Are you losing sales to 3P Sellers while selling on Vendor Central? In this article, you’ll learn effective strategies to win back the Buy Box.

When selling your products on Amazon, winning the Buy Box may be one of the most critical elements in your journey to success with the online retailer.

Because if you can’t secure your place in this prime digital real estate, you won’t be able to sell your products to end customers.

So today, we will take a closer look at how you can increase your chances of winning the Buy Box if you’re a 1P Vendor to Amazon.

This guide will cover:

Let’s get to it.

What is the Amazon Buy Box?

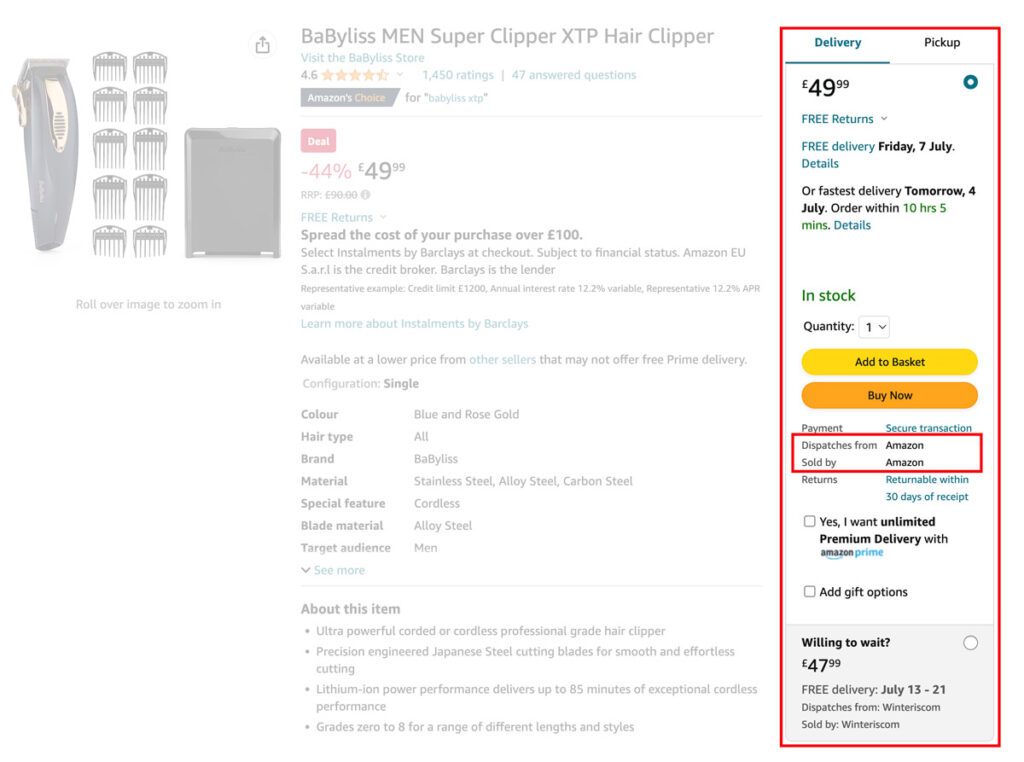

You’ve likely seen Amazon’s Buy Box a thousand times. It’s the white box on the product detail page that allows you to add a product to your basket and check out.

The reason this Buy Box exists is because Amazon is an online marketplace. This means that Amazon is often not the retailer that sells and ships products to end shoppers.

Instead, Amazon competes with thousands of third-party sellers for the Buy Box. Whoever wins it, gets the sale and can ship the product to the end customer.

This often surprises vendors who sell their products directly to Amazon, as they believe Amazon will always get the sale. But as we have found out, this is not the case.

How does Amazon determine who wins the Buy Box?

