Growing a business is no easy task. There are many strategies to choose from, but how do you know which one is best for your business? The Ansoff Matrix can help you find the answer.

First introduced in 1957 by Igor Ansoff, the Ansoff Matrix (also: Product-Market Matrix, or Market-Field Strategy) has become a popular tool among business leaders to assess new ways of generating sustainable growth.

If you want to increase your turnover but are not sure whether you should launch new products or rather enter new markets, then you’re in the right place.

This article will cover:

The Ansoff Matrix (Base Model)

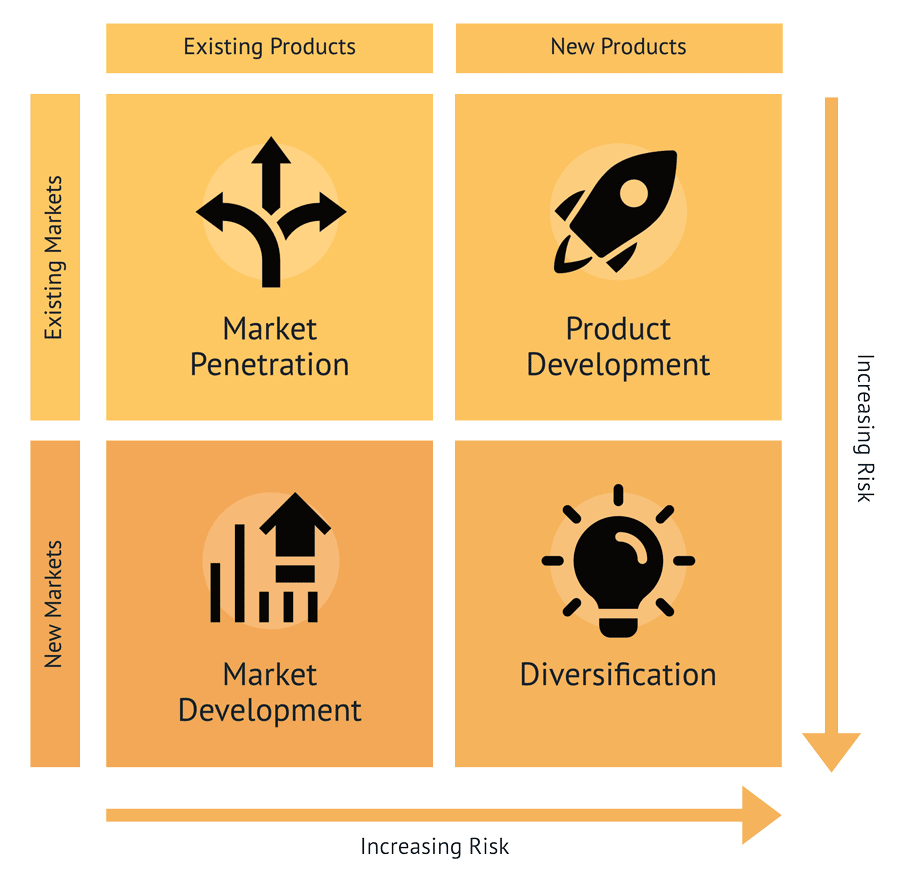

The Ansoff Matrix was developed by Igor Ansoff and first published in 1957 in the Harvard Business Review, in the article “Strategies for Diversification“.

His model defines four strategies to grow a business:

- Market penetration,

- Market development,

- Product development,

- Diversification.

The framework also helps managers to analyse the risks associated with each quadrant: With every move into a new quadrant (horizontal or vertical), the risk increases.

Let’s take a look at each of the strategies.

Market penetration

The market penetration strategy focuses on gaining additional market share with existing products. In other words, an organisation tries to sell more of its products to existing and new customers as well as to those of its competitors.

Existing marketing activities usually have to be adapted to achieve this goal. While the product portfolio does not change, companies often have to adjust their messaging to appeal to a wider consumer base.

However, managers can only successfully implement the market penetration strategy if the market is not fully saturated.

The potential can be assessed by measuring the degree of market penetration:

Market penetration = (number of own customers / number of potential customers in the market) * 100

The lower the market penetration in %, the greater the remaining growth potential.

Market Development

The creation of new sales markets for existing products is the focus of the market development strategy.

By entering new market segments or expanding into new geographic regions, a company can attract new target groups for its existing products.

