The 5 Forces Analysis is a useful tool to analyze the competitive intensity of an industry. Managers use it to better understand and counter the threats their company is facing.

While it is rare for a company to be the only player in its industry, other market players are not the only threat to a successful business:

Technologies may change, new entrants may pose a threat and suppliers may raise their prices to increase profits.

Successful businesses thrive because they identify and counter these threats early and effectively.

So today, we’re taking a closer look at Michael E. Porter’s 5 Forces Model and how it can help you identify the threats to your business from your industry.

This article will cover:

What are Porter’s 5 Forces?

First published in the Harvard Business Review in 1979, Michael E. Porter’s 5 Forces Analysis serves as a framework to analyse and measure an industry’s attractiveness based on the degree of its competitive intensity.

Porter’s basic assumption is that the external market structure is the main determinator of an industry’s attractiveness.

Consequently, these industrial factors drive companies to continuously monitor their economic environment and take it into account in their strategic planning.

As a result, a company’s success or failure indirectly depends on its surrounding market structure.

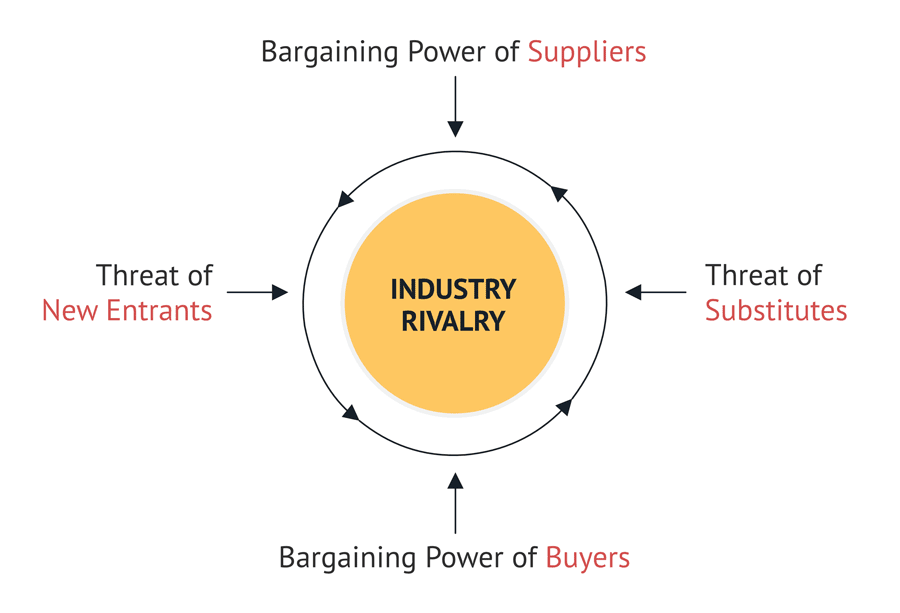

Porter defines a total of five forces (5-Forces) that company’s need to consider when carrying out a systematic competitive analysis:

- The existence of existing competition in an industry (competitive intensity & rivalry)

- The threat of potential competitors entering the market

- The threat of substitutes

- The bargaining power of suppliers

- The bargaining power of buyers

But before the individual forces can be analysed, the sector or industry under consideration must be clearly defined. Only then can data be effectively collected and reliably used for a company’s decision-making.

Finally, the 5 Forces Analysis leads to an assessment of the threats posed by potential competitors and substitutes, as well as the bargaining power of suppliers and customers.

The results can be used to derive whether and to what extent the industry under consideration is attractive for a company. As such, the 5 Forces is also an ideal framework for evaluating potential investment strategies.