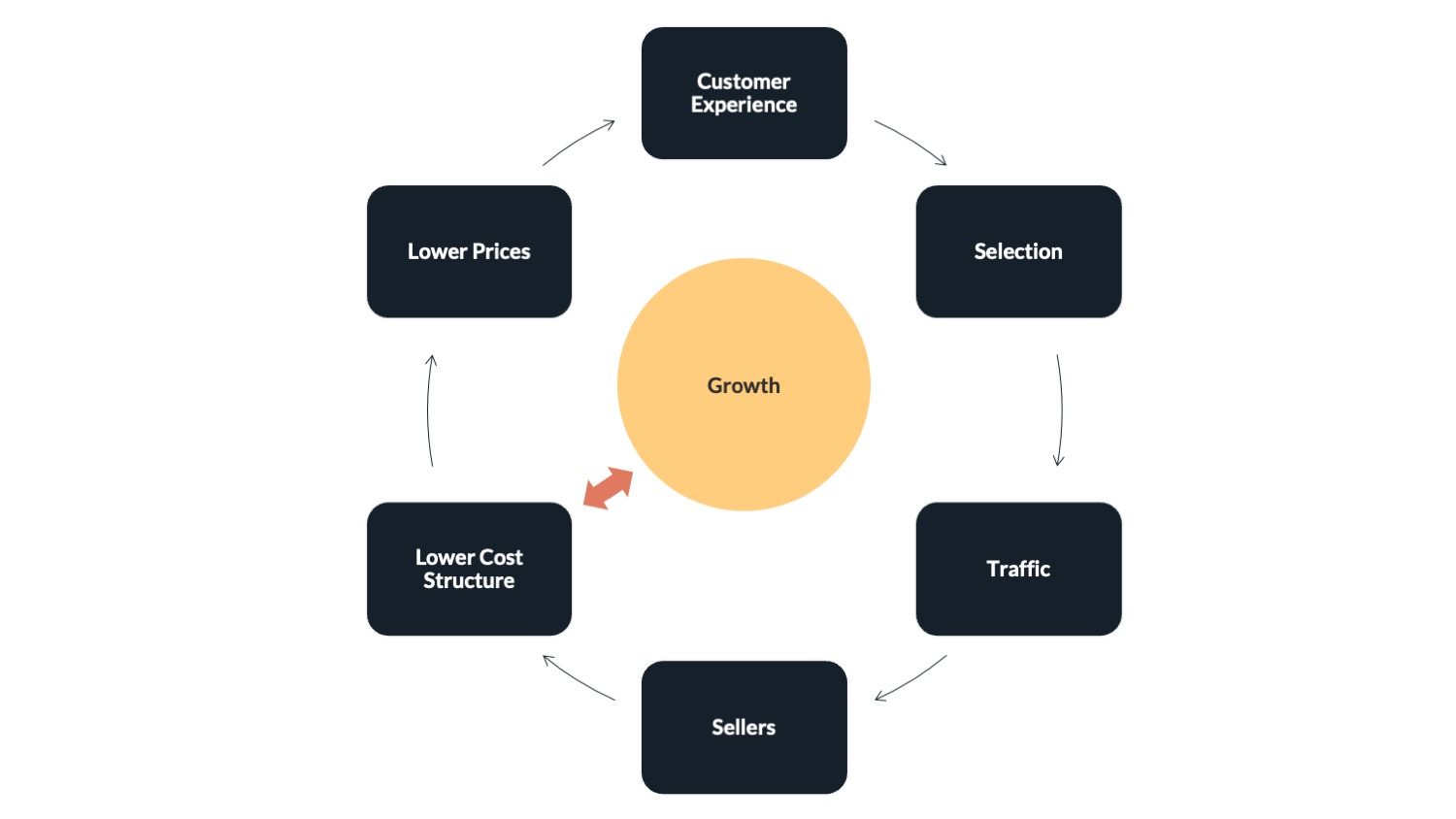

Having 3P Sellers compete for the Buy Box directly results from Amazon’s business model (the Flywheel). It states that attracting more sellers and selection leads to lower prices that improve the customer experience.

But with more and more sellers joining its marketplace, how does Amazon determine who should win the Buy Box?

Many experiments have shown that the Buy Box is awarded to the vendor or seller who:

- Offers the lowest price, AND/OR

- Has the fastest delivery option, AND/OR

- Has the best operational performance.

Please note: The exact weighting and individual factors are not made public by Amazon and change constantly; they also may vary by market and category.

5 Strategies to Win the Buy Box as an Amazon Vendor

With the definition and mechanics out of the way, let’s look at five strategies to increase your chances of winning the Buy Box when selling through Vendor Central.

1. Tighten distribution control

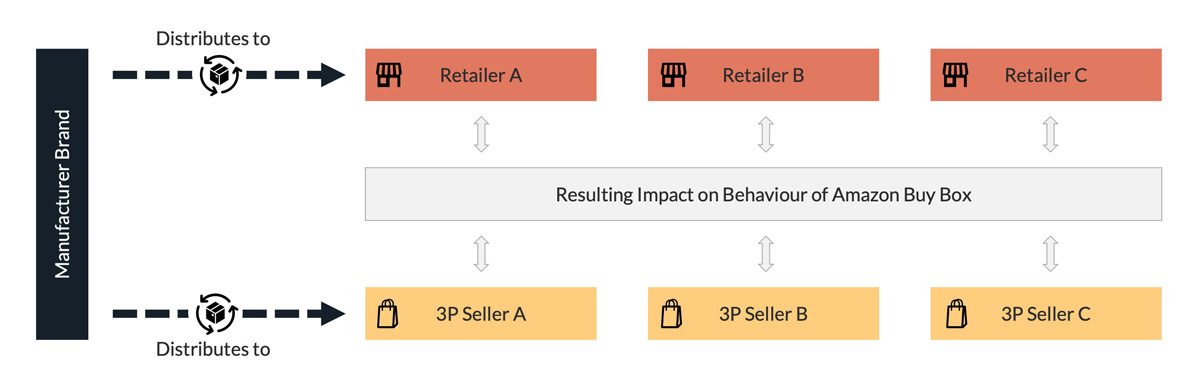

While many brand owners see Amazon as the enemy, it’s often better to think of it as the mirror of your distribution strategy.

