The last few years have been a rollercoaster for Amazon vendors.

In 2020, the pandemic pushed sales growth to the top priority for most retail businesses. Today, both Amazon and first-party vendors focus on raising profit margins, causing tension in their business relationship.

But how are vendors handling Amazon’s renewed margin focus?

The answer isn’t so obvious.

That’s why I recently ran a comprehensive industry survey with over 500 vendor representatives. Specifically, I asked them about their relationship with Amazon, the annual negotiation process, and future priorities with the online retailer.

And now it’s time to share the results.

There’s an updated version of this survey available. Click here for the 2024 results of my AVN survey.

Summary of Key Findings (2023)

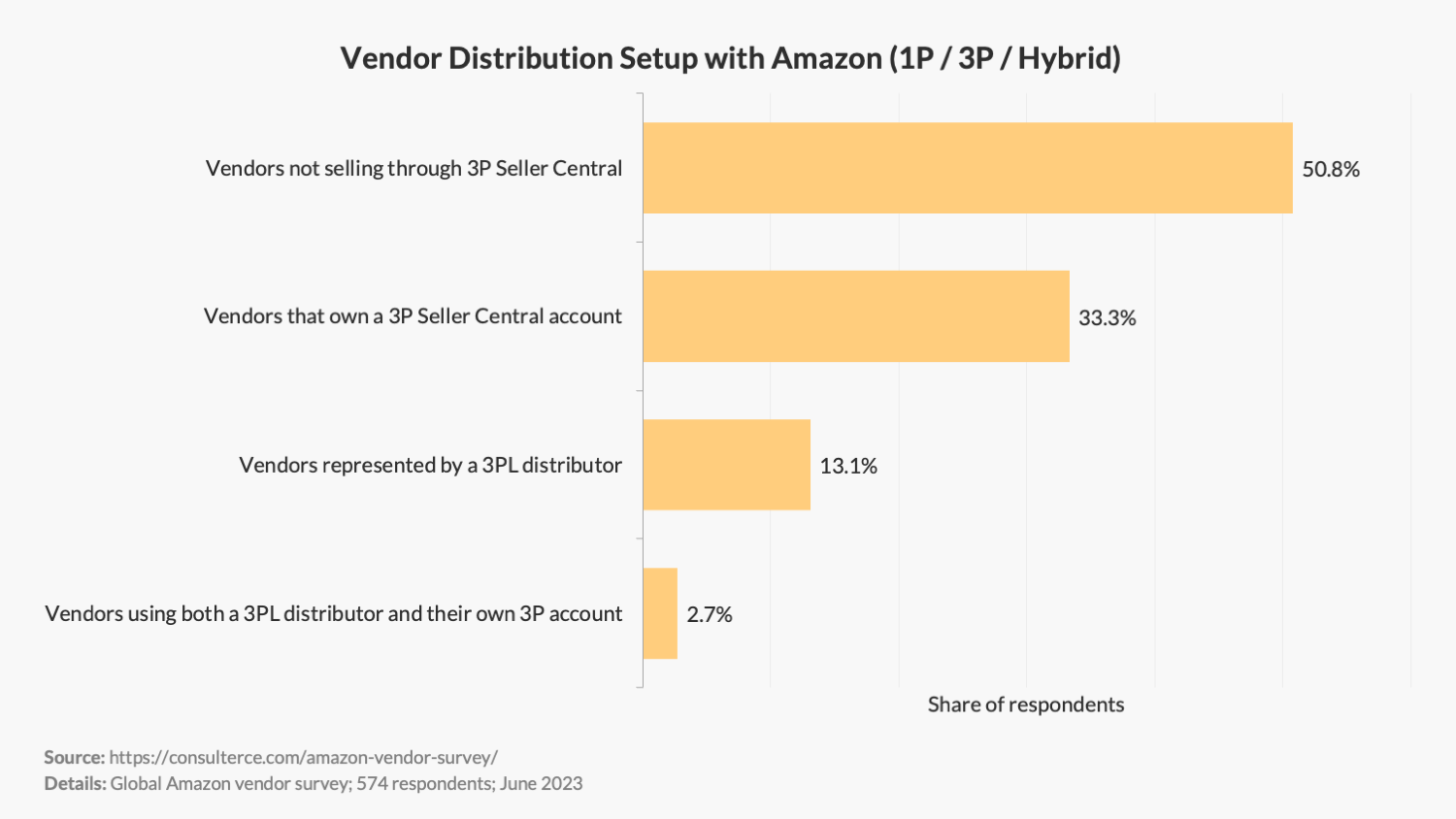

1. Nearly half (49.2%) of all surveyed 1P vendors also sell directly or through a third-party provider via Seller Central.