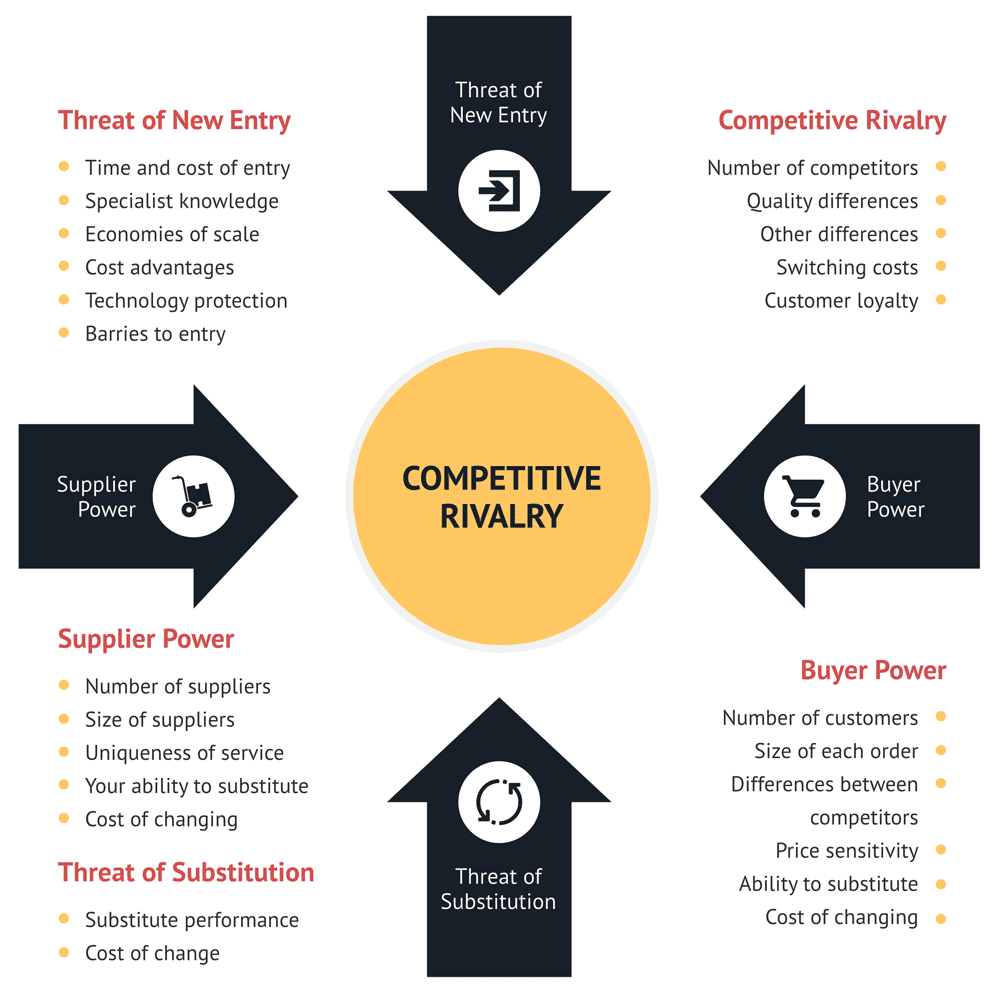

Competitive rivalry & intensity

The main purpose of the 5 Forces Analysis is to assess the competitive situation in an industry. Central questions about the number of competitors and the nature of potential threats need to be answered.

High competition intensity can result from two main factors: Price competition and performance competition.

- Price competition refers to market players trying to undercut each other with lower prices by increasing the efficiency in their value chain.

- Performance competition focuses on product quality and additional service offerings instead of price.

The intensity of an industry’s competition can be evaluated with the following parameters:

- The number of competitors: The higher the number of competitors, the greater the intensity of competition. Profit margins tend to be low, and production takes place at marginal cost.

- Industry growth: Emerging markets are often characterised by rapid growth and offer the advantage that only a few experts can compete with existing offerings. Stagnating or shrinking markets offer less potential, as competition has matured and customer expectations are clearly defined.

- Product differentiation: The greater the differentiation of products, the lower is usually the intensity of competition. Products are more difficult to compare and have unique characteristics.

- Market demand: The ratio between supply and demand provides information about the utilisation and available capacities on the market. If supply is greater than demand, the individual market players will fight more intensively for their market share to achieve higher utilisation rates. In this case, the attractiveness level of an industry drops sharply.

