Protecting your vendor margins is critical to the success of your trading relationship with Amazon. If you are looking for proven strategies to increase your bottom line, look no further.

Most consumer brands have seen fantastic growth with Amazon over the past twelve months. But increasing commercial demands and volatile markets have caused profits to plummet, forcing vendors to take action.

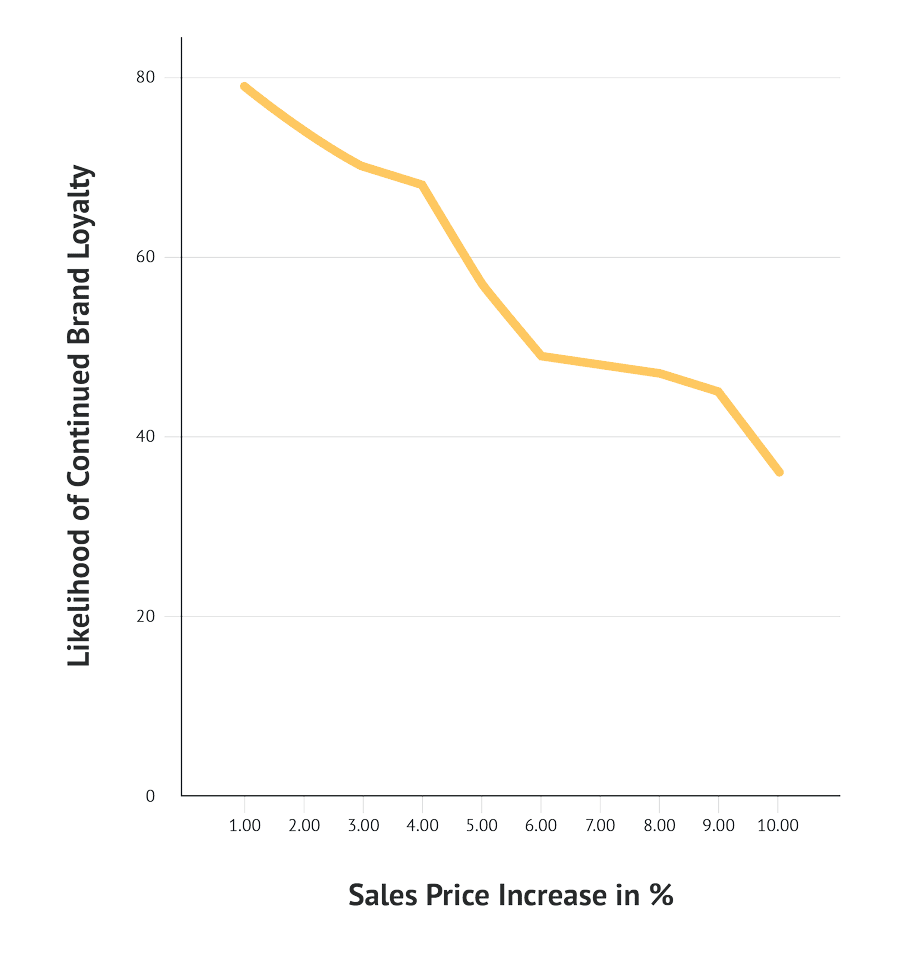

In times like these, you may be tempted to raise retail prices. But that might not be your best move: Studies have found that over 40% of consumers would switch brands if the prices of their favourite brand would increase.

To add to the complexity, Amazon pursues a price follower strategy. This means that even if you had to raise prices, it is unlikely that Amazon would accept the associated cost increases from you as a vendor.

So if raising your costs and consumer prices is out of the question – how can you improve your vendor margins on Amazon?

Here are 8 actionable strategies:

- Review your portfolio mix

- Focus on high-margin products

- Clean up your distribution channels

- Launch bigger packs & bundles

- Negotiate with your suppliers

- Delist unprofitable selection

- Address hidden P&L cost centres

- Initiate commercial discussions with Amazon

1. Review your portfolio mix

Knowing the profitability composition of your portfolio is key when selling online. Sure, this isn’t a big deal if you only sell a handful of products. But your brand’s catalogue is likely much larger than that.

