3P sellers. They can regularly speak to an account manager on the phone and receive well-documented instructions on self-serving their seller account.

So if you feel that Amazon isn’t showing much interest in your 1P business, opening a 3P account will likely give you access to a better support system that your teams can use to develop your marketplace sales.

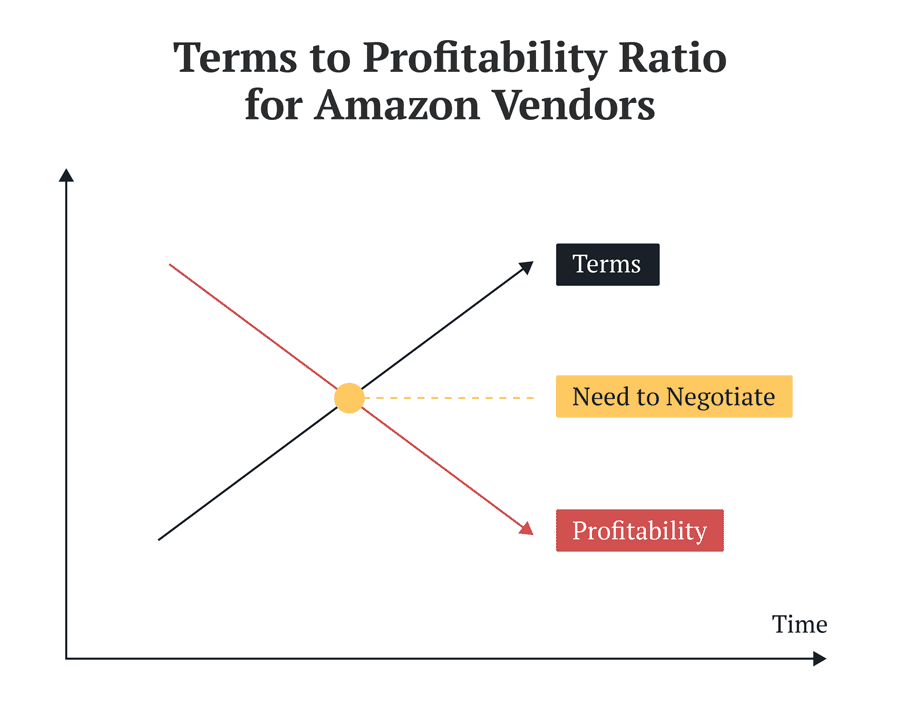

Scenario 2: The cost to serve Amazon has become unsustainable

Annual vendor negotiations and matching compensation requests mean that the relationship with your Vendor Manager is likely to be transactional.

As long as you invest more each year, the 1P business model will likely return growing sales figures.

But add chargebacks, quantity and price variances to the equation and your costs to serve Amazon quickly become unsustainable.

Then you can either negotiate an increase in your cost prices or a reduction in trade terms. Both are lengthy and complex discussions that your Vendor Manager won’t readily accept.

Another option is to move unsustainable selection to 3P/FBA. This ensures you can continue to sell your entire portfolio while working with your Amazon manager to find a long-term solution.

Scenario 3: Amazon erodes your prices

Before we get to this point, let me say one thing right up front: it is unlikely that Amazon is eroding your prices. Instead, chances are that the incentive structure of your distribution channel strategy is causing issues.

For example, if you’re a brand offering volume discounts to wholesalers who happen to sell on the Amazon marketplace themselves, you’ve just created competition that will undermine your prices to win the BuyBox.

As a result, switching to Seller Central is unlikely to be an effective solution. You’ll need to streamline your incentive structures first.

However, if Amazon pursues a price-leading strategy on your portfolio, switching to 3P will be your only option to regain control over your product’s prices.

Note that Amazon recently introduced a feature that prevents 3P sellers from displaying non-competitive prices. In such cases, Amazon will simply not display the Buy Box. So you’ll still need to ensure that your 3P price is competitive when compared to other retailers.

Related: How to Increase Your Average Selling Price on Amazon

Scenario 4: You want to diversify your Amazon business

Another scenario in which brands may want to move to Seller Central is to reduce their dependency on Vendor Central.

In this case, a seller account serves as insurance if anything drastic happens to Amazon’s vendor ecosystem, such as introducing higher fees, margin pressure, or discontinuing the 1P business model.

Brands will typically open a 3P account to familiarise themselves with the systems but do not (yet) see it as the primary route to selling on the Amazon marketplace.

This allows brands they assemble the right teams, acquire the necessary knowledge and train their employees to eventually switch to 3P without losing sales.