- Exit barriers: If it is difficult or costly to leave an industry, firms will remain and add to the intensity of competition by trying to secure their market share.

Examples of highly competitive industries

Grocery Retailing. In the UK alone, customers can choose from over 87,000 physical grocery stores.

That’s why price competition is fierce, and retailers have to focus on cutting down costs to attract customers into their stores.

Note that the above figures do not consider the recent rise of online grocery shops, putting additional pressure on the industry.

Air travel. The airline industry is another example of an industry with fierce competition.

Budget airlines like Ryanair or EasyJet have long become a substantial threat to premium brands like Lufthansa or British Airways.

This has led to an overall decrease in ticket prices, which for many routes has led to a race to the bottom.

The long list of airlines that have had to file for bankruptcy over the years is just another proof that doing business in this industry is not for the faint-hearted.

Threat of new entrants

New entrants pose another threat to existing businesses in an industry.

Innovative and quickly growing niches naturally draw the attention of others who may be attracted to launch similar products or services. But even established markets are not excluded from this threat.

Assessing the risk of new entrants is critical, as potential competitors may be about to target the same customer segments that are important to existing brands in the market.

New entrants often develop more efficient value chains and exploit their flexibility over large corporations to offer better services.

It is not uncommon for new entrants to take advantage of these lower production costs. It allows them to offer their product at a lower price with the same or even better quality than existing solutions.

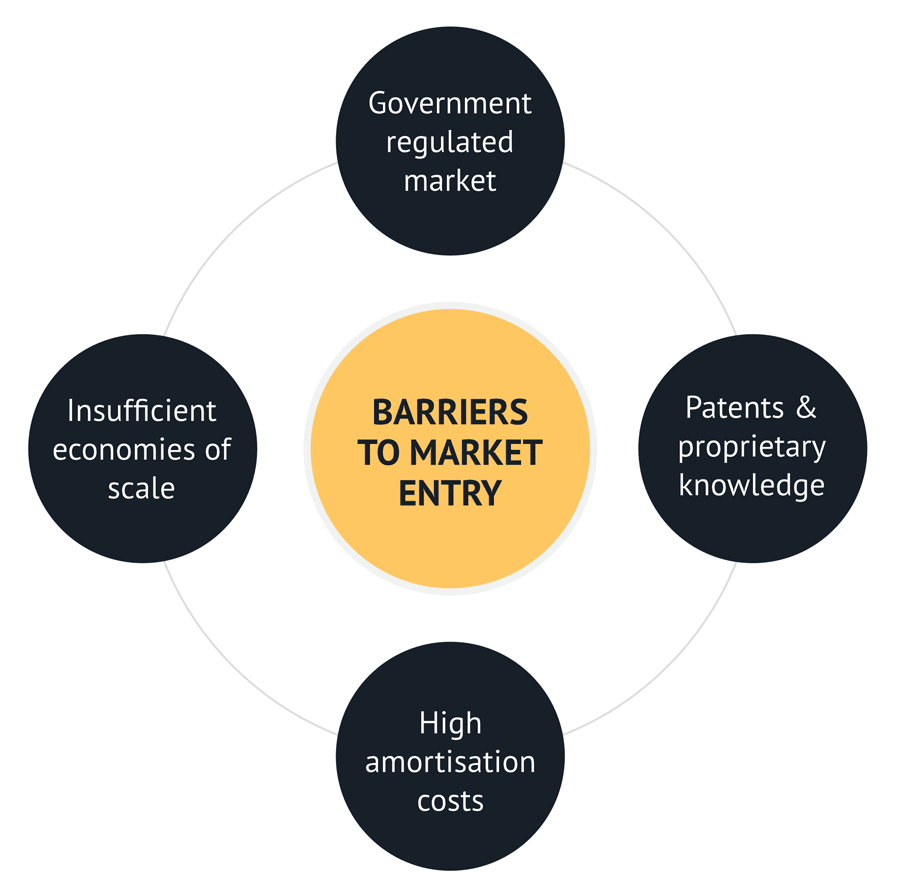

To better evaluate the threat of new market entrants, it makes sense to assess an industry’s entry and exit barriers:

Evaluating Market Entry Barriers

If the costs to enter a market are tied to high investments, the market entry barriers are relatively high.