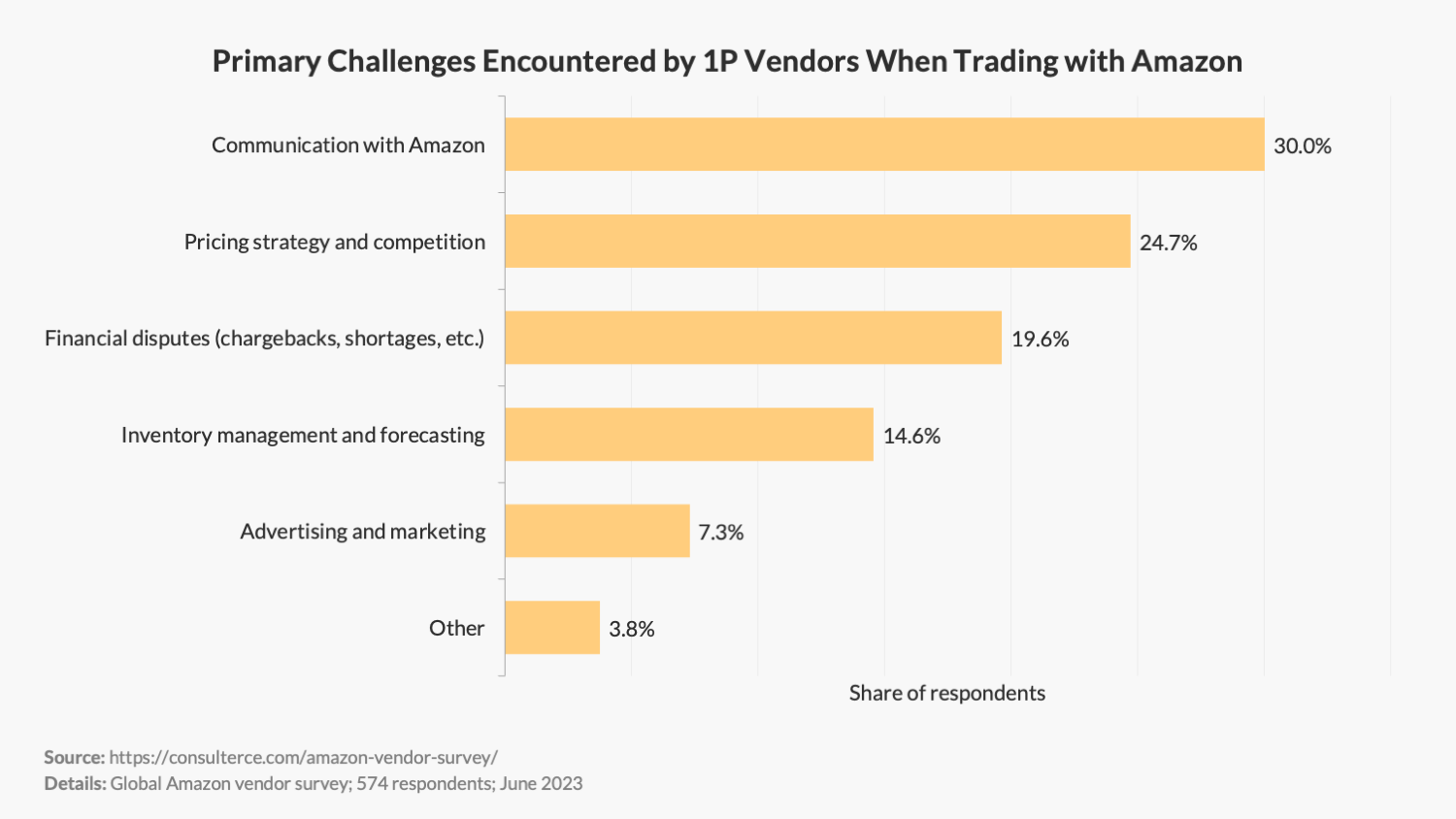

2. The lack of effective communication with Amazon is the #1 cited challenge among 1P brands.

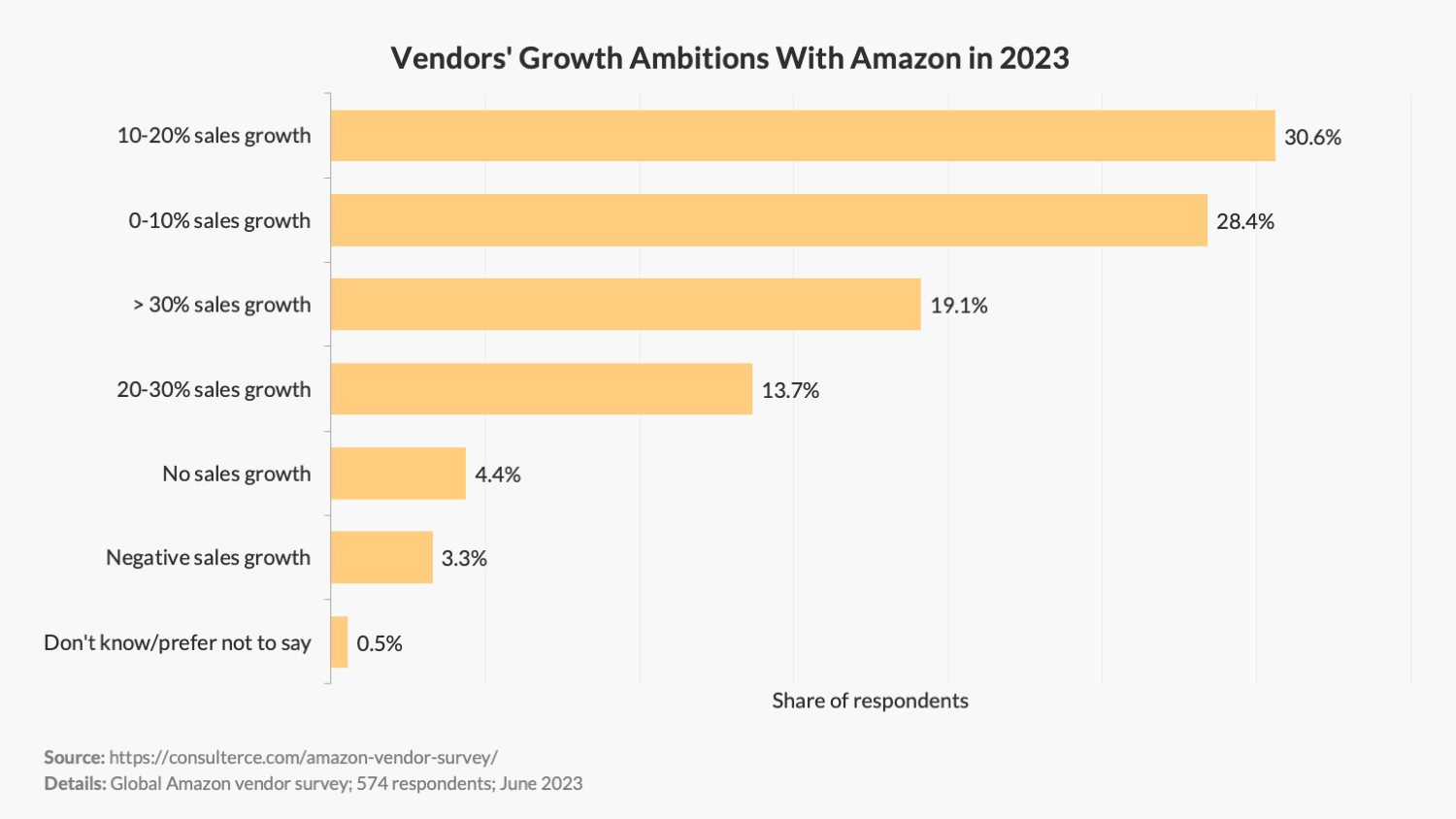

3. An overwhelming majority (91.8%) of vendors plan to grow with Amazon this year.

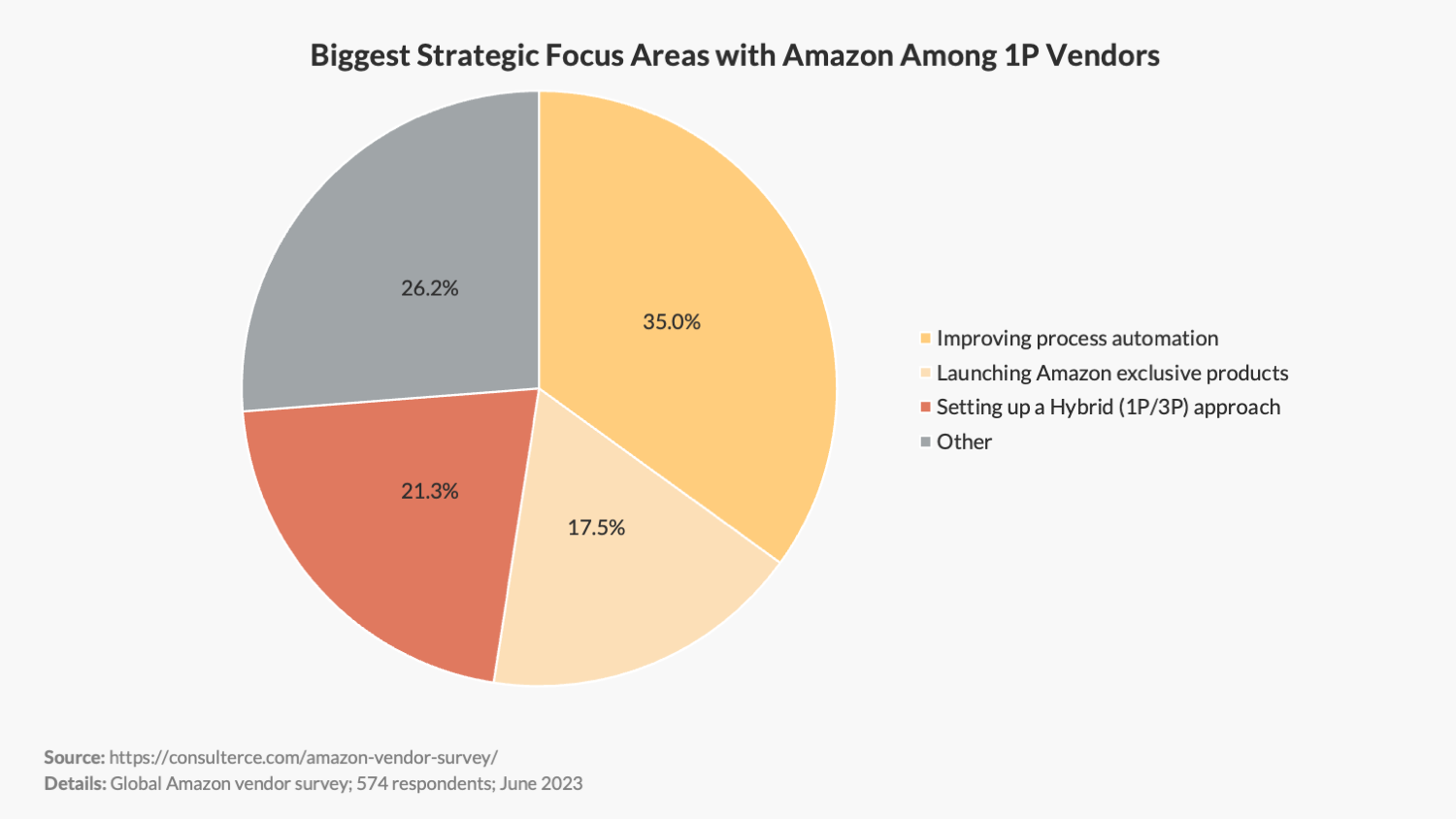