How to make the switch to Seller Central

Brands that want to pursue a move from Vendor to Seller Central should first consult their legal team and review their terms and conditions with Amazon.

Amazon often includes a manufacturer clause that prevents vendors from becoming sellers without their written approval.

It’s advisable that you discuss the move with your Vendor Manager and let them know that you intend to open a 3P account.

Then, brands can follow these steps to migrate from Vendor to Seller Central:

- Open a Seller Central account

- Register with Brand Registry

- Choose a fulfilment option (FBM/FBA)

- List your products

- Set your product pricing

- Manage your inventory

- Manage product content

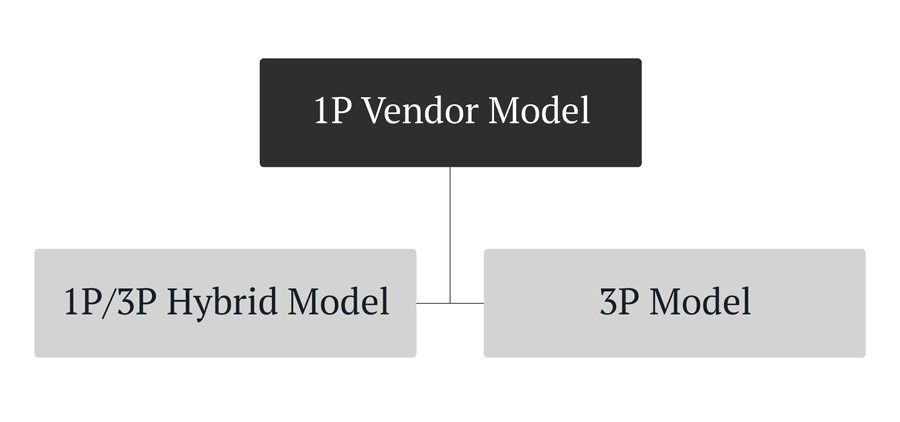

Vendors generally have two options to become 3P sellers: They can either take a 1) hybrid approach or 2) make a hard switch to Seller Central.

Hybrid approach

A hybrid approach enables brands to maintain control over key aspects, like pricing and inventory, while also strategically leveraging Amazon’s infrastructure in areas such as fulfilment and marketing on key products.

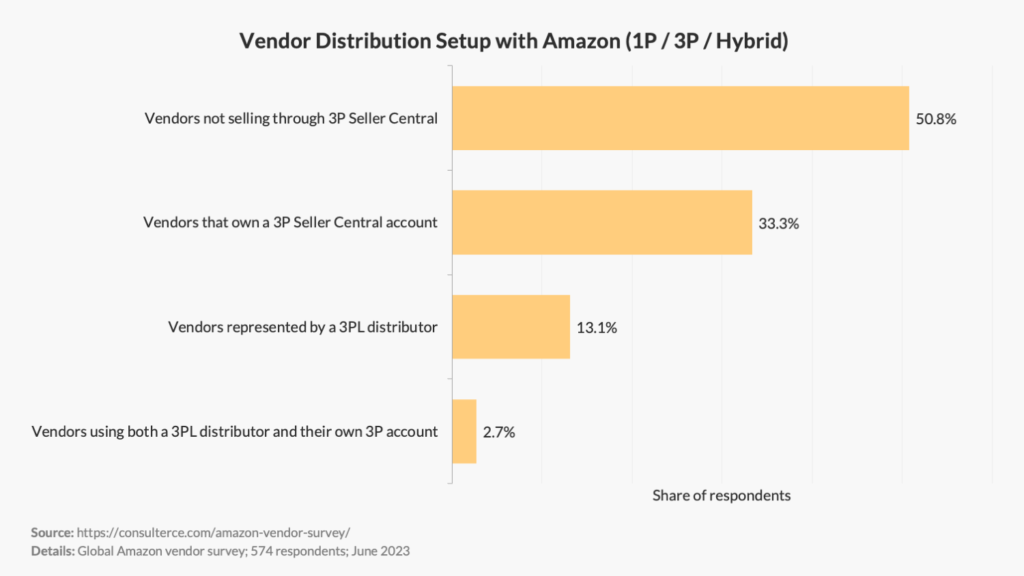

In a recent industry study I conducted, half of all Amazon vendors take a hybrid approach, using both first-party (1P) and third-party (3P) selling models.

The advantage of a hybrid approach is that vendors can choose which distribution mix is most profitable for their business.

For example, unprofitable products in Vendor Central can often be sold at a fraction of the cost through 3P, increasing their profitability in a brand’s P&L.

This makes the hybrid approach also an effective alternative to continue selling products for which Vendor Managers have refused to adapt cost prices.

