Want to understand the profit impact of your Amazon listings? You’ve come to the right place.

As an Amazon vendor, you know that managing your profitability can feel like an overwhelming task. After all, hundreds of factors impact your vendor margins.

But whether it is pricing headwinds or market-driven promotions: The profit level of your listings decides whether they become top sellers or get delisted from Amazon.

That’s why it’s critical to understand the impact of your listings on your profit and loss account. To do that, I have developed the Amazon Vendor Profitability (AVP) Matrix.

This article will cover:

What is the Amazon Vendor Profitability (AVP) Matrix?

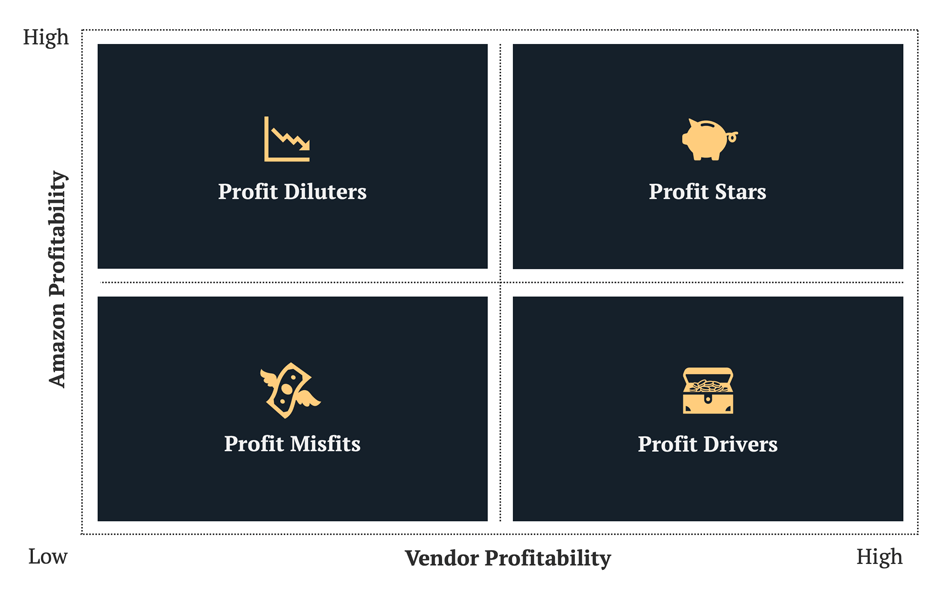

The AVP Matrix is a management framework designed to help vendors prioritise their listed Amazon portfolio. It intends to support decisions on which products and brands vendors should focus their inventory allocation, retail media, and trade investments.

By identifying a product’s margin performance in the vendor business and for Amazon, the matrix clusters each product into one of four categories: Profit Stars, Profit Drivers, Profit Diluters, and Profit Misfits.

Profit Stars

If a product returns high profitability levels for both Amazon and you as the vendor, it is considered a “Profit Star“. These listings are the ideal candidates to include in retail media campaigns and deal events.

Profit Stars are often the hidden champions in a vendor’s portfolio. This is because their high profit margins do not always correlate with an outstanding sales performance.

Identifying these mutually accretive ASINs is critical, because it lets your teams focus retail media and promotional spend on these listings. This, in turn, can improve your account margin and Amazon’s Net PPM average even further.

Profit Drivers

Listings that return good profit margins for your brand, but low margins for Amazon are considered “Profit Drivers“. They subsidise the margin performance of your P&L account with Amazon and counterbalance the negative margin of less profitable products.

Profit Drivers are excellent items to consider for any price promotions or retail media campaigns, as their margin performance gives your teams room for investment.

However, you want to keep the share of listings in the Profit Driver category at moderate levels. After all, their low margin performance for Amazon carries the risk of delistings.

Related: Amazon Vendor Survey: Industry Insights & Key Statistics

Profit Diluters

ASINs that return high margins for Amazon but low profits for your brand are “Profit Diluters“. They weaken the overall margin performance of your Amazon customer account.

Your teams need to identify Profit Diluters early to ensure they do not overinvest in listings in this category. While ASINs in this quadrant of the AVP matrix are unlikely to be delisted by Amazon, you should focus on identifying the root cause of the low margin performance.

If you can address the root cause, it is best to maintain the listing in your portfolio. But if you expect the low margin levels to last, your teams should evaluate whether the advantages of keeping the listing outweigh the negative impact on their P&L.

Related: How to Increase Your Vendor Margins on Amazon

Profit Misfits

Listings that return low margins for you and Amazon are so-called “Profit Misfits“. They depress the P&L performance at product and account level.

Profit Misfits may have strategic relevance in the broader portfolio of your brand. But given their dilutive profitability, your teams should not allocate media and retail budgets and consider delisting them from Amazon.

Where delisting is not a viable option, I recommend closely monitoring the revenue share of Profit Misfits. That’s because if listings in this category outgrow the rest of the portfolio, Amazon may take steps to reduce the growth of your vendor account.

