Value-based pricing is one of the most popular pricing strategies used by ecommerce sellers worldwide. And today, you are going to learn everything about it!

In the age of digital transparency, consumers spend a considerable amount of time comparing offers and prices online. Yet, the price of a product dictates the profitability of any ecommerce business.

So when you are selling products online, how can you avoid a price war with your competition? By following a value-based pricing strategy.

In this article, we’ll cover:

- What value-based pricing is,

- The advantages of value pricing,

- The disadvantages of value pricing,

- How to define prices based on value,

- Examples of companies following a value-based pricing approach.

And without further ado, let’s get started.

Definition: What is Value-Based Pricing?

Value-based pricing (or value pricing) is the strategy of setting a product’s price based on the perceived value to your customers. This pricing method focuses entirely on what your customers think a product is worth paying for.

Merchants with a unique product or strong brand portfolio particularly benefit from this approach. They do not set prices based on a fixed markup on product costs (so-called “cost-plus” pricing). Instead, they orient the product price based on what they think customers are willing to pay for it.

Value pricing allows you to add higher markups to product prices in various scenarios:

- When selling in competitive market segments. As prices have already settled around price points that generate customer demand.

- When selling luxury or high-end products. Customers pay for the prestige of, e.g., a luxury watch. Not for a product to read the time.

- When selling products with inelastic demand. In this case, lower price points would not result in an increase in demand.

However, you need to take a considerate approach when estimating what customers are ready to pay for your product. Setting the price too high and customers will shy away from making a purchase. Setting the price too low and you will lose out on the extra profit potential.

Advantages of a Value-Based Pricing Strategy

With the definition out of the way, you most likely ask yourself the question: Is value pricing the right fit for your business?

Let’s take a look at the advantages of this pricing method.

1. You Can Achieve Higher Markups

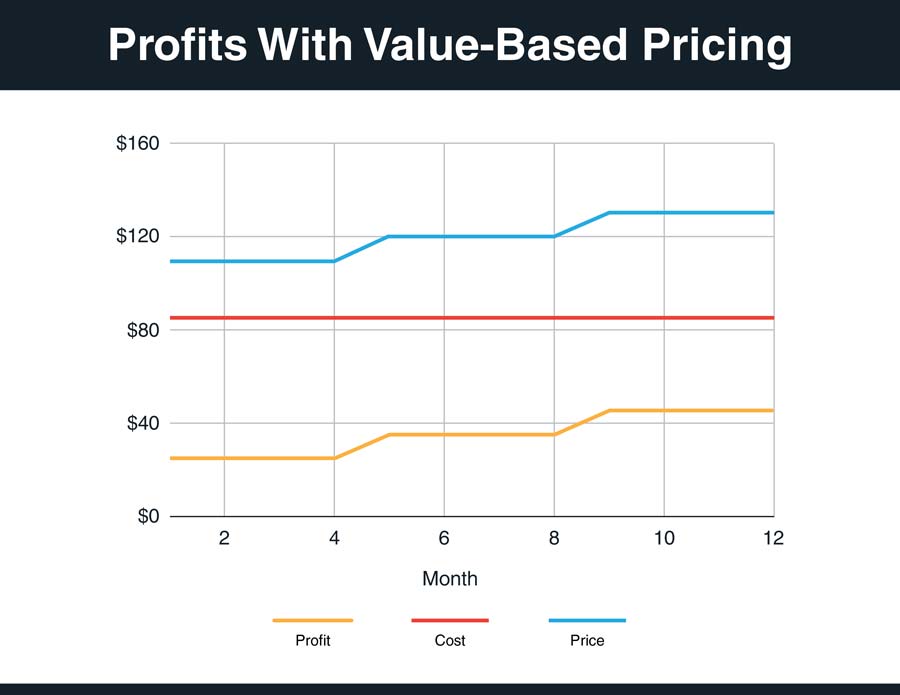

Value-based pricing allows you to add higher markups to the cost of your products compared to other pricing methods. This makes the value-based pricing strategy attractive for industries with high research and development costs.