4. Top priorities among 1P vendors are process automation, diversifying sales channels (1P/3P), and launching Amazon-exclusive selection.

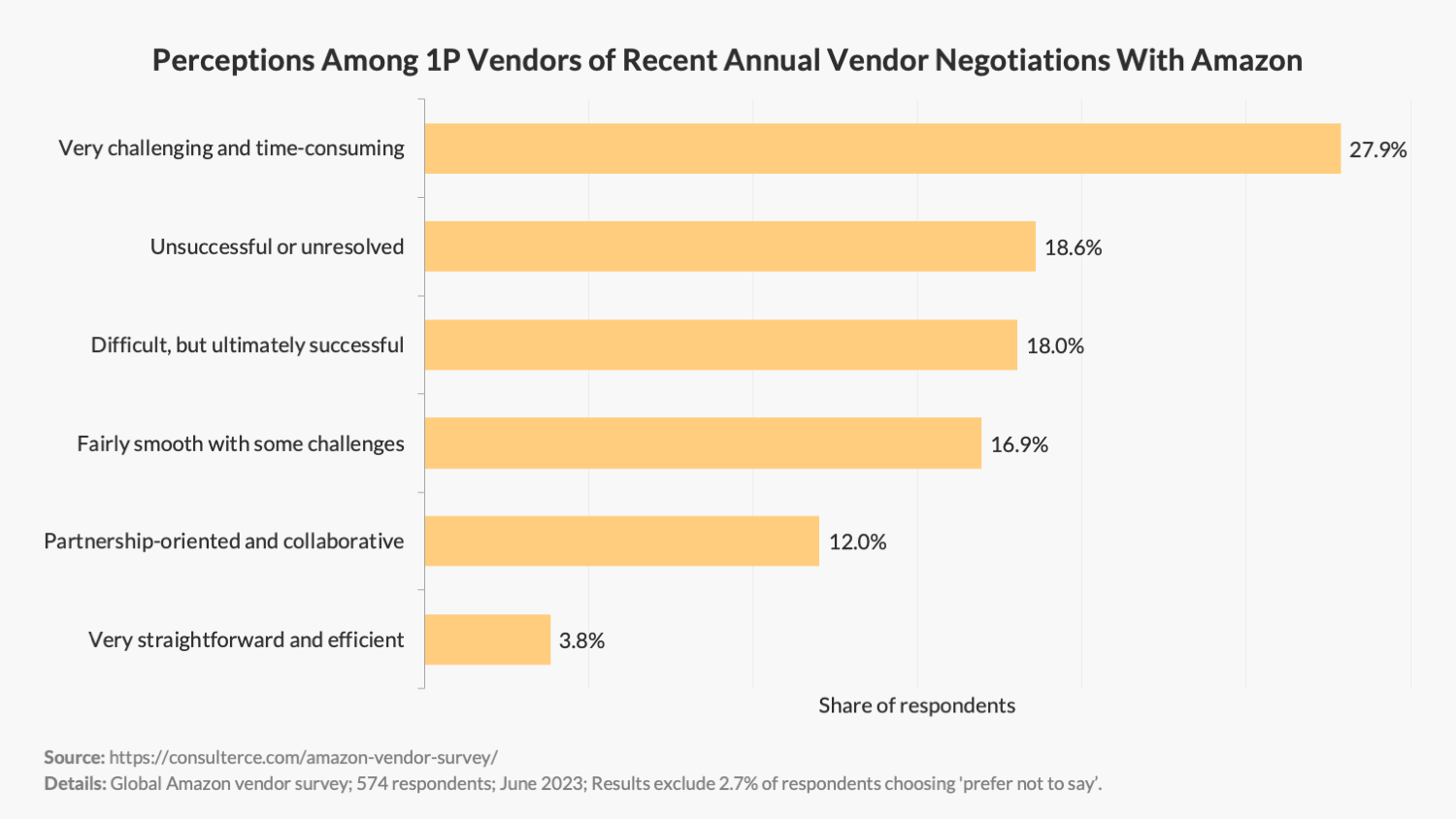

5. Over 64.5% of vendors surveyed refer to their trade negotiations with Amazon as challenging, time-consuming and inefficient. Only 15.8% think their negotiations were efficient or partnership-oriented and collaborative.