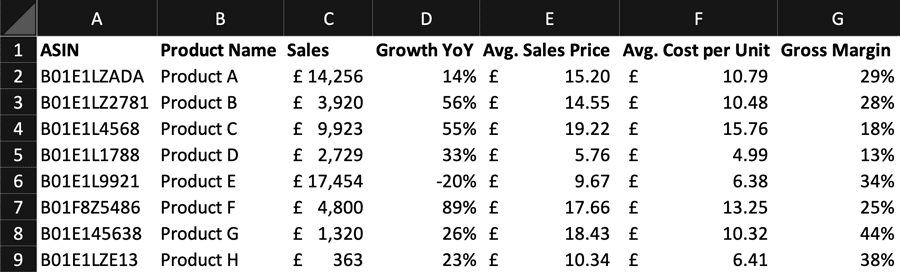

The good news is that reviewing your Amazon portfolio isn’t rocket science. Simply download all your ASINs from Vendor Central and enter their sales, growth and profit margin into an Excel spreadsheet.

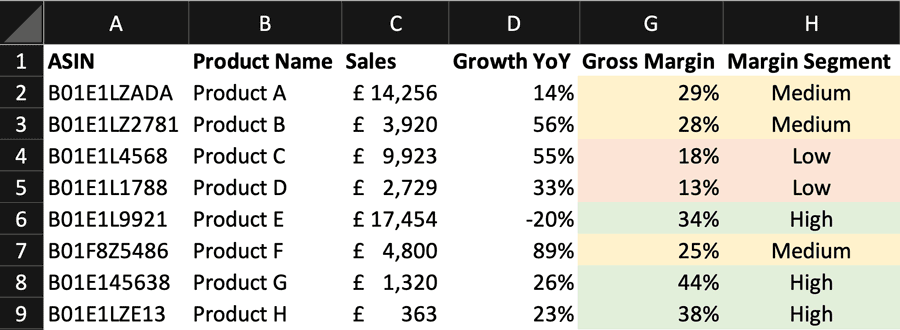

Next, group your low, medium and high margin products. This step is crucial as you want to understand how much each segment represents of your total sales.

As a final step, take a closer look at each segment’s growth. If your low-margin products are outpacing the growth of your higher-margin segments, you need to find ways to slow their growth and redirect customers to your more profitable offerings.

You can do that by shifting your retail investments to more profitable items or by launching low-cost pack sizes. We will explore these options in more detail in a second.

You see, becoming aware of your portfolio mix is key to ensuring you make the right decisions regarding your retail investments.

You and your teams should review the profitability of your portfolio at least every quarter to make sure you identify adverse trends early.

Related: 5 Ways to Increase Your Average Selling Price on Amazon

2. Focus on high-margin products

Once you become aware of the margin structure of your portfolio, it’s time to focus on your profitable selection. Chances are that your high-margin products are growing at a slower pace than their low-margin peers.