Take a local jewellery shop as an example. By setting up an online store, they can reach new customers with their existing product portfolio.

The implementation of this growth strategy comes at considerable investment costs upfront. That’s why managers should first assess the chances of success through careful planning and comprehensive risk analysis.

Product Development

If entering new markets is not an option, it is often worth exploring the product development strategy.

It expands the existing offer through product innovations or product variations in the existing market. The resulting added value aims to encourage consumers to buy.

This strategy is particularly attractive for companies in niche markets where customer acquisition would be difficult to achieve with a pure market penetration strategy.

Diversification

The riskiest quadrant of the Ansoff Matrix is that of diversification.

It requires the development of a new product while also entering a new market.

The associated investment costs in terms of product development, business analyses, the establishment of local subsidiaries, etc., can quickly spell the end for a company if the corresponding ROI fails to materialise.

The diversification strategy can take different forms, mainly the …

- horizontal,

- vertical and

- lateral diversification.

Horizontal Diversification

Horizontal diversification describes the launch of a product that complements a firm’s existing product range.

The value chain can continue to be used with minimal adjustments. In horizontal diversification, a company expands its product range at the same economic level to reach new customers.

An example of this type of diversification is the iPad, which successively expanded Apple’s existing smartphone and Mac product portfolio.

Vertical Diversification

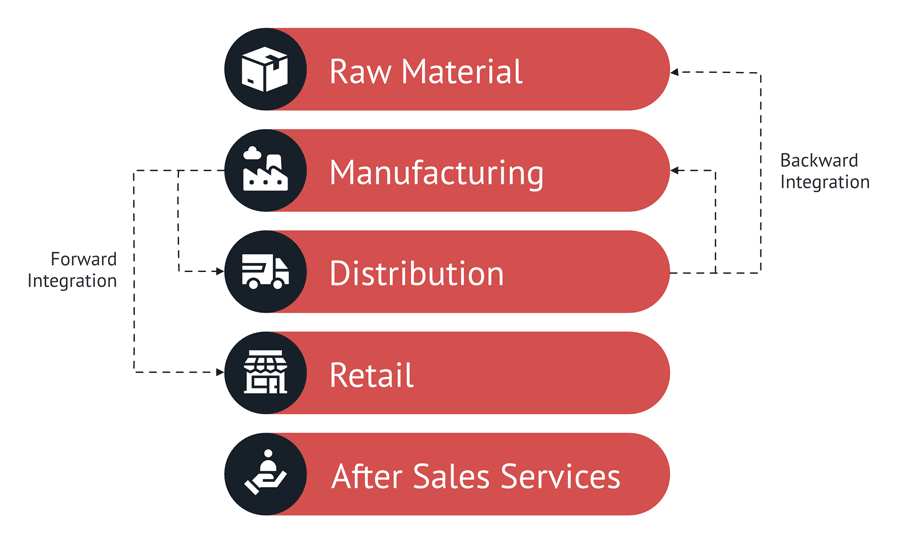

In vertical diversification, a business deepens its involvement in the

- sales-oriented activities (forward integration), and/or

- products’ manufacturing process (backward integration).

Contrary to horizontal diversification, vertical diversification does not occur at the same level of the value chain.

In forward integration, a company takes the distribution of its products and services into its own hands, e.g., by opening its own stores or an online shop.

Backward integration describes the consolidation of a company’s procurement markets, e.g., by taking over production processes that were previously outsourced to external companies.

While horizontal diversification aims to reduce the dependence on one product line, vertical diversification focuses on reducing the dependence on suppliers and distributors.

However, acquiring the necessary skills and know-how to carry out sales and production processes comes at high costs and thus higher financial risks.

Lateral Diversification

The lateral diversification strategy describes the expansion into completely new markets with no connection to the existing business.

The goal is to minimise the dependence on the existing market segment.

Google is a good example in this context: In addition to its core search engine business, the firm expanded early on into other market segments, such as telecoms (Fiber), biotech (Calico) or autonomous mobility (Waymo).

Globally active firms often use the lateral diversification strategy to respond to changes in the market.

The know-how is usually obtained by acquiring businesses that are already active in the market of interest.

This strategy comes with high investment costs and, in addition to the financial risks, also entails intangible risks, such as a diluted brand image due to overly diversified product offerings.