That’s because if your teams sell your products to everyone and anyone, chances are some distributors or wholesalers will also offer your products to shoppers on the Amazon marketplace.

This becomes a challenge when offline resellers with traditionally higher volume discounts start passing these rebates on to Amazon customers.

In other words, they effectively begin to compete for the Buy Box directly with your 1P account. And with Amazon being a self-proclaimed price follower, the resulting competition on price is directly visible in its Buy Box.

This is a challenge but also an opportunity. After all, you as the manufacturer brand, control whom your products get sold to in the first place.

So when losing the Buy Box to 3P Sellers, understand who else is selling your brand on Amazon. Then, have your teams review existing incentive and discount structures across offline and online reseller accounts to avoid feeding your competition yourself.

The setup of Selective Distribution Agreements (SDA) or Minimum Advertising Policies (MAP) can also help address the unauthorised sale of your products on Amazon.

2. Improve forecasting processes

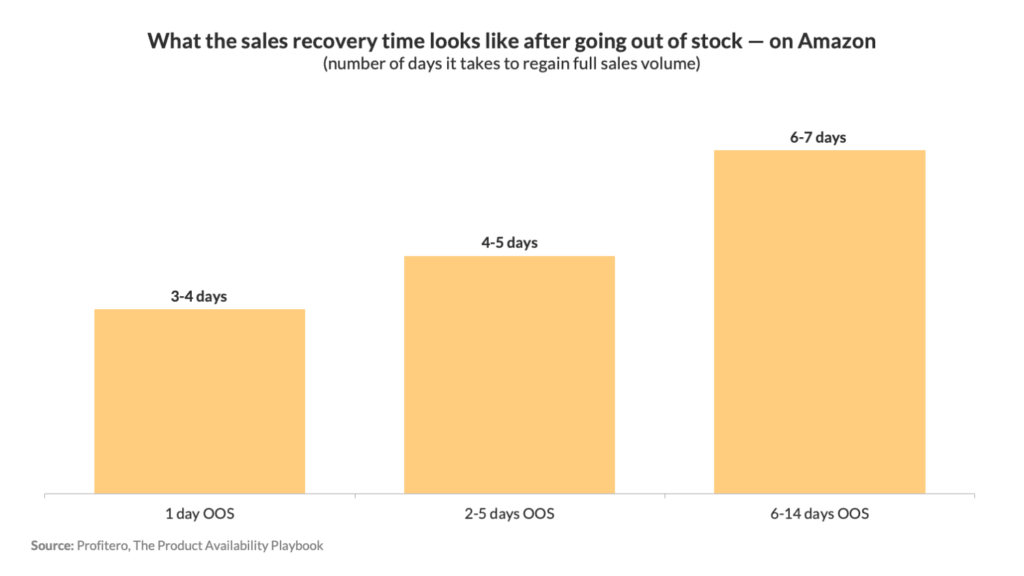

It’s no secret that Amazon rewards vendors with high product availability. A recent study by Profitero found that it takes 3-4 days to regain your full sales volume after being out of stock for 1 day on Amazon.

Being out of stock isn’t the same as losing the Buy Box. But Amazon will consider your availability performance when deciding whether to award the sale to 3P or your 1P account.

So if you want to protect your sales rank and consistently win the Buy Box, make sure you improve your forecasting processes with the online retailer.

As a vendor, you can ask your Vendor Manager to enrol in Amazon’s Commitment Ordering Programme. It allows you to access visibility into Amazon’s future order quantities before Purchase Orders are placed.

The main difference to the forecast in Vendor Central is that Amazon will commit to the quantity it intends to post as a future PO each week.

3. Prioritise inventory allocation to Amazon

Even the best forecasts aren’t flawless. But if you didn’t forecast enough inventory for Amazon, it’s critical that you still prioritise your stock allocation to the online retailer.

I know this doesn’t sound too appealing. Especially if your other retail partners have given you better forecasts or are more profitable.

But you must think of the hidden costs of unavailability on Amazon:

- Your media teams need to invest more to regain the original sales rank.