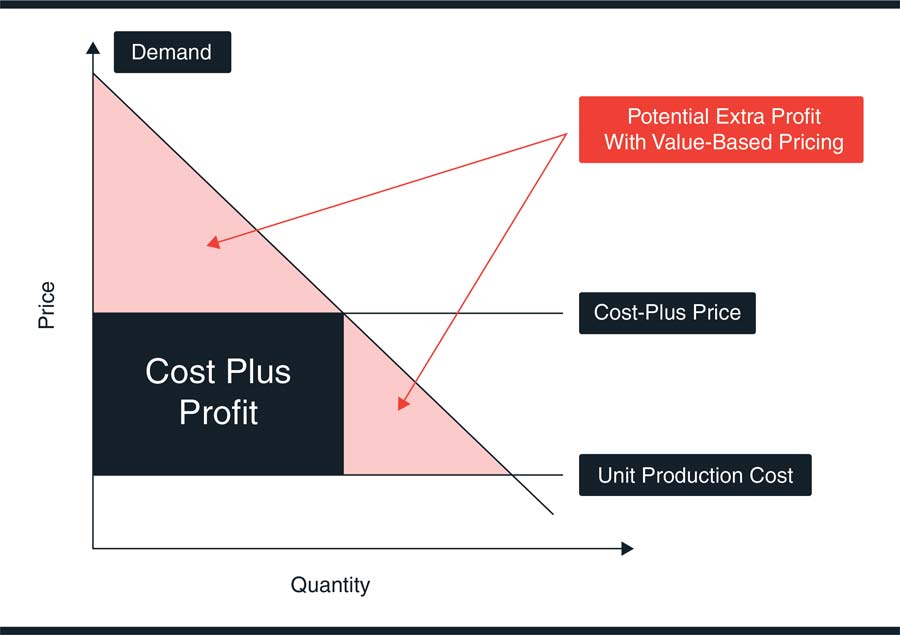

Contrary to “cost-plus” pricing, you do not orient product prices based on your production cost. Instead, you define the markup dollar amount based on what you think a customer is willing to pay for the value of the product itself.

This leaves room to raise prices over time when unit production costs sink or customer demand increases. And taps into profit areas cost-plus pricing cannot access.

![]() Pro Insight

Pro Insight

A value pricing approach also benefits companies that are able to distinguish their products from the rest in an existing market.

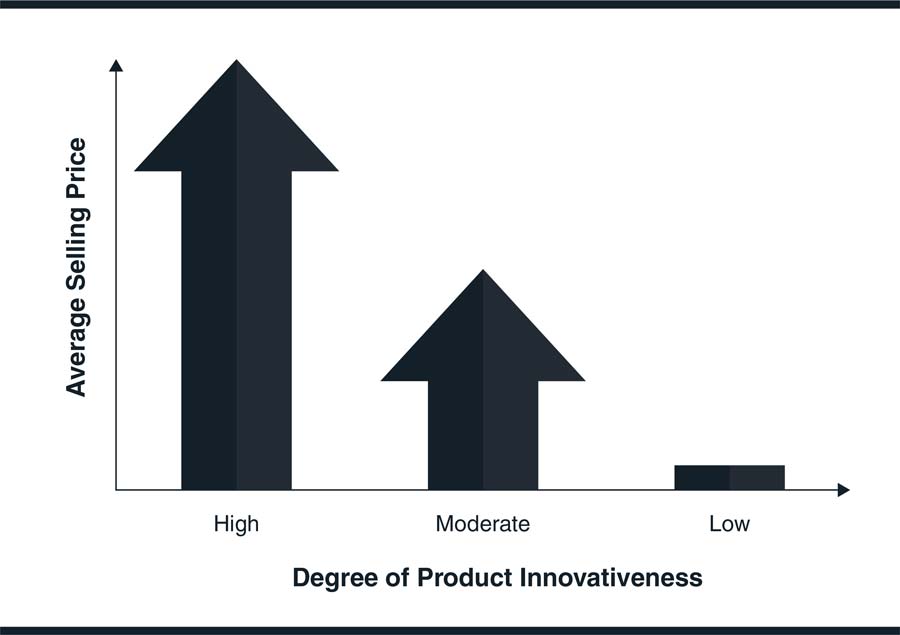

In fact, research has shown that value-based prices for highly innovative products can be up to 100x higher than their competition. Moderately innovative products can still claim up to a 25x higher markup.