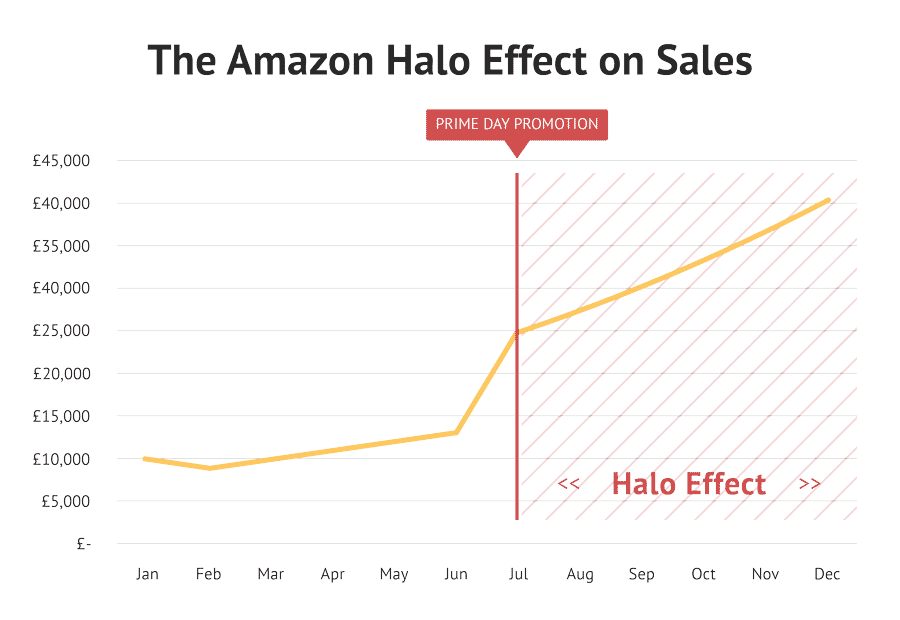

That’s why you should redirect your promotional efforts towards your profitable selection. Use major sales events such as Prime Day, Black Friday or Cyber Monday to discount these products.

Promoting your high-margin products with a price discount?

It may sound counterintuitive first, but hear me out. The key here is not to focus on the short-term price drop but on the so-called Halo Effect that follows right after.

The Halo Effect describes the sustained sales increase of products after a promotion on Amazon. Due to the temporary increase of conversion rates and the influx of fresh product reviews, products typically rank higher in the Amazon search results after a promotion.

If you start focusing your promotional efforts on products with a good profit margin, the halo effect will positively influence the profitability mix of your portfolio.

Tip: You can still promote your low margin products. Consider running them in promotions outside major sales events or enrolling them into loyalty programs such as Subscribe and Save.

3. Clean up your distribution channels

It is widely known that Amazon bases its prices on the available offers of a product in the market. That’s why the marketplace is often referred to as the mirror of your brand’s distribution strategy.

Understanding this is key to managing your profitability with Amazon, as it means you have indirect control over their displayed prices.

For example, if you sell most of your products through wholesalers who happen to be 3P sellers themselves, you’ll have a much harder time winning the Buy Box than a brand that only sells directly to Amazon.

That’s because your teams will give those distributors significant cost price discounts to incentivise bulk orders or volume commitments. This, in turn, allows them to discount your products at very low levels.

The result? Your average selling prices on Amazon go down.

Here’s the deal: While you cannot change Amazon’s long-standing pricing strategy, you can review how you incentivise your retail partners to make buying commitments.

Overhauling the cost rebate structure across your distribution channels is one of the most effective starting points to raise your prices from a front-margin perspective.

Related: How to Design a Profitable Amazon Portfolio Strategy

4. Launch bigger packs & bundles

Another way to improve your vendor margins is to launch bigger value packs or bundles of your existing top sellers. This aims to improve your average selling price and to lower your variable costs.

Many CPG brands have already seen massive success after introducing larger pack sizes on Amazon:

For example, Mars launched a 2.4 kg version of their beloved Celebrations product back in 2018. After only a few months, it ranked in the top ten products in the “Chocolate Boxes & Gifts” category on Amazon.

Reckitt Benckiser has taken a similar approach, launching its Finish dishwasher tablets in large sizes. While offline shoppers typically find packs of 30-50 tablets in shops, Amazon customers can buy packs of up to 110 tablets.

But you don’t have to sell consumer goods to lower your variable cost structures online. Many brands in other categories have successfully increased their profit margins by launching complementary bundles of their existing product range.

A great example is the Sodastream water carbonator megapack. With it, customers receive not only the main product but also two additional PET bottles and six syrup samples. This enhances the value proposition of the listing dramatically while also improving the profitability of each item.

All of these examples are available at competitive prices for end customers and come for brands with the benefit of reduced shipping costs through the effective packaging of different pack sizes.

5. Negotiate with your suppliers

Raising the cost prices with Amazon is almost impossible if you sell via the 1P vendor model. Instead, it’s often easier to turn to the other side of the value chain and renegotiate commercials with your suppliers.

