Ever wanted to know how vendors can achieve high margins on Amazon? It’s the deployment of a designated portfolio strategy.

Rising costs to serve Amazon require brands to rethink their distribution structures. After all, the price-follower strategy of the online marketplace has the potential to erode margins year after year.

However, most organisations neglect the need to adapt to the unique business model of the online retailer. The result? Unprofitable growth that senior decision-makers are increasingly concerned about.

A designated portfolio strategy can help vendors improve their margins and outperform their peers through a unique selling proposition with Amazon.

This article will cover:

- How the Amazon business model works

- Why the Flyhweel is unprofitable for Amazon vendors

- How to design a profitable Amazon portfolio strategy

How the Amazon business model works

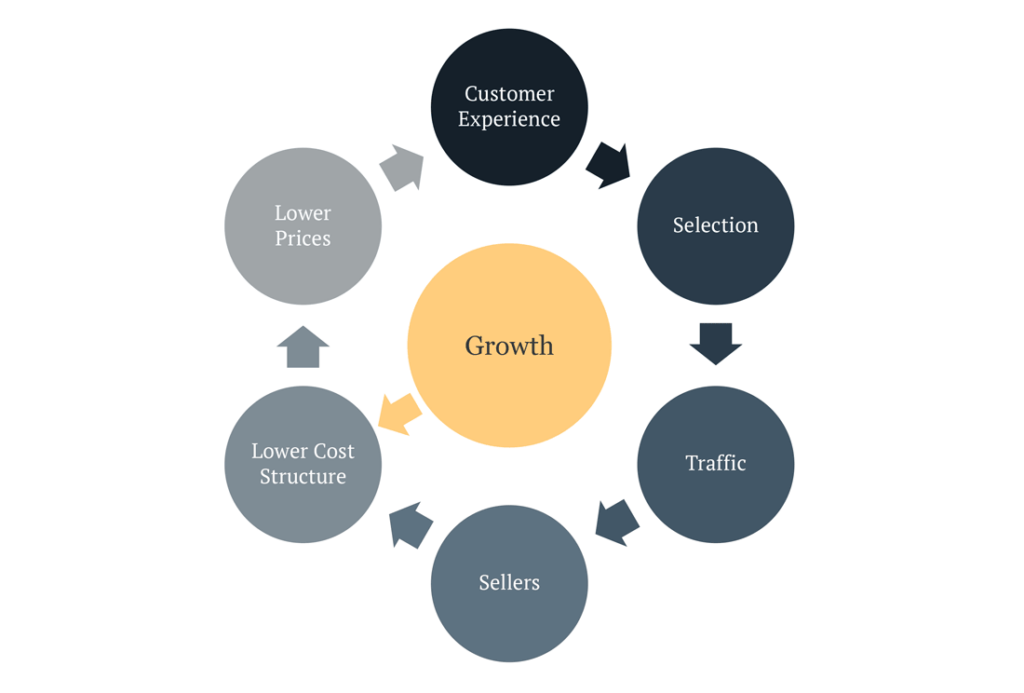

Understanding a retailer’s business model is vital for the design of an effective portfolio strategy. Jeff Bezos introduced the growth model of Amazon in a so-called Flyhweel or Virtuous Cycle back in 2001.

The Amazon Flywheel states that growth results from available selection paired with a good customer experience. Both attract traffic, which leads to more sellers coming to the marketplace.

The resulting growth leads to economies of scale that reduce cost structures for Amazon and its suppliers.

The business model is a Virtuous Cycle because lower cost structures allow Amazon to offer more products at lower prices. This expands the available range and customer experience, fueling the retailer’s growth.

Why Amazon’s Flywheel is unprofitable for 1P Vendors

The Amazon Flywheel relies on a broad product selection to drive customers to a category. So the online retailer encourages its suppliers to list their entire catalogue.

However, this has two important implications:

First, it leads to brands offering products that were never designed for the ecommerce channel. These items are delivered in unoptimised packaging, which drives up costs and lowers profitability for Amazon and its suppliers.

Second, Amazon pursues a price-follower strategy. It matches the lowest price of a product available from 3P sellers and competing online retailers.

This results in everyday low prices that brands often cannot finance as they rely on rotating price promotions with different retailers and limited budgets.