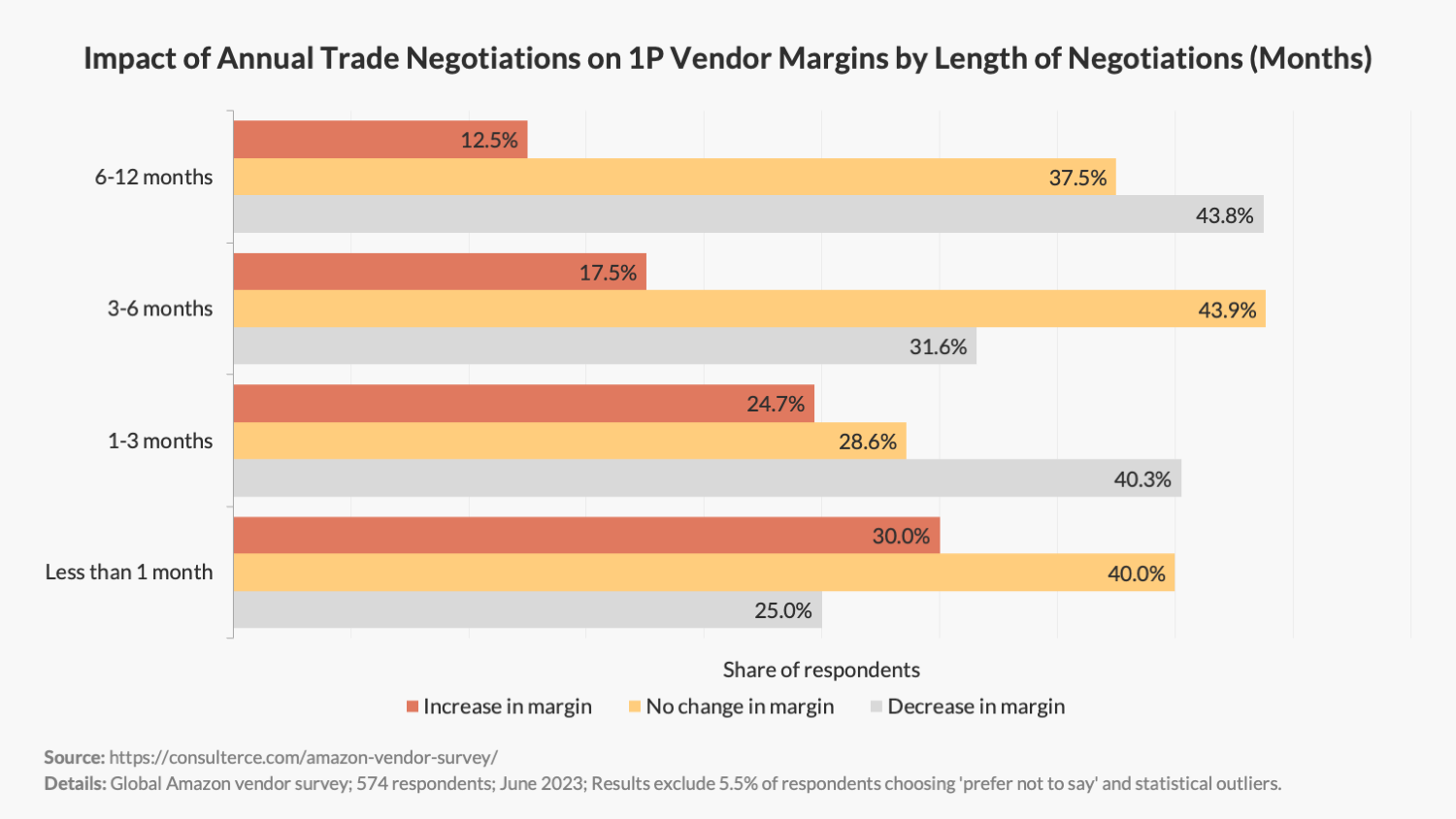

6. There is no correlation between a longer negotiating cycle and a better negotiating outcome for Amazon suppliers.

7. The longer trade negotiations with Amazon take, the less profitable the negotiation outcome is for most 1P vendors.

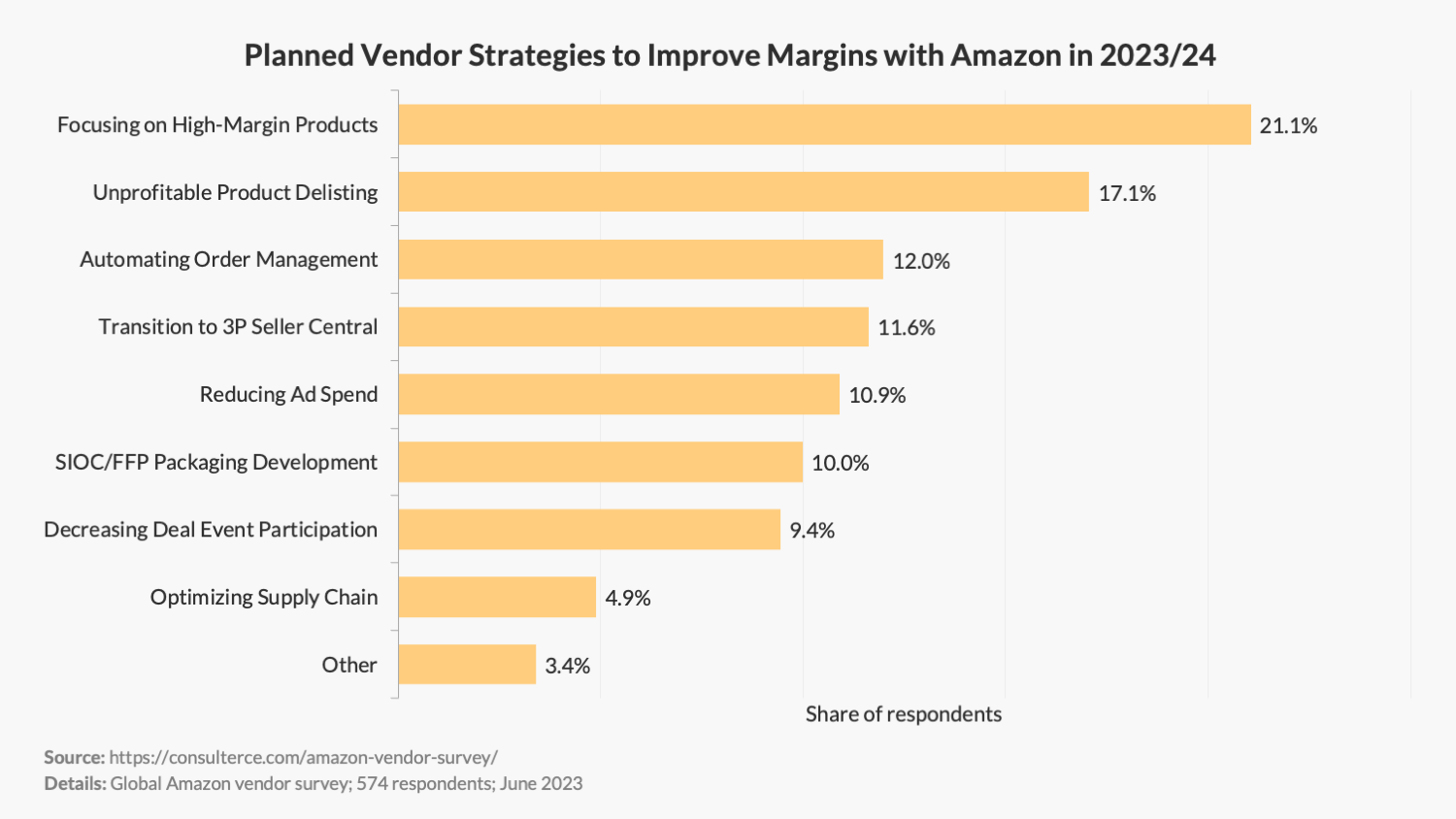

8. 17.1% of surveyed brands want to improve their margins by delisting unprofitable selection, likely reducing available choice for customers.