Related: How to Design a Profitable Vendor Portfolio Strategy

What to consider when using the AVP Matrix

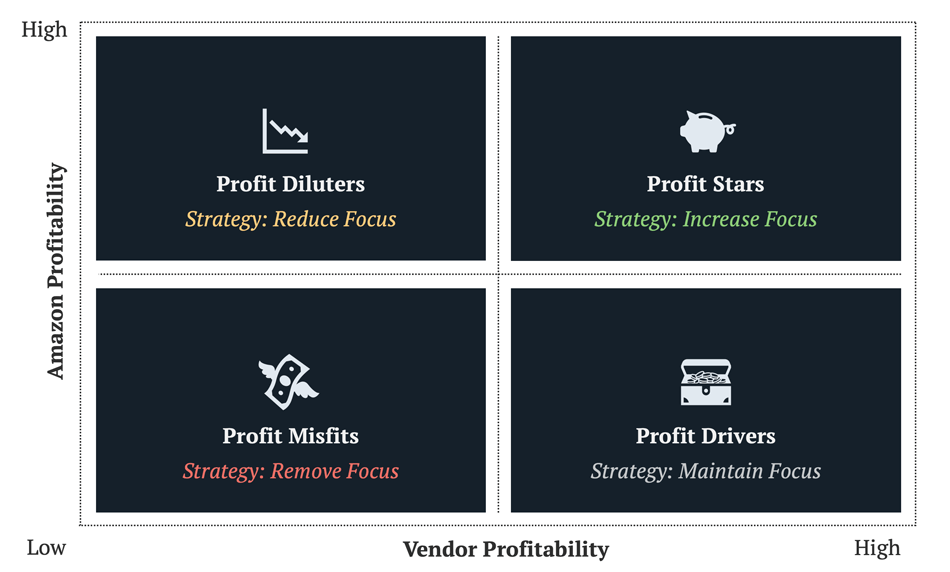

Once all listings have been categorised, your teams can identify four key strategies:

- Increase the sales and investment focus on Profit Stars

- Maintain the sales and investment focus on Profit Drivers

- Reduce the sales and investment focus on Profit Diluters

- Remove the sales and investment focus on Profit Misfits

However, when using the AVP Matrix, there are a few things to consider before taking action. So let’s take a closer look at the main watch-outs.

1. Defining the right margin thresholds

The AVP matrix requires your teams to define their internal profit margin and Amazon’s Net PPM from which a product is deemed profitable or unprofitable.

Vendor profit margins

To do this effectively, they need to know your margins at the product level. But more often than not, this information does not exist.

Either because it isn’t reviewed regularly. Or because it doesn’t exist in the right format. In these cases, your commercial teams should work with their finance business partner to produce an internal profit report first.

Product margins should always be calculated based on the cost price uploaded to Vendor Central. Any regular trade terms and product-specific investments can then be added in a secondary step.

Once product margins are identified, you can set the desired profitability level and start analysing the proportion of revenue in each quadrant of the AVP Matrix.

Amazon Net PPM%

Ranking the profitability levels of listings for Amazon is less straightforward. Your teams need to rely on averages and historical assumptions to determine what Amazon considers healthy and unhealthy from a Net PPM perspective.

However, a data-driven approach can help here too. Reviewing the Net PPM of listings that have been subject to CRAP in the past can help identify the profit thresholds at which Amazon deems a product no longer viable.

Other category averages that you may consider to inform Amazon’s profitability thresholds are:

| Product Family | Avg. Net PPM% |

|---|---|

| Hardlines | 40-45% |

| Softlines | 30-37% |

| Consumables | 28-35% |

2. Excluding one-off investments

Another factor to consider when assessing the profitability of a listing is one-off events.

For example, your teams have likely run price promotions on products with Amazon in the past. If these promotions were unprofitable, they would have negatively impacted your internal profit margins and inflated Amazon’s Net PPM.

In these cases, you risk classifying products as Profit Diluters that perform just fine. So it is important your teams identify these one-off mistakes and consider them when categorising products in the AVP Matrix.

3. Identifying and understanding profitability root causes

We already hinted at this point earlier. But I want to stress it once again:

Your teams need to understand the actual root cause(s) that led to the profit performance of your product listings.

Otherwise, they will be unable to take effective action.

So you need to ensure your teams are certain that catalogue and pricing errors, or other addressable issues, won’t lead them to delist a top-selling product portfolio.

4. Considering variable cost components

As with any framework, the AVP Matrix is only as good as its weakest component.

While the Net PPM is a reliable KPI to measure your vendor account’s commercial performance, it only considers your Average Selling Price, Cost Price, and Trading Terms with Amazon.

However, it does not reflect any variable handling and shipping costs that may weigh heavily on your Amazon account. This is why products with decent Net PPM levels still get delisted by the online retailer.

If you are finding yourself in this situation, it’s best to rework the packaging of the listing and optimise it for the ecommerce channel. Moreover, you may also want to revisit supply chain efficiency programmes that can deliver mutual cost savings with your Vendor Manager.

Related: How to Increase Your Vendor Margins on Amazon

5. Reviewing the strategic relevance of unprofitable listings

Not every item that is a Profit Diluter or Misfit should also be delisted from your Amazon account. After all, these products may have other strategic functions in your portfolio.

For example, unprofitable listings often serve customer acquisition targets. You may use them to attract new shoppers into your category. Or as an entry-level version to build your marketing funnel.

So as long as these items do not outgrow your profitable range, their strategic relevance may justify their existence. This is an important aspect to remember when making any ranging decisions with the AVP Matrix.

Conclusion

The Vendor Profitability Matrix helps to visualise the margin performance of listings for vendor brands and Amazon.

While it ensures that brands can make smarter decisions on where to allocate their inventory, retail and media budgets, business leaders should focus on addressing the root cause of low margins first.

Have questions? Ping me on Twitter.

Need help assessing your vendor profitability?

If you want to better understand your profit situation with Amazon, get in touch. I offer tailored vendor audits with actionable advice that will improve your vendor margins.