The conflict between the two pricing models leads Amazon to request margin support which, if granted, puts further pressure on the vendor’s profit and loss account.

As a result, most vendors default to stop funding Amazon to break this unprofitable cycle. However, this may lead to increased friction and delistings, leaving brands with an unprofitable portfolio mix sold by Amazon.

Consequently, vendors need a more practical approach to managing their margins.

As selection forms the central component of the Amazon Flywheel, a targeted portfolio strategy offers the opportunity to address the specific needs of the online marketplace.

Defining a profitable Amazon portfolio strategy

Before we dive into the detailed blueprint for a profitable portfolio strategy, it’s critical to introduce the thought that:

Amazon is a marketplace and not a retailer.

Their teams do not actively develop a category. They simply connect existing consumer demand with the available supply from vendors.

This makes brands gatekeepers for the assortment they list on Amazon. And this is a direct lever for profitable growth that can be formalised in a designated portfolio strategy.

Let’s break down this process step by step:

Step 1: Define your goals with Amazon

A successful portfolio strategy rests on a clear definition of a brand’s goals with Amazon. These goals typically fall into three main categories:

- Sales growth,

- Profit growth, or

- Survival.

Sales growth

If the goal in selling on Amazon is to increase sales, the actual objective is to increase or regain market share. Brands can either drive customers to their existing listings or expand their product portfolio.

Both routes require investments into two areas: 1) Sales capabilities, i.e., content, availability, and advertising; and 2) NPD & Innovation, to expand the product portfolio and access new customer segments.

Profit growth

If profitability is the goal of selling on Amazon, brands need to prioritise sustainable sales with a long-term focus.

Research has found that differentiation strategies have proven most effective in driving brand performance output (e.g., price premium).

However, vendors can also increase margins by optimising their return on investment and reducing cost structures along their supply chain with Amazon.

Survival

Brands that are in survival mode must limit their loss of market share. Instead of a determined portfolio expansion approach, the focus with Amazon is on a margin-oriented reduction of the available range.

Step 2: Determine the right portfolio distribution model

Once the goal of selling on Amazon has been defined, it’s time to focus on defining the right distribution model.

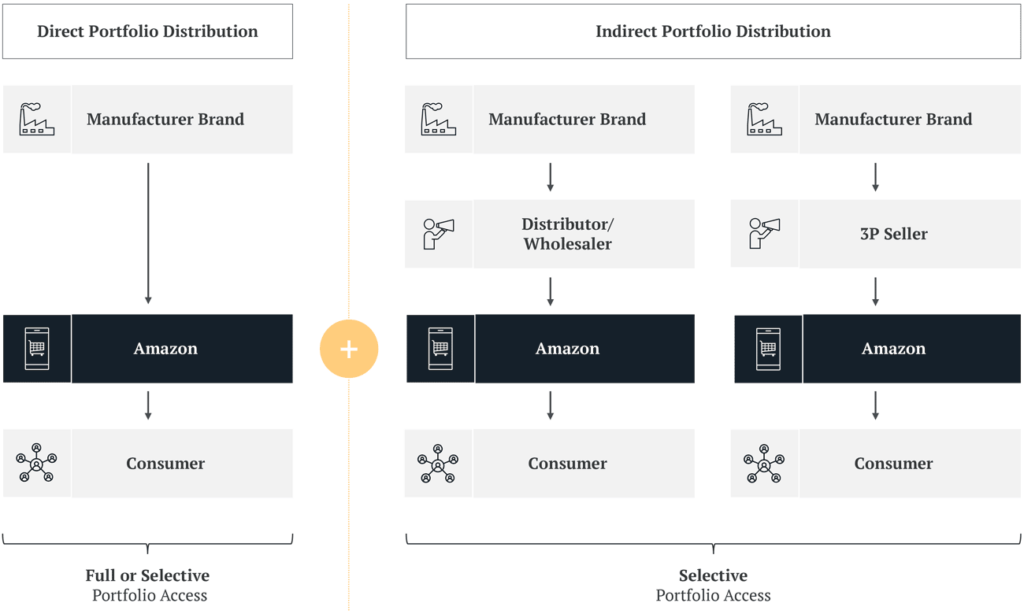

Manufacturer brands have a variety of options to serve the Amazon channel. A direct portfolio distribution ensures that 1P vendors own large parts of the brand experience at key customer touchpoints.