2. Value Pricing Helps You Build A Stronger Brand

When following a value-based pricing approach, you automatically have to deliver added value to your customers. This also lets you build a better brand.

Here’s why:

- It puts the customer first. To price the value of a product, you first need to understand how much your customers are ready to pay for it. You will have to carry out some qualitative and quantitative research, e.g., surveys. The results can then also be used to build a strong brand around what your customers value.

Example: Vodafone. Their marketing communication evolves around connecting users with their loved ones. Something their users care deeply about.

- It matches product features with customer needs. If you know what your customers value, you can develop more products that they will love.

- It increases brand trust. If you can explain the value of your product to customers, they will be empowered to make an informed buying decision. Once they purchased the product and their expectations are being met, customer retention rates towards your brand are likely to increase.

3. You Can Increase Prices Over Time

Another advantage of value-based pricing is the ability to increase product prices over time. If you are able to explain the value of your product to customers, you can raise the price of your products and charge similar rates for variations or bundle versions.

The same applies if you optimise your existing product range: Adding new features that create extra value will allow you to raise prices between product generations. As long as your customers are willing to pay for the added features.

The main benefit of the ability to raise prices over time is clear: It allows you to absorb production cost changes more easily. Without taking a severe hit in profit margins.

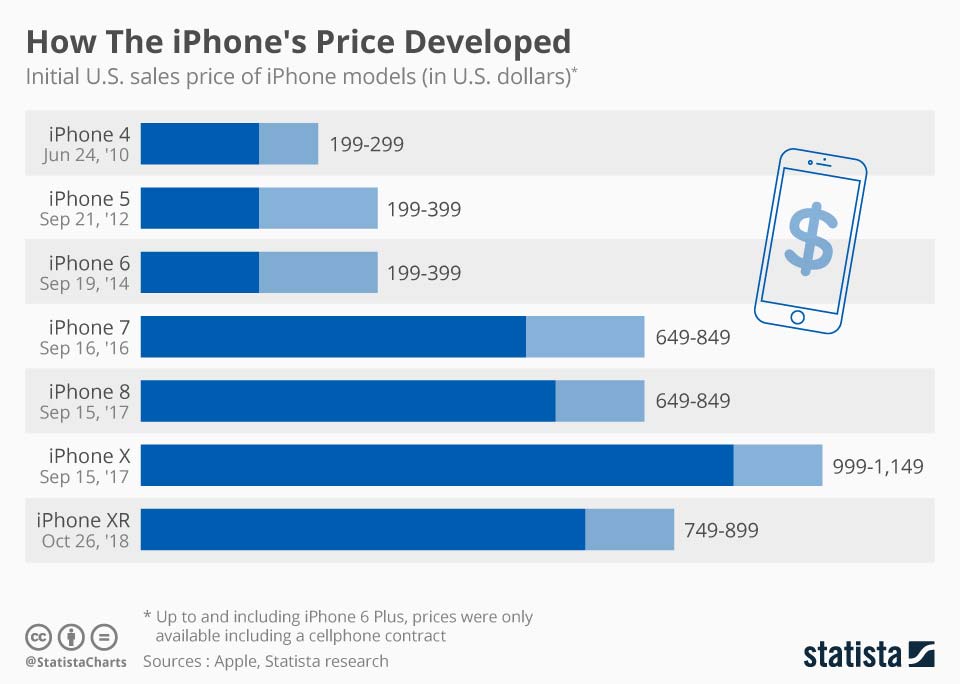

A good example of a company which is able to increase prices over time is Apple.