Contrary, the probability of new firms entering the market is low if there are high market exit barriers. This could be due to long-term contractual commitments or generally long payback periods for larger investments.

Markets are also seen as difficult to enter if current players hold patents or the market is regulated by governments.

Typical examples of markets with high entry barriers can be found in the arms or pharmaceutical industry.

Threat of substitutes

Another threat is the one of substitution. It is one of the most underestimated factors in any competitive analysis.

A substitute is an offer that replaces the existing products on the market.

The modern age has seen many pivotal shifts with the rise of new technologies, better infrastructure and the increase of wealth in Western countries.

As such, innovations are part of our modern society but can pose an existential risk to entire industries.

The challenge many managers face is to accurately assess the risk these innovations pose to their business model. This is especially true for industries that are not used to regular innovation cycles.

Examples of substitutes

Amazon’s Kindle. Released in 2007, the e-reader of retail giant Amazon was laughed at by established publishers in the book industry.

They didn’t realize the threat that the device would pose to their business model, as they did not think that customers would prefer a lightweight alternative to bound books.

While the Kindle may not have substituted physical books entirely, Amazon now sells over 95MM ebooks per year in the UK alone.

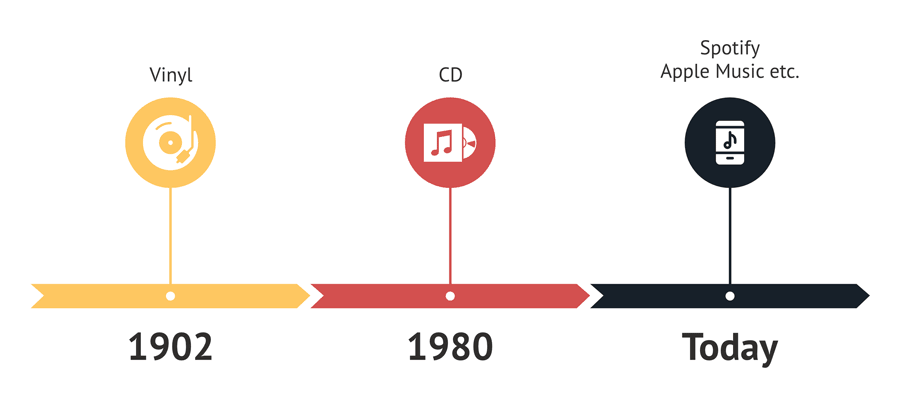

The Music Industry. Another sector that felt the disruption of multiple innovations was (and still is) the music industry.

The evolution from vinyl records to CDs to modern streaming services like Spotify, Apple Music & Co. has left its mark on labels and artists alike.

While it used to be perfectly normal to own dozens of physical records, most teenagers today will grow up not owning even a single one of them.

Bargaining power of suppliers

Another central component of Porter’s 5 Forces Analysis is the bargaining power of suppliers.