However, this doesn’t mean manufacturers have to distribute their entire product catalogue to Amazon directly. Vendors can also choose to work with distributors, wholesalers or other third parties to sell their products on the marketplace.

In the pursuit of creating a profitable portfolio strategy, brands should assess the option to limit their available assortment through a direct distribution model. This selective portfolio access allows vendors to reduce the exposure of dilutive listings on their accounts.

At the same time, the less profitable assortment can be made available through an indirect portfolio distribution strategy. In this case, the brand manufacturer supplies its less profitable range to distributors or wholesalers. These then sell them via the Amazon 1P Vendor or 3P Seller model.

Step 3: Optimise your listing strategy by forecasting margins

Amazon has a good track record of convincing vendors to list their entire product catalogue.

But that’s not the best strategy for most brands.

Selling items that were never designed for the ecommerce channel often lead to high fulfilment and shipping costs. And that’s driving down margins for vendors and Amazon.

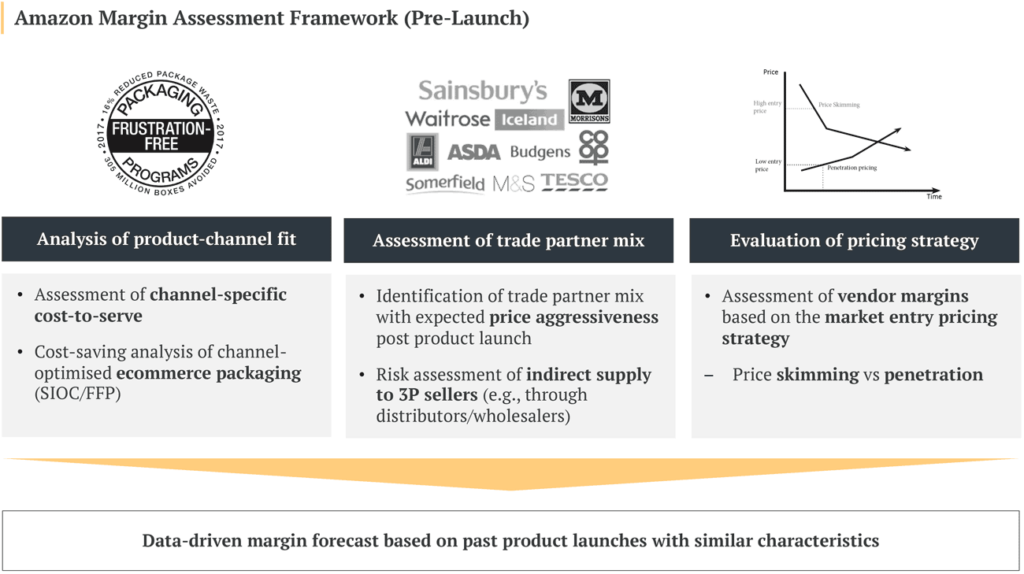

So before launching a product, vendors should avoid this profitability trap and forecast their profit margins instead. By using historical data from listings with similar characteristics, they can assess the product-channel fit with Amazon.

Assessing price and channel conflicts

Speaking of product-channel fit: Vendors shouldn’t underestimate the implications of Amazon’s price-follower strategy. It’s the leading cause of price and channel conflicts between their distribution partners.

Knowing which sales channels are most likely to conflict with Amazon can help vendors differentiate their portfolio strategy.

A proven model is to assess each channel partner’s sales volume, price aggressiveness and cost to serve.

For example, a brand could forego the opportunity to offer a product to Amazon mainly traded at discounters. Their high price aggressiveness is unlikely to allow for adequate margins with Amazon 1P.