As a manufacturing brand, you should do this consistently. Have our sales grown over the past few months? There are likely some economies of scale that could justify cost reductions.

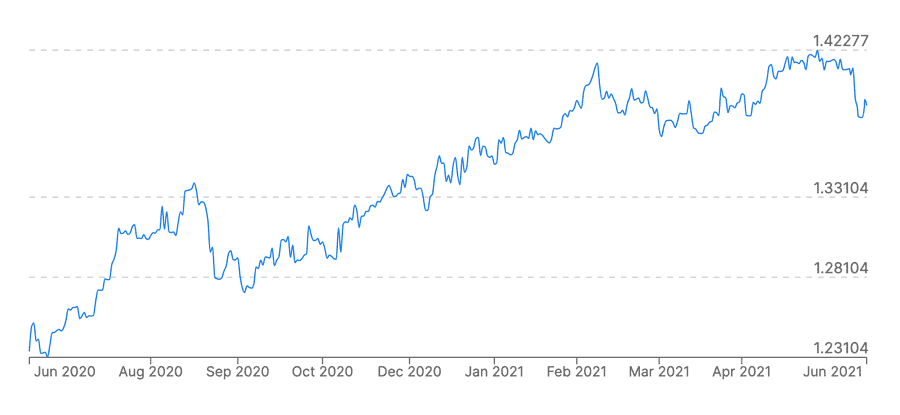

Fluctuations of raw material prices and the dollar exchange rate also directly impact your margins. If they have changed over the past three to six months, it’s time to assess the viability of your sourcing costs.

But even if you’re not able to gain cost benefits right away, there are often opportunities to optimize your cash flow: Agreeing longer payment terms or product shipments to your country of sale can also positively impact your profits.

6. Delist unprofitable selection

Not every product will turn into a cash cow for your business. And that’s fine. Yet, many account managers feel uncomfortable removing unprofitable items from their portfolio.

Partly because Amazon wants their entire selection on its marketplace. But also because those products still drive conversions, i.e., sales for their brand.

However, if a listing turns unprofitable over a longer period of time, it’s better to remove the offer sooner rather than later.

Not only will you avoid requests from your vendor manager to compensate for the losses incurred by Amazon, but you will also free up time to focus on growing your profitable range.

7. Address hidden cost centres

As Amazon has grown significantly over the years, it has also tightened the requirements for brands to conform to standardised processes. This helps the online retailer smooth out its inbound and outbound procedures, improving its operational efficiency.