Each year, they add new functions to their product lines. Following a value-based pricing strategy allows them to notably raise prices between product generations.

Take a look at the below graph. It shows how iPhone prices have increased over the past ten years:

Disadvantages of a Value-Based Pricing Model

As you can see, there are many advantages when following a value-based pricing model. However, this pricing technique also comes with a couple of drawbacks to watch out for:

1. Product Prices Are Harder to Set

Setting the value-based price point of a product can easily become a challenge. There simply is no formula to exactly quantify the monetary value of your product’s benefits.

Before launching a product, you need to conduct a lot of research to understand what your customers would be willing to pay for it. And even with a solid foundation of customer insights, the actual perceived benefit will differ between customers.

This can lead to a price that is set too high and generates no demand. In this scenario, you will have to decrease the price up to the point customer demand starts to appear. With negative effects to your originally calculated margin position.

On the other hand, prices may have been set too low. Customers would be ready to pay even more for the offered product. This can have many reasons. Maybe its because comparable products come with less qualitative materials. Or there is simply no similar product available on the market.

In this scenario, you lose out on the additional profit opportunities. Starting off with a product price below its value will also make it harder to justify any price increases after its launch.

All in all, you will have to take the best guess of what you think the value of your product is worth to your average customer. This requires not only a lot of research in the beginning. But also to listen to customer feedback over time.

2. Value-Based Pricing Needs Communication

Just because a product offers a benefit, does not mean your customers understand it. It’s important that you explain the value of your product to your potential customer base. And the more specific the use case of your product is, the more it needs to be explained.

If customers have the choice between nearly identical products, they usually chose the product from the brand they know. Even if the price is higher.

In other words, branding helps customers to separate offers from each other. And value pricing allows adding your brand’s value into your product prices. But this value needs to be communicated. On product detail pages, TV ads, etc.

This usually results in higher marketing costs, which you need to account for when setting the value-based price point.

3. The Perceived Value May Change Over Time

Another challenge of value-based pricing is that the perceived value of your products may change over time.

Changes to economical, cultural and technological aspects can also affect the value perception of your customers.

A competitor could enter the market and offer a product with a higher perceived value to customers. As a result, customers will turn away from offers that can not compare to it.

And in times of economic crises, the value of having access to certain products might surge, while it may drop for others.

A value-based pricing strategy requires you to constantly review and adapt prices if the value perception of your customers changes over time.

How to Define Value-Based Prices

Setting value-based prices is far from being an easy task. However, there is a simple process that can help you get started:

- Find the best offer that compares to your product on the market.

- Identify the selling price of that offer.

- Define the $ value of the benefits this product offers to customers.

- Gauge the $ value of the benefits your product offers.

- Add the $ value of your product benefits to the selling price of the rivalling offer.

- Subtract the $ value of the benefits of the comparable product.

Of course, the above process is very simplified. It doesn’t consider the total market size or the spending power of your customers. But gauging the monetary value of a product’s benefits does not follow an exact science. The truth is: You will often have to ask your customers directly to understand how much they value single product features.

Also always keep your break-even point in mind. You don’t want to end up pricing your products at a loss.

Examples of Value-Based Pricing in Ecommerce

If you look for companies that follow a value pricing approach, you don’t have to look very far. The following list highlights a handful of industries that often follow a value-based pricing approach:

- Art (e.g., Picasso paintings)

- Consumer Electronics (e.g., Apple),

- Consulting (e.g., McKinsey)

- Luxury Goods (e.g., Ralph Lauren)

- Pharmaceuticals (e.g., Bayer with Aspirin)

- Health and Personal Care (L’Oreal)

What Do You Think?

Now I’d like to turn things over to you: Are you following a value-based pricing strategy for your products? Or maybe you have a tip that you would like to share.

Let me know by messaging me on Twitter!