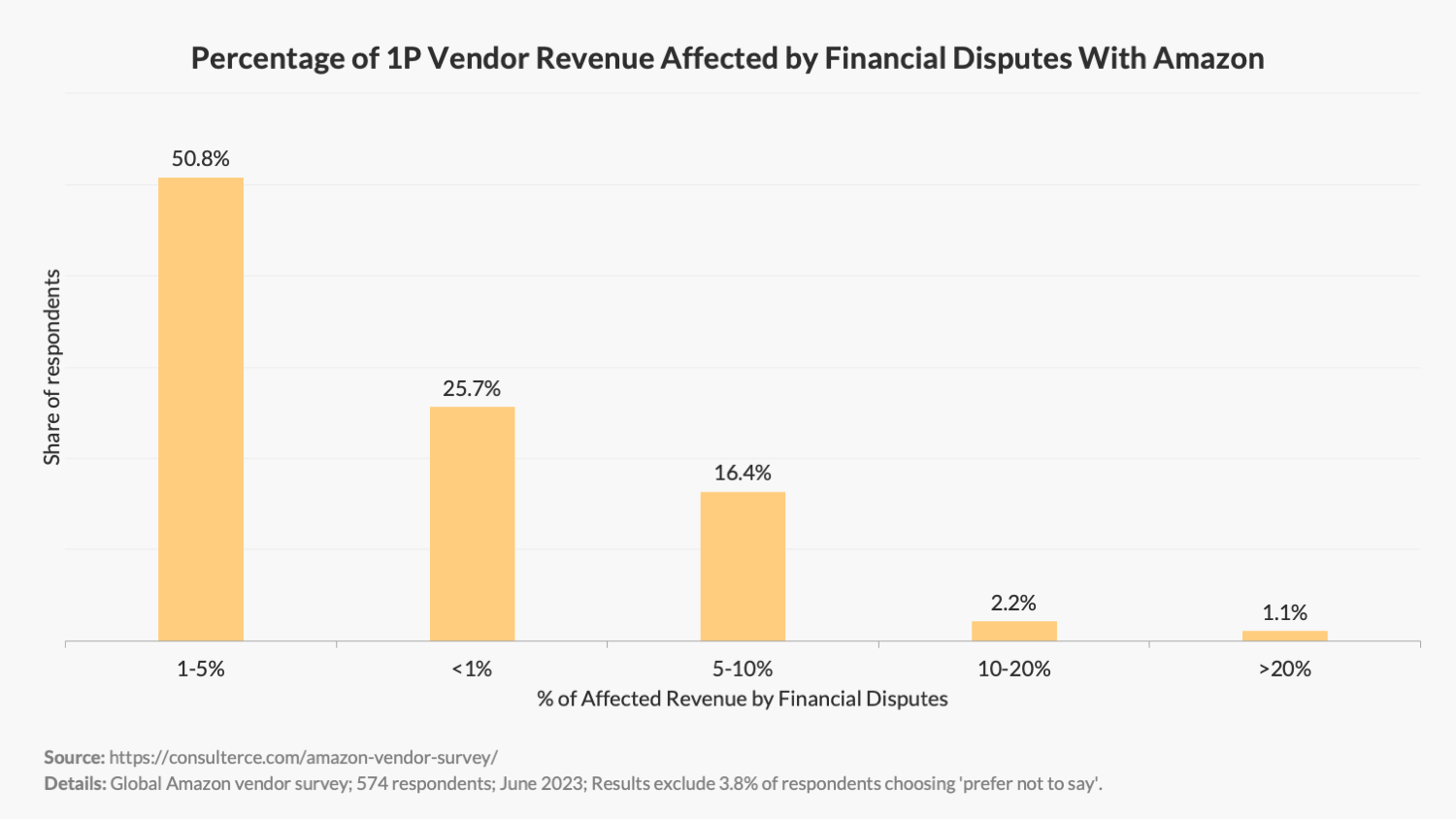

9. Over 70.5% of surveyed vendors state that financial disputes affect at least 1-5% of their Amazon sales.

49.2% of Amazon Vendors Sell Through Seller Central

Because of its marketplace model, Amazon is not your typical retailer. The online retailer allows 3P sellers to offer the same product alongside its own offering on a product detail page.

With 1P vendors seeing their profit margins squeezed, products delisted, and cost increases rejected by Vendor Managers, many turn to Seller Central to regain control over their business.

Moreover, many vendors cited the lack of communication with Amazon as the #1 challenge with the online retailer. In light of recent layoffs, that’s not a major surprise. After all, fewer buyers now have to manage a similar number of brands. As a result, we can expect more vendors to try and diversify their business with Amazon between 1P and 3P.

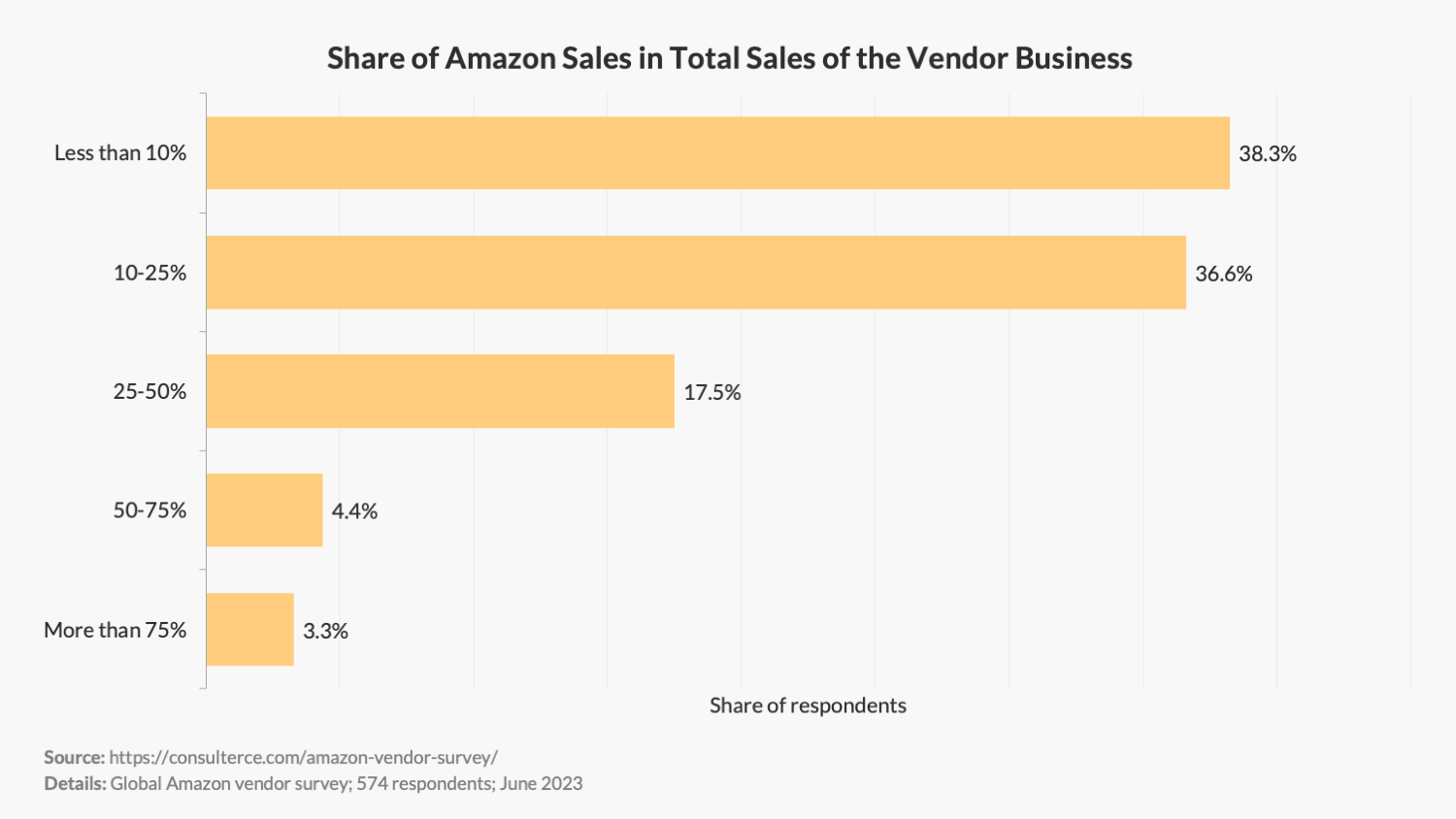

The Majority of 1P Brands Reveal a Moderate Sales Dependency on Amazon.