Brands should generally consider a hybrid approach if they:

- Struggle with Amazon regularly running out of stock;

- Want to speed up NPD launches;

- Lower their cost structures;

- Want to become more agile when testing new products;

- Sell seasonal products their Vendor Manager doesn’t want to buy.

Vendors gain more control over their brand and customer experiences when leveraging data insights from the first- and third-party models.

However, not every brand wants to continue selling via Vendor Central. Their alternative is a hard switch to Seller Central.

Hard switch

Transitioning from 1P to 3P requires brands to effectively transform their internal capabilities to cater to the third-party model.

After all, a hard change also risks interrupting existing revenue streams if not planned carefully.

In such cases, brands should consider hiring external agencies or consultants to bridge any knowledge gaps in their organisation.

The hard switch is suitable for brands that:

- Struggle with high trade terms in Vendor Central;

- Receive small PO volumes that don’t justify the cost to serve;

- Sell a wide portfolio range across multiple product categories;

- Focus only on private-label products;

- Want to use Amazon as a DTC channel instead of a wholesaler;

- Seek to avoid annual vendor negotiations.

Challenges of switching from 1P to 3P

Moving to Seller Central comes with many challenges brands need to be aware of. The following highlights the most common hurdles organisations face when considering leaving the 1P Vendor model.

Amazon may hinder your move to Seller Central

Amazon introduced their first-party business to ensure the availability of critical products at low prices. Leaving Vendor Central poses a direct threat to their Flywheel model.

If you count yourself as a category-critical brand, you can expect your Vendor Manager to exhaust their options to keep you as a vendor.

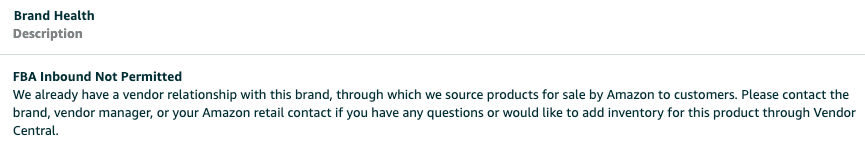

Amazon’s Standards for Brands Policy states that it may prevent you from creating a 3P account or listing products previously available through 1P.

In these cases, a switch to Seller Central needs to be carefully executed.

The hybrid model will almost always be the preferred option as it allows you to list future products through 3P while selling your existing portfolio in Vendor Central.

Alternatively, you can also consider appointing a distributor to sell part of your range on the Amazon marketplace. This can often still be more profitable than selling through Vendor Central alone.

Related: Amazon Standards for Brands Policy: The Complete Guide

Your distribution strategy gets in the way

Brands that sell to multiple retailers know that Amazon will follow the price of the cheapest option in the market.

This becomes even more difficult when your teams sell to wholesalers who are themselves third-party sellers.

In such cases, switching to Seller Central means that you’ll be competing with your own distribution partners on the Amazon marketplace. But without the benefit of being prioritised as a vendor in the Buy Box.

Amazon may suppress the Buy Box

One of the biggest misconceptions about moving from Vendor to Seller Central is that brands regain full control over their product pricing.

Let me be absolutely clear: This is not the case.

Instead, Amazon will suppress your Buy Box offer if you set an uncompetitive product price. So if another retailer sells your product at a lower price than what you’re offering it for, Amazon will remove your offer from the product detail page.

Amazon imposes tough requirements on sellers

Lastly, brands that aren’t operating efficiently will struggle to meet the expectations of customers and Amazon alike.

Amazon strives to provide an exceptional experience for its customers. For this reason, all third-party sellers are expected to meet a set of minimum performance goals:

- Order defect rate: <1%

- Pre-fulfillment cancel rate: <2.5%

- Late shipment rate: <4%

If brands fail to meet these requirements, they risk having their seller account deactivated and being left without a revenue stream on Amazon.

Therefore, business leaders need to ensure their organisations can meet the operational requirements of a 3P seller model before ending their 1P relationship.

Final thoughts

Moving from Vendor to Seller Central has become the holy grail for many consultants and brands out there. They consider it an attractive alternative to the expensive vendor model.

However, brands should be aware that the transition to 3P requires a very different set of skills and knowledge from their teams. After all, Seller Central lacks most automated supplier systems such as order or inventory management, which means that brands have to manage them themselves.

As a result, brands must weigh up the risks associated with moving to 3P and calculate the exact business case to ensure they protect their profit margins long term.

Unsure about switching from Vendor to Seller?

If you’re thinking about moving your vendor business to 3P, we should talk. I offer tailored advice to help you navigate through the complex decision-making process and assess your business case.