Optimising the launch of products on Amazon

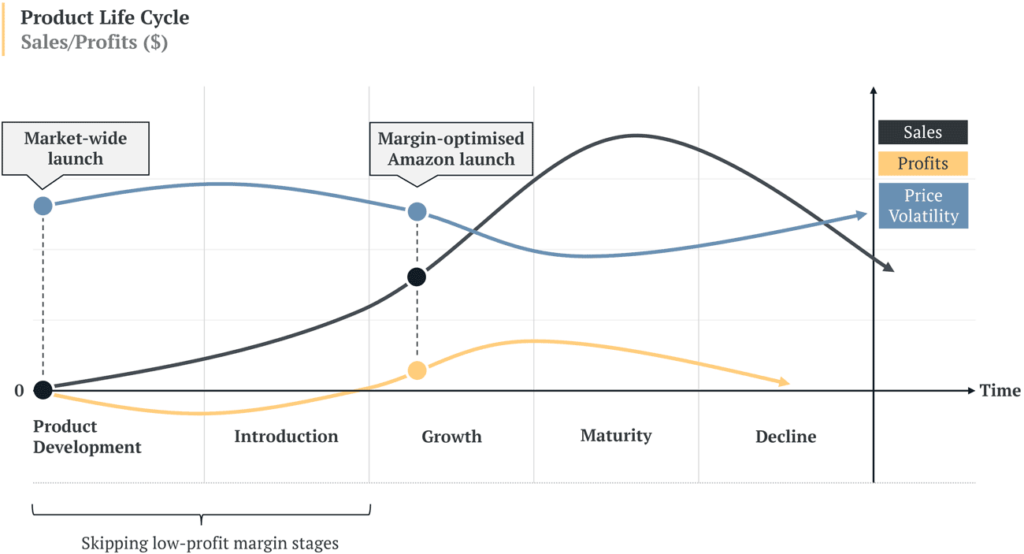

Another factor that is often forgotten is the chosen price strategy of the brand itself. It has direct implications on the time of a product launch with Amazon.

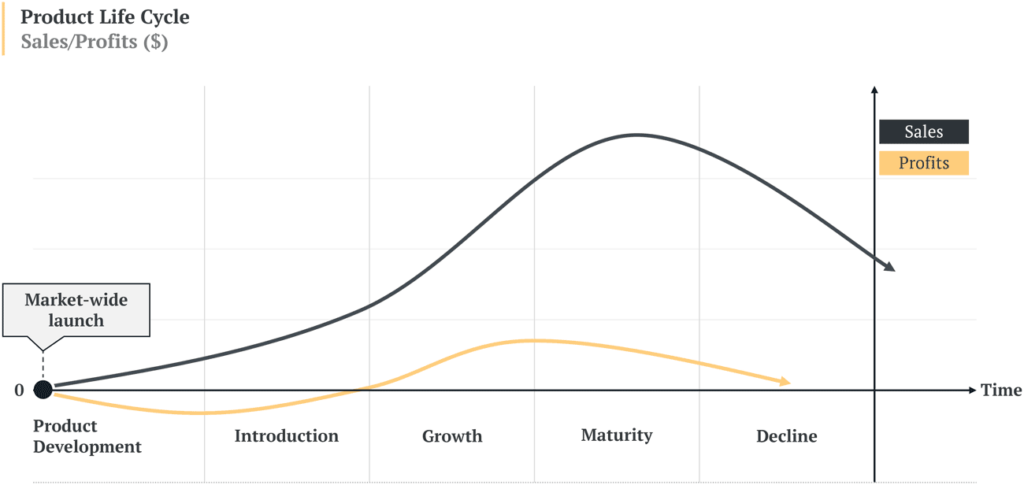

For example, let’s say a business follows a price skimming strategy. In this case, a simultaneous launch on Amazon with other retailers allows capturing the highest profits in the product life cycle.

However, many brands choose to follow a price penetration approach. It’s used when gaining market share quickly after the launch of a product is essential.

This often results in aggressive price promotions and high price volatility at the beginning of the product life cycle.

With Amazon’s price-follower strategy in mind, brands may delay listing items on Amazon to avoid these low-margin periods in the early stages of the product life cycle.

Step 4: Launch exclusive Amazon selection

The concept of launching products exclusively with some retailers is not new. It helps brands differentiate their portfolio, while retailers benefit from a unique selling proposition that none of their competitors can offer.

Making an exclusive range part of an integrated portfolio strategy also ensures brands can boost their margins due to more favourable terms with retailers.

However, the launch of products that are exclusive to Amazon offers another benefit: it allows brands to bypass Amazon’s price matching.