Approximately 54.1% of brands surveyed identified Amazon as a notable part of their sales strategy. The definition of ‘moderate dependency’ was qualified in the survey as being responsible for 10-50% of their total sales. 38.3% of survey participants stated that Amazon makes up less than 10% of their overall revenue.

This shows that while Amazon is an important player in the sales strategies of suppliers, many brands are not exclusively reliant on the ecommerce giant.

It is noteworthy that the distribution of the dependency on sales varies between the survey participants from Europe and North America. While 51.9% of European survey participants stated that they generate less than 10% of their turnover with Amazon, only 20.0% of North American participants confirmed this value. Conversely, 57.8% of North American respondents indicated an Amazon sales dependency of 10-25%, while this level of reliance was only revealed by 25.9% of European participants.

Amazon Is Seen as a Channel That Can Still Deliver Growth

While growth rates have decelerated in recent months, the survey found that the majority (91.8%) of brands plan a positive growth scenario with Amazon. Only 4.4% of survey participants stated they don’t intend to grow with Amazon this year.

This shows that the dependence on Amazon as an online retailer has matured significantly in recent years. As the pandemic has accelerated sales growth across product categories, most brands now cannot achieve their overall sales targets without the online giant.

Process Automation, Diversifying Sales Channels, and Launching Amazon Exclusives Are Top Priorities for 1P Vendors

Based on the survey results, the top priorities for 1P vendors are process automation, diversifying sales channels, and launching Amazon-exclusive selection.

35% of respondents marked process automation as a top priority, pointing to the increasing recognition of its ability to improve efficiency, accuracy, and productivity. Brands are looking to automate repetitive tasks, freeing up valuable time for their teams to focus on strategic, revenue-generating activities. These automation efforts span across operations, logistics, customer service, and marketing.

Considering the silent transfer of task ownership from Amazon to brands (think: Born-to-run, deal creation, etc.), vendors are increasingly required to automate processes instead of increasing their headcount, ultimately driving hidden P&L cost centres.

Simultaneously, diversifying sales channels via a hybrid 1P/3P approach emerged as a significant focus, with 21% of survey participants highlighting its importance.

Lastly, 17.5% of respondents cited the launch of Amazon-exclusive products as their company’s biggest strategic focus. The motivation behind this strategy is clear: vendors are mainly looking to escape Amazon’s price-matching algorithm. But launching exclusive products also allows brands to leverage Amazon’s massive consumer base while creating a unique value proposition.

The (Lack of) Communication With Amazon Is the Biggest Challenge for Suppliers

With Amazon recently announcing a wave of layoffs across divisions, it’s no surprise that suppliers are feeling the impact on their trading relationships. With fewer buyers to manage the same or even a larger number of brands, suppliers often only see their buyers when it’s time to negotiate annual investments.

In addition to the lack of Vendor Manager support, most industry insiders know that Amazon’s case system for raising issues with associates is far from perfect. Simple catalogue updates or requests for help often go unanswered or are met with pre-formatted responses that do not apply to the problem at hand.

As a result, it’s no surprise that 30% of survey participants overwhelmingly cited a lack of communication as their #1 challenge with Amazon.

Annual Vendor Negotiations Consume Resources and Time With No Guarantee of a Successful End Result

As with other retailers, 1P suppliers conduct annual negotiations (AVN) to discuss their business and align on trade investments with Amazon. A staggering 46.5% of survey respondents stated that their most recent AVN was very challenging, time-consuming, unsuccessful, or unresolved.

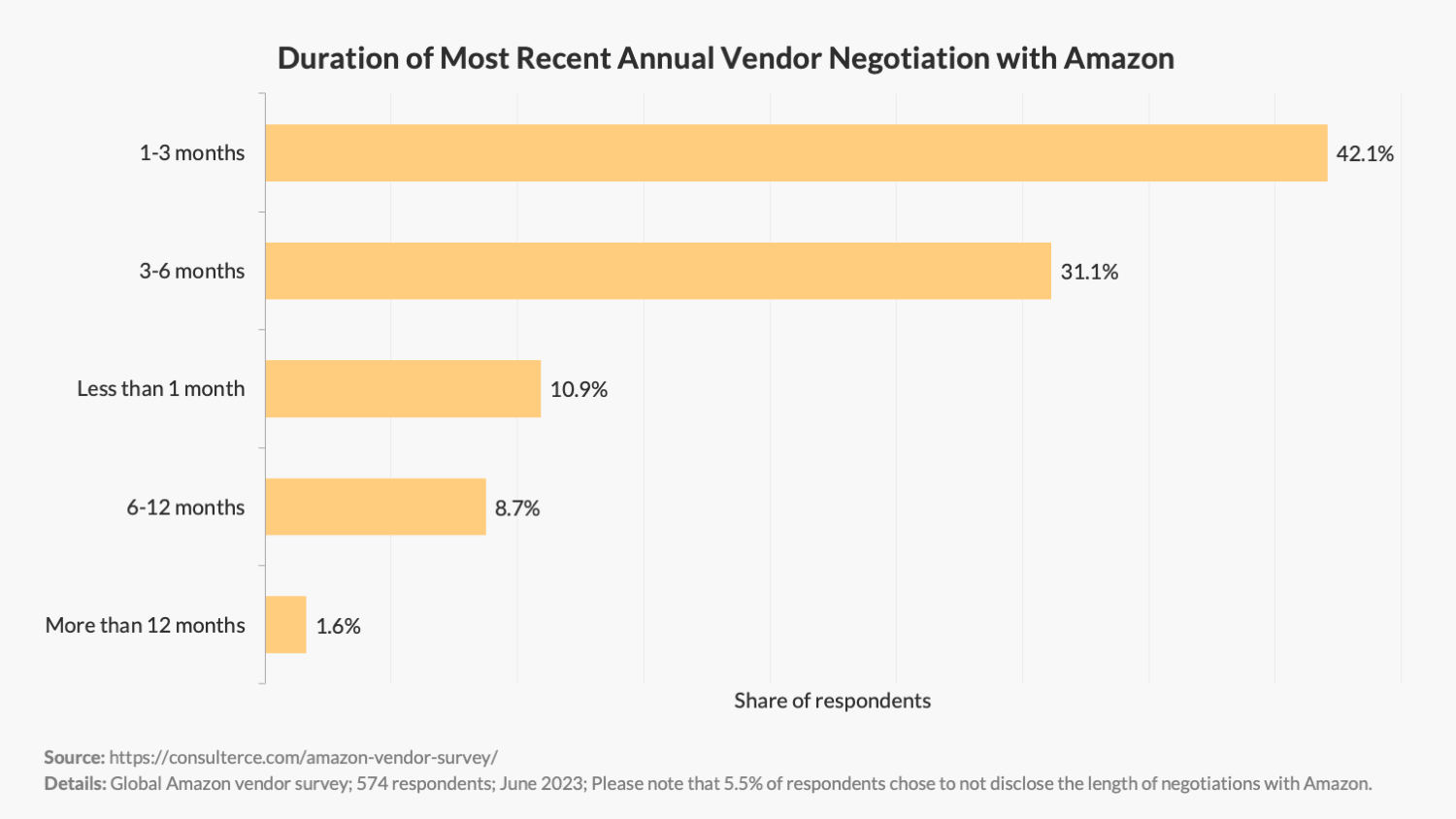

Combined with the fact that most vendor negotiations last between 1 and 6 months (excluding the preparation), the AVN process binds a significant amount of headcount resources that often exceed the industry benchmarks with other retailers.