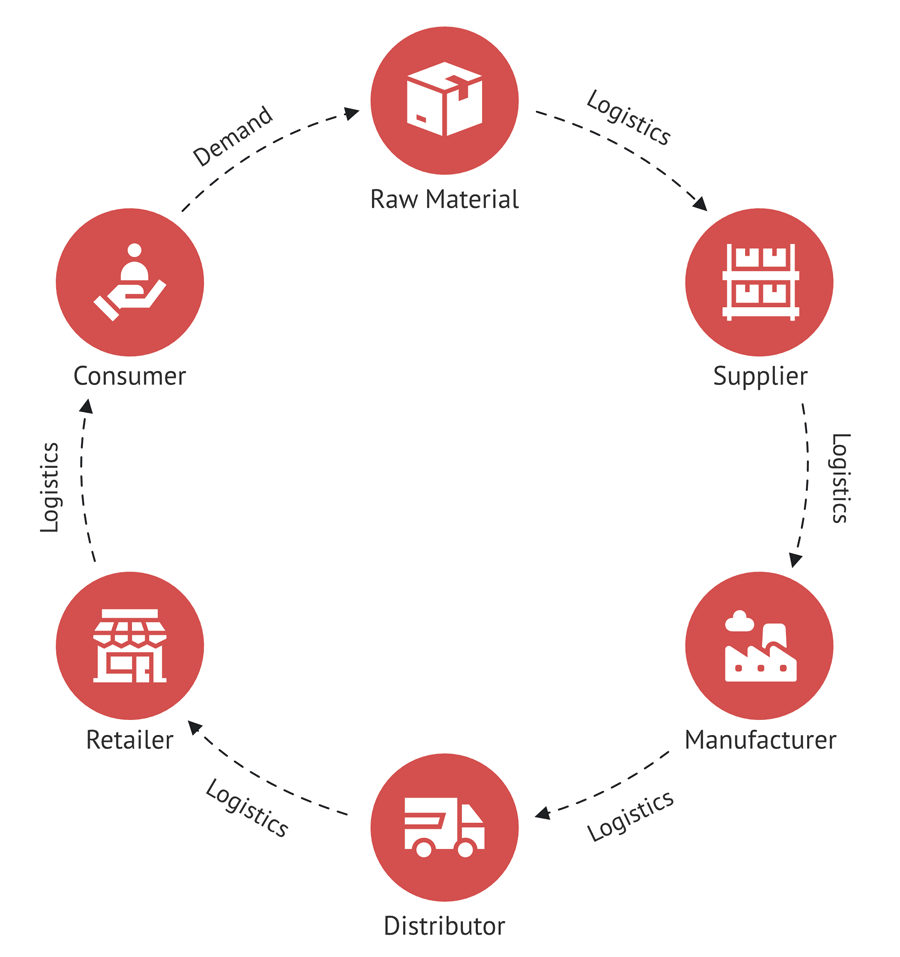

That’s no surprise because suppliers are the backbone of any value chain.

There are two central types of suppliers: those who provide raw materials to manufacture products and those who supply products to the trade.

When assessing the bargaining power of suppliers, the focus is on the relationship between the supplier and the buyer.

As in any partnership, some conflicts of interest need to be balanced for a trade to be beneficial to both parties:

Suppliers may want to raise cost prices, minimum order quantities or the minimum purchase value to increase their profits. On the other hand, the buyer’s interest is to keep these costs and commitments as low as possible.

But the fewer suppliers there are in a market, the greater is their bargaining power. And if a buyer becomes too dependent on a single vendor, their whole business may depend on this one relationship.

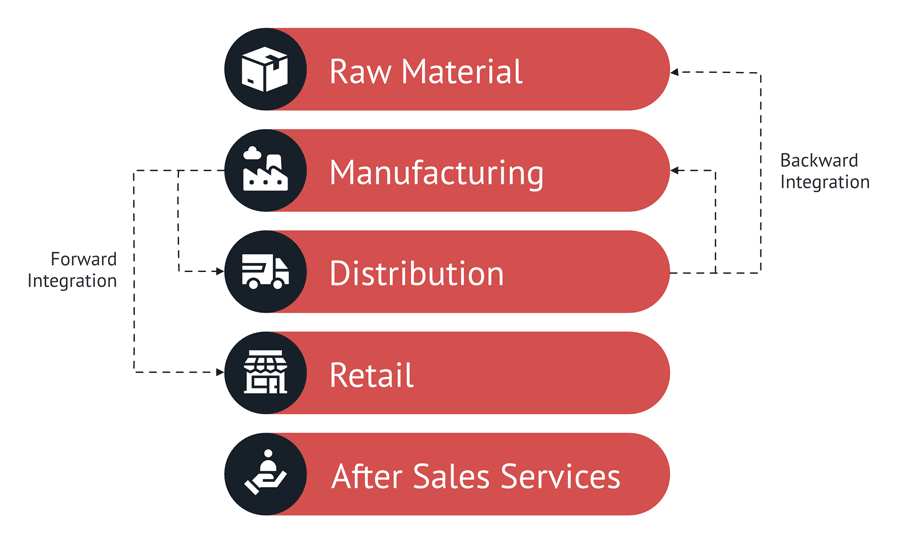

This threat is also known as forward integration risk:

It refers to the risk that suppliers either can choose to use their access to raw materials to manufacture goods themselves. Or they skip retailers entirely to sell their products directly to consumers.

IKEA is a good example of a company that has extended its business directly to the end consumer. They don’t rely on retailers to buy their products.

Assessing the bargaining power of suppliers is essential to secure the survival of any business. The 5 Forces Analysis serves as a good method to effectively uncover and address the threat of overly powerful suppliers.

Examples of powerful suppliers

Unilever. Known for its wide range of popular household brands like Marmite and Ben & Jerry’s, Unilever is one of Britain’s largest Grocery suppliers.

Supermarket chain Tesco felt Unilever’s bargaining power back in 2016 when it rejected to increase Unilever’s cost prices.

What followed was a months-long dispute and a supply freeze that received a lot of media attention as customers complained about empty shelf space in their local supermarkets.

While Tesco could fend off the increase in purchase prices, further concessions likely had to be made behind closed doors to achieve this deal.

A similar dispute kept shelves empty back in 2018 when Nestle and German supermarket chain Edeka could not align on common trade terms.

Bargaining power of buyers

Just as suppliers are part of a competitive analysis, buyers must be considered in it as well.

The larger and more important the buyer, the greater is its bargaining power with suppliers.

Retailers like Walmart benefit from their size and large customer base because it allows them to command lower prices and more favourable terms than a small corner shop.

Similar to the risk of a forward integration discussed above, the reverse threat is the buyer’s ability to integrate backwards:

In this case, the buyer (e.g. retailer) decides to manufacture the products themselves and eliminates the need to buy from existing suppliers.

This allows them to better serve their demand forecast and cuts out the middlemen, which in turn improves the buyers’ own margin.

Examples of powerful buyers

Apple. The tech giant is a recent example of a powerful buyer that made its main supplier redundant.

With the introduction of its new MacBook series in late 2020, the era of Apple computers powered by Intel chips came to an end.

Instead, Apple started to sell computers with their own M1 chips, depriving its main supplier Intel of $3+ billion in annual sales.

Discounters. LIDL, Aldi & Co. are known for their low prices. Besides the larger brands in each category, they offer private label products that they produce on their own behalf.

This allows them to become less dependent on the suppliers of larger brands, keeping their margins high and costs low.

Conclusion – The 5 Forces is a powerful tool to assess your industry’s landscape

Michael E. Porter’s 5 Forces Analysis has long become the leading standard for understanding an industry’s competitive landscape.

The clear structure helps start-ups and multinationals alike to identify the current and future threats in their markets.

However, when analysing the results, decision-makers must not forget that the analysis is only a snapshot of the industry under consideration. By the time the analysis is completed, the market situation may have already changed.

Therefore, especially companies operating in industries with short product life cycles need to put mechanisms in place that continuously monitor the discussed threats in their industry.

Need help with your 5 Forces Analysis?

If you want to better understand the forces that could threaten your business, get in touch. I offer tailored advice to help you assess your competitive landscape and gain a competitive advantage.

—

Got questions or comments? Ping me on Twitter!

—

Enjoyed this article? Here are more things you might like:

What is Business Strategy? – Increase your chances of success and understand what it takes to build an effective business strategy.

The Importance of the Product Life Cycle – A complete break down of the individual stages of the product life cycle to plan your next marketing moves.

The PESTLE Analysis Explained – Ever wondered how to analyse the macro-environment of your company? This article shows you how to do it.