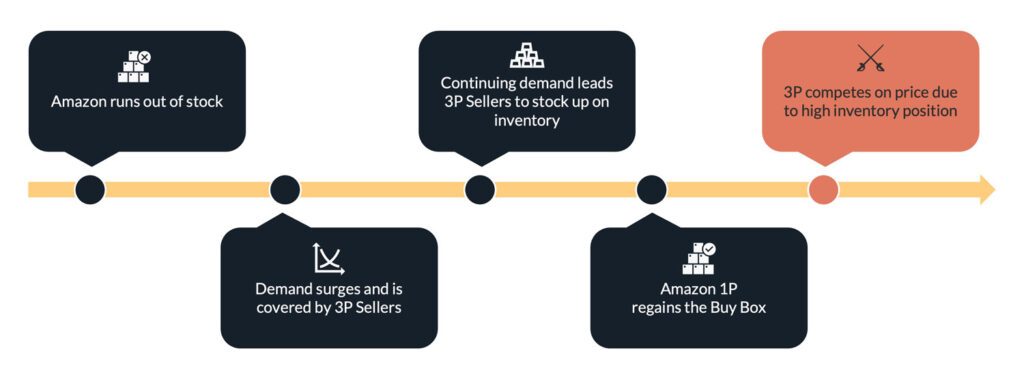

- Competition for the Buy Box among 3P Sellers may intensify while Amazon cannot meet demand.

- Longer unavailability may cause 3P Sellers to stock up on your product to meet customer demand. When you ship back to Amazon, 3P Sellers may compete more aggressively on price as they sit on all the inventory.

This is exactly why you need to educate your internal stakeholders about the mechanisms with Amazon across functions.

If your operational teams don’t know why availability is critical on Amazon, they will simply give the stock to someone else.

4. Improve your supply chain setup

Selling products online can be expensive. And the different compensation models between Vendor and Seller Central play an important role in distributing the Buy Box.

After all, Amazon receives an average of 15% commission for each sale. Plus an additional fee from sellers using its FBA programme. With vendors, the compensation is agreed upon individually.

So it only makes sense that Amazon may often pass the Buy Box to 3P Sellers if the compensation through Vendor Central doesn’t cover the cost of shipping your product to the end customer.

This mainly applies to:

- Low ASP products (<$ 10)

- Heavy products (>9 kg)

- Bulky products (> 45.5 x 34.0 x 26.5 cm)

Thankfully, Amazon offers 1P Vendors ways to improve these variable handling and shipping costs. Vendor Managers can onboard suppliers to supply chain efficiency programmes that will cut down shipping costs for Amazon and vendors.

Tapping into consolidation efforts through a Direct Import, Full Truck, or Full Pallet Ordering model help Amazon receive POs more cost-effectively. The resulting cost improvements are often enough to win back the Buy Box more consistently.

And if you’ve just recently switched to a Direct Fulfilment or Vendor Flex model, ensure your operational performance to confirm and ship orders meet Amazon’s strict requirements. Otherwise, you may lose the Buy Box to 3P Sellers.

Related: 5 Ways to Increase Your Average Selling Price (ASP) on Amazon

5. Improve your cost structures with Amazon

Losing the Buy Box to 3P Sellers is mainly a commercial challenge. When selling through Vendor Central, the online retailer expects you to provide competitive cost prices and trade terms.

So if you keep losing the Buy Box to 3P Sellers, it may be time to review your cost structures for those products.

| ASIN | SOA Funding | Cost Price Reduction |

|---|---|---|

| Average Selling Price | $10 | $10 |

| – Cost Price | $5 | $4 |

| + Trade Terms (CCOGS) | $2 | $2 |

| + Sell Out Agreement (SOA) | $1 | – |

| Resulting Net Pure Product Profit | $8 | $8 |

Granting ASIN-specific sell-out support can serve as a short-term measure. But it involves a great deal of effort that can lead to problems in auditing processes later down the road.

Especially if you can’t address the issue through a tighter distribution control, you may want to consider permanent cost decreases instead. While this requires you to deviate from existing list prices across countries, it serves as an effective way to structurally address Buy Box challenges.

And ensures that commercial misalignments don’t affect your brand experience on Amazon when 3P Sellers with slow delivery speeds or poor customer support are winning the Buy Box.

Related: How to Increase Your Vendor Margins on Amazon

Final thoughts

Winning the Amazon Buy Box isn’t difficult. But it requires your teams to prioritise product availability and focus on distribution control, as Amazon mirrors your broader sales strategy.

This often requires a significant change in how you integrate Amazon into your wider set of retailers. But making this change will reward your teams with higher margins and a better Buy Box performance.

Need help assessing your vendor performance with Amazon?

If you need help to understand your vendor performance with Amazon, get in touch. I offer tailored vendor audits to uncover your full margin potential with the online retailer.