As a result, C-suite decision-makers need to consider the complexity and duration of trade negotiations with Amazon in the headcount planning and coverage of the account. After all, Amazon is too complex to be treated as a side project.

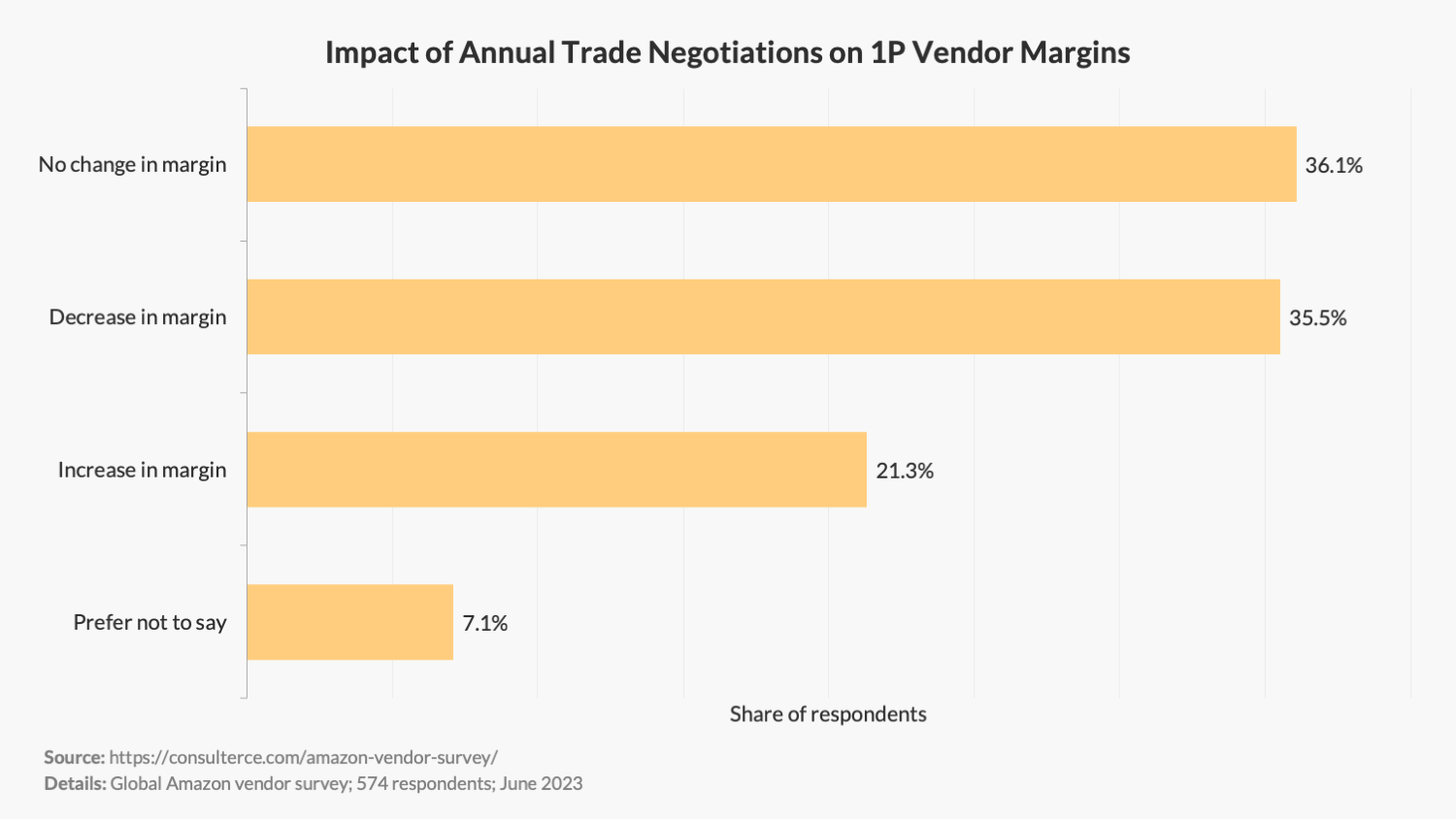

Annual Vendor Negotiations Fail to Improve Profit Margins for Majority of Brands

It may not surprise you, but many suppliers do not welcome annual vendor negotiations (AVN). After all, most expect to have to invest more in Amazon year after year, while Vendor Managers don’t guarantee any growth in return.

When analysing the survey results, 35.5% of respondents reported that the most recent AVN outcome resulted in a reduction or no change in their profit margin. Only 21.3% of respondents indicated that the AVN improved their bottom line.

What’s noteworthy is that I couldn’t find a distinct correlation between longer negotiation cycles and better negotiation outcomes for vendors. In fact, the longer a negotiation took, the less profitable the negotiation outcome was for suppliers.

This shows that brands are well advised to define precise escalation plans early on and build relationships with key stakeholders outside the AVN to facilitate the negotiation process.

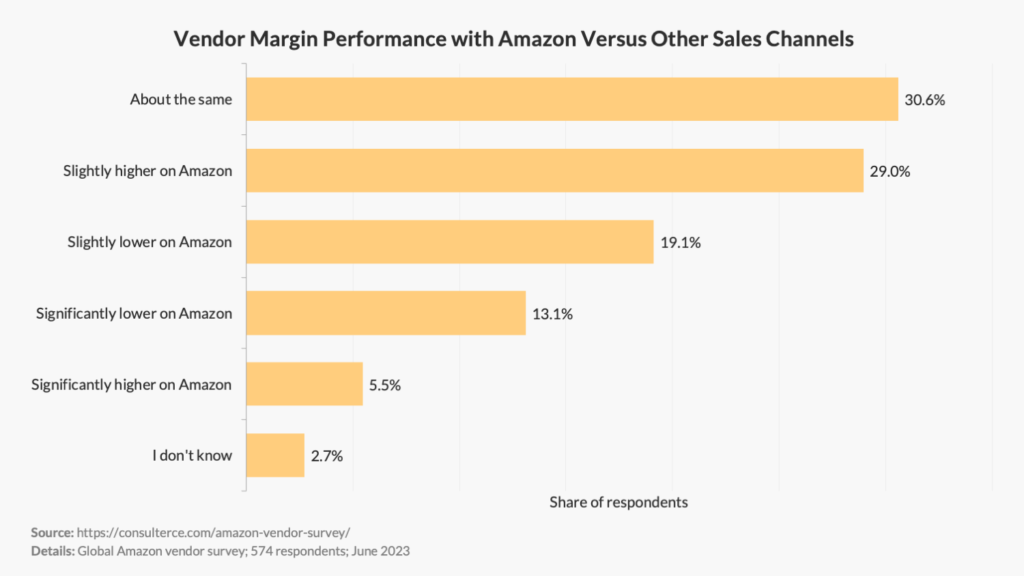

Nearly 60% of Brands Report Similar or Slightly Higher Profit Margins with Amazon Compared to Other Sales Channels

Despite Amazon’s relentless focus on increasing profit margins, 59.6% of survey respondents stated that their margins with Amazon are ‘about the same’ or ‘slightly higher’ than other sales channels.