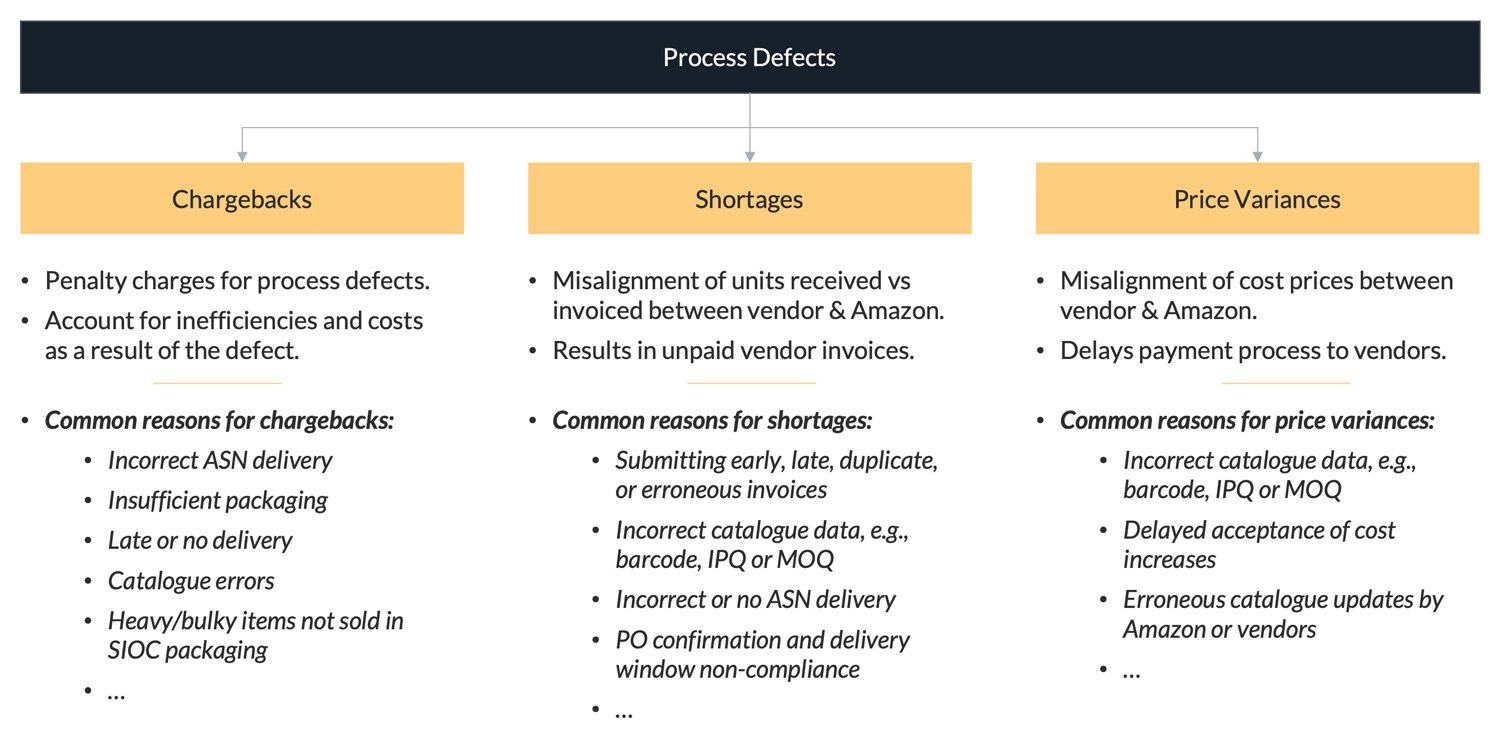

Non-compliance with Amazon’s requirements will lead to hidden costs affecting your P&L. The most common types of financial misalignments are chargebacks, shortages, and price variances.

To address these, you can follow a simple 3-step formula:

- Analyse and understand chargebacks and other financial discrepancies.

- Review and align internal processes to meet Amazon’s standards.

- Dispute all erroneous charges.

Note that you must dispute any financial misalignments within 30 days in Vendor Central. If you don’t, Amazon may not accept your request for repayment, even if your dispute is valid.

8. Initiate commercial discussions with Amazon

Lastly, you should always negotiate your commercial terms with Amazon. Their trading conditions can be restrictive and are the ceiling of your profitability prospects on the marketplace.

I’ve personally seen too many brands blindly accepting minimum standard term agreements without asking for anything in return.

Don’t do that!

Instead, ensure you are aware of your costs to serve Amazon and have discussions with your vendor manager on how to drive efficiencies on an ongoing basis.

While annual vendor negotiations define the framework of your terms, you can always use mid-year funding requests from Amazon to request a reduction of chargeback or promotional fees in return.

Bonus: Amazon also offers a wide range of free cash flow initiatives that support vendors in simplifying their supply chain. Make sure you ask for opportunities to deliver to fewer fulfilment centres via full pallets or full truckload orders.

Conclusion – Start increasing your vendor margins today

Improving your 1P vendor margins can be a complex task if you don’t know where to start. But even with Amazon’s restrictive sales model, there are ways to effectively manage your account’s profitability.

I hope this guide has helped you to uncover some starting points to begin this journey. But, remember that it takes perseverance, creativity and a determined approach that will not bear fruit overnight.

The earlier your start executing these measures, the earlier you will be able to see the results.

If you found value in today’s article, please share it on LinkedIn or any other social platform.

Want a custom roadmap to higher margins with Amazon?

If you want straightforward advice on how to increase your profit margins with Amazon, get in touch. I offer tailored advisory services that will uncover your true bottom-line potential.