This can allow vendors to sell these products at a higher average selling price than their non-exclusive counterparts. As a result, margins are more predictable and less volatile for brands.

Please note: Pricing is always at the sole discretion of the retailer.

Step 5: Differentiate your Amazon portfolio

Is selling on Amazon now harder than it was five years ago? It sure is.

Thousands of brands compete for the attention of users on the marketplace, and many offer similar products to their competitors. This often leads to price wars and unsustainable margins for most brands.

The solution?

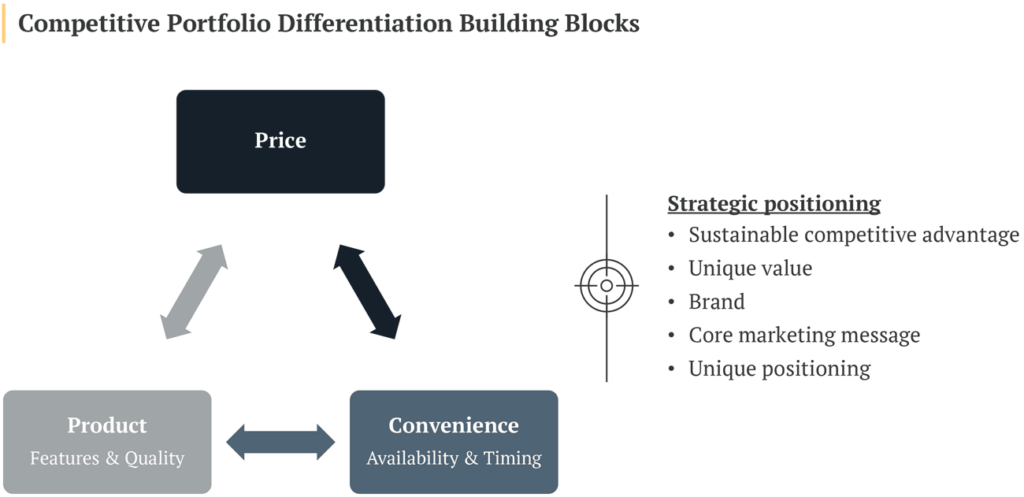

Brands need to differentiate their portfolio to create value that consumers notice. In a competitive environment, brands can differentiate themselves on price, product and convenience.

Expanding the portfolio through sub-brands and line extensions is an effective way to build the value of a brand’s strategic positioning.

Common examples of this strategy are the launch of value packs or product bundles that help suppliers maintain their strategic positioning and create unique value that differentiates them from their competition.

While this strategy does not necessarily allow brands to escape Amazon’s pricing algorithms, it does ensure that they can target specific customer segments that are strategically relevant to their business.

Step 6: Improve your Amazon supply chain

The final step in developing a profitable Amazon portfolio strategy is to ensure that the product range is supported by the right supply chain setup.

After all, shipping products to Amazon and end customers as efficiently as possible can make or break a vendor’s bottom line.

Fortunately, Amazon offers several supply chain initiatives for both sortable and non-sortable items. Depending on the individual business case, these initiatives can help reduce the cost to serve Amazon by up to 70%.

Vendors primarily selling sortable products should focus on introducing Vendor Flex and Full Truck Load Ordering. If non-sortable items make up the majority, Direct Fulfilment and Direct Import have proven to be profitable options.

Note that all of these initiatives have to be negotiated with your Amazon Vendor Manager. I recommend reading this article if you want to learn more.

| Product/ Fulfilment Fit | Sortable | Non-sortable |

|---|---|---|

| Direct Import | x | x |

| Direct Fulfilment | x | |

| Vendor Flex | x | x |

| WePay | x | x |

| Small & Light | x | |

| Pallet Ordering | x | x |

| Full Truck Ordering | x | x |

| PICS (EU) / Cross-Dock | x | x |

Final thoughts

Developing a profitable portfolio strategy doesn’t happen overnight. Vendors need to consider various factors to break the negative spiral of Amazon’s pricing algorithm.

However, I hope that this step-by-step guide has given you an insight into how to get started.

Got any questions? Ping me on LinkedIn.

Need help with your Amazon assortment strategy?

If you want to speed up the process of designing a profitable portfolio strategy, get in touch. I offer industry-leading advisory services that help your teams get it right on the first try.