Only 13.1% of participants indicated that margins would be ‘significantly lower’ with Amazon than their other sales channels.

These findings indeed highlight the importance of designing a channel strategy that realistically considers Amazon as a price follower. But also balances the benefits of selling through Amazon against the potential for higher margins elsewhere.

Erroneous Charges and Unpaid Invoices Affect at Least 1-5% of Total Amazon Sales for Over 70% of 1P Vendors

Catalogue defects plague 1P vendors across product categories. But the magnitude of sales affected by either shortage claims, price discrepancies or other erroneous deductions, where brands have to fight a (lengthy) financial battle with Amazon to get their money back, is significant.

Over 70.5% of surveyed vendors state that erroneous charges and unpaid invoices affect at least 1-5% of their Amazon sales. Only 25% of surveyed brands stated that financial disputes impact less than 1% of their revenue with Amazon.

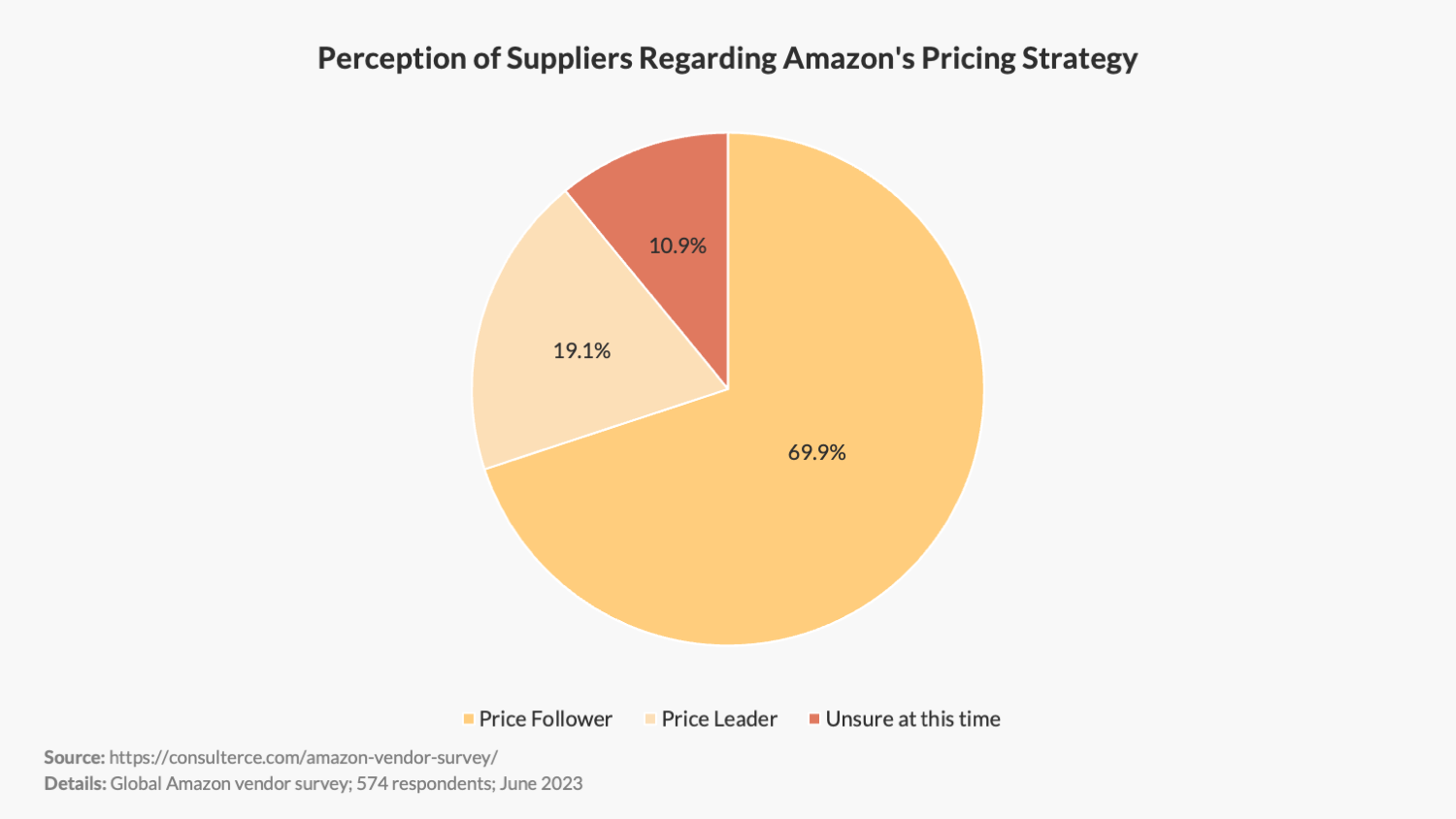

Amazon Is Still Seen as a Price Follower, Not a Price Leader

Despite profitability challenges with Amazon, most brand representatives still perceive Amazon to be a price follower. Only 19.1% of surveyed brands perceived Amazon as a price leader, while 10.9% were unsure about Amazon’s adopted pricing strategy at the time of the survey.

The Profit Focus of Suppliers Will Likely Lead to Less Product Choice for Amazon Shoppers in 2023/24

When asked about the most critical measures to improve vendor margins with Amazon, the answers ranged from focusing marketing activities on high-margin items to operational improvements through automation and the optimisation of processes.

However, 17.1 % of brands surveyed said they were planning to or had already delisted unprofitable items from Amazon. 11.6% of vendors surveyed said they consider shifting assortment from 1P to 3P Seller Central as a key opportunity to improve their margins.

This trend is likely to reduce customer choice for Amazon shoppers:

As brands either delist products from Amazon or move items to Seller Central, products will likely reappear on the marketplace at higher prices via sellers other than Amazon. That’s because 3P sellers are not bound by Amazon’s price-matching algorithm, which allows them to raise prices to customers.

Conclusion

That wraps up our Amazon Retail study. I hope you found the data interesting and useful.

If you found value in today’s article, please share it on LinkedIn or any other social platform.

And if you participated in the survey, thank you! Without your contribution, this study would not have been possible.

Questions? Ping me on Twitter.

Background of Survey and Profile of Survey Participants

The survey was conducted from mid-April to mid-May 2023 and targeted representatives of first-party Amazon suppliers. A total of 574 survey responses were recorded. The survey was conducted anonymously.

Vendor Business Size with Amazon

39.9% of survey respondents reported annual Amazon sales between $0 and $10 million. 36.0% of survey respondents reported annual Amazon sales between $10 and $50 million. 10.4% of survey respondents reported annual Amazon sales between $50 and $100 million. And 13.7% of survey respondents reported annual Amazon sales of over $100 million.

Seniority of Survey Participants

The seniority of survey participants ranged from mid-level to C-Suite. 23.1% of participants said they were mid-level managers, 45.7% were senior managers, 20.4% were executives, and 9.7% were part of the C-Suite or owners of the company.

Geographical Distribution of Survey Participants

The survey participants trade with Amazon across multiple regions. 52.7% of respondents said their company is trading with Amazon in North America, 72.6% in Europe, 15.1% in Asia Pacific, 12.9% in Latin America and 8.6% in the Middle East and Africa. Participants were able to select multiple regions at once.

Disclaimer

The survey is not and was not sponsored by, run, or affiliated in any way with Amazon.com, Inc. or any of its subsidiaries.