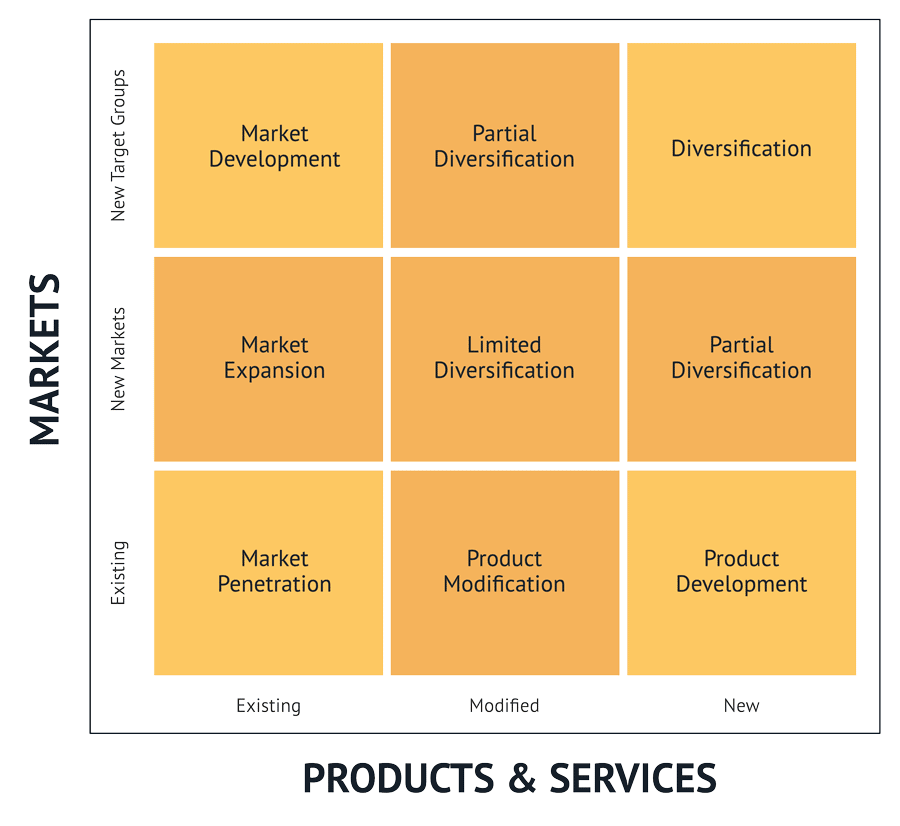

The extended Ansoff Matrix (Nine-Field Matrix)

The Ansoff Matrix is a great model to explore the future growth options of an organisation.

But it does not reflect all the options a company can choose from when looking for a new match between its products and markets.

Simple product modifications to reach new customers in existing markets, for example, are not considered in this basic concept.

That’s why McKinsey developed the 9-Field Matrix. It extends the Ansoff Matrix by the fields of …

- Market expansion,

- Product modification,

- Limited diversification and

- Partial diversification (new product / new market).

1. Market expansion describes the sale of existing products in geographical markets that are new to a company, while the target groups remain identical.

2. Product modification closes the gap between market penetration and product development. In this case, an existing product is sold into existing markets with slight modifications.

3. Limited diversification describes the modification of existing products for new geographical markets.

4. Partial diversification can take different forms depending on the area of the matrix in which the action aimed at growth takes place: Either new products can be sold to geographically new markets, or modified products can be sold to new types of customers.

Conclusion – The Ansoff Matrix as a tool for exploring growth strategies

The Ansoff Matrix and the 9-Field Matrix are effective tools to assess the growth opportunities of any business.

Decision-makers have to consider their product life cycle stage and risk tolerance when deciding on future growth initiatives. But it is also important to note that the Ansoff Matrix ignores the existence of any competition.

For this reason, managers need to consider the wider competitive landscape and macroeconomic forces when assessing future growth strategies.

Need help growing your ecommerce business?

If you want to better understand your growth opportunities, get in touch. I offer tailored advice to help you access new markets and product innovations.

—

Enjoyed this article? Here are more things you might like:

The PESTLE Analysis Explained – Ever wondered how to analyse the macro-environment of your company? This article shows you how to do it.

What is Business Strategy? – Increase your chances of success and understand what it takes to build an effective business strategy.

Porter’s Five Forces Analysis – A complete guide to Michael E. Porter’s 5 Forces Analysis to help you assess